Cardano, with its innovative technology and expanding ecosystem, is on track to be a major player in the blockchain space. But will ADA have what it takes to dethrone Ethereum and become the industry’s dominant force?

While ADA has experienced a significant 52% rally in the past week, the subsequent 5% correction and overbought RSI levels indicate a potential period of consolidation or even a downward trend. This shift in momentum could be attributed to various factors, including profit-taking, changing market sentiment, and broader cryptocurrency market volatility.

Despite these short-term fluctuations, Cardano’s long-term potential remains promising. Its strong community, ongoing development efforts, and focus on sustainability position it as a key player in the blockchain ecosystem. However, it’s crucial to monitor market trends, technical indicators, and fundamental factors to make informed investment decisions.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Cardano (ADA) development team.

Current Price Performance

Cardano’s (ADA) recent price surge has been impressive, but technical indicators suggest a potential shift in momentum. The Average Directional Index (ADX) has declined from nearly 70 to 45.02 in just two days, signaling a weakening trend. While ADA remains in an uptrend, the decreasing ADX indicates a potential slowdown in the pace of the uptrend. This shift in momentum could lead to a period of consolidation or even a minor pullback. As always, it’s crucial to monitor market sentiment, on-chain metrics, and broader cryptocurrency market trends to make informed investment decisions.

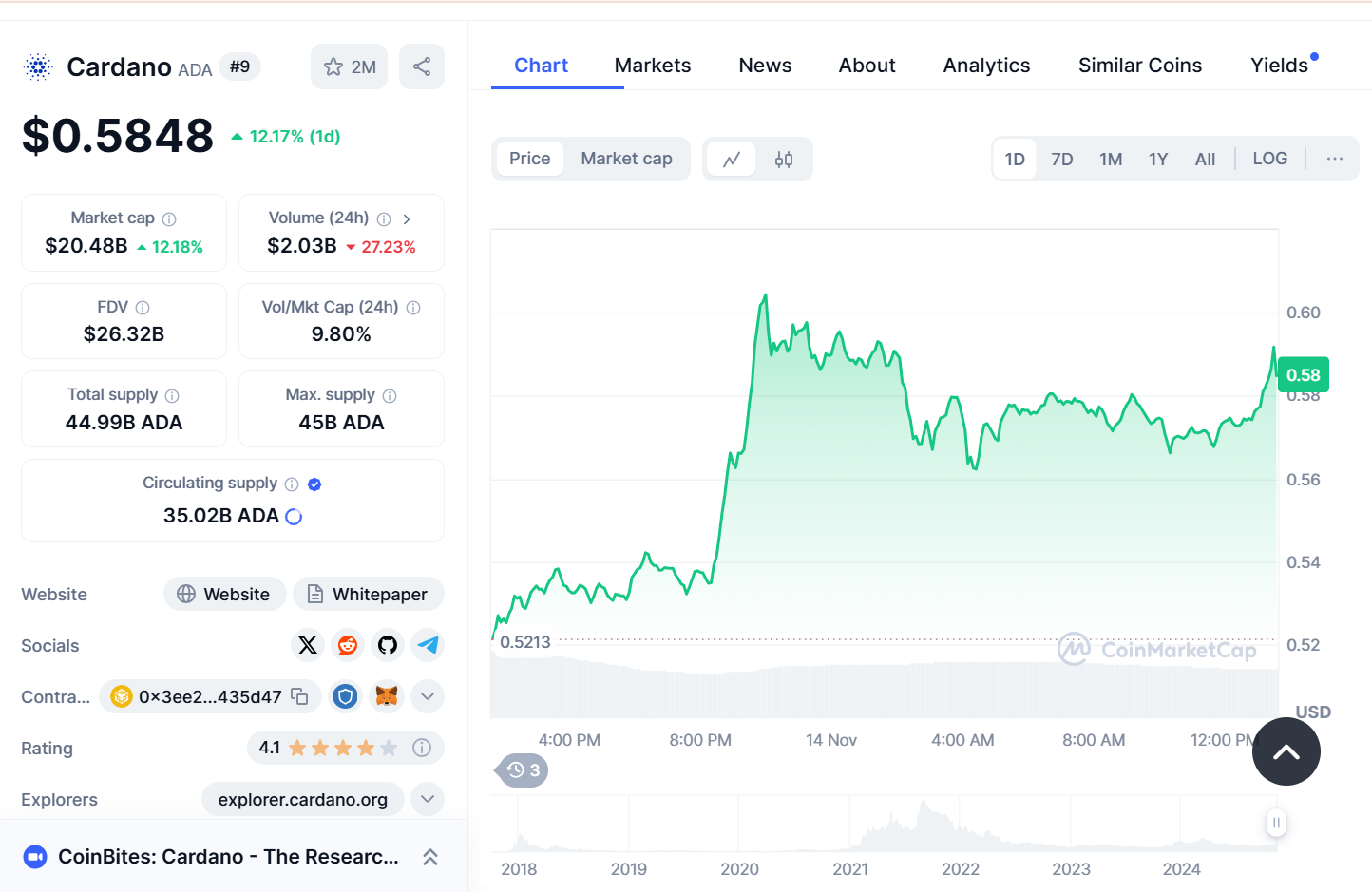

Based on data from CoinMarketCap, Cardano (ADA) is experiencing a period of significant volatility. As of November 14th, ADA is trading at $0.5848, down 12.17% from the previous 24 hours. Despite a previous impressive rally, ADA is now showing signs of a downward correction. ADA’s market capitalization stands at $20.48 billion, indicating that it is one of the largest cryptocurrencies by market cap. The 24-hour trading volume is $2.03 billion, demonstrating substantial investor interest in ADA.

ADA’s price may continue to experience downward correction in the near future, driven by investor caution and profit-taking following a strong rally. If Cardano continues to develop and achieve significant milestones, ADA’s price could recover and resume its upward trend. Cardano has immense potential, especially as it is built on scientific principles and has a strong and growing community. However, to accurately assess ADA’s long-term potential, it is essential to closely monitor the project’s development and the factors affecting the cryptocurrency market.

Community Sentiment

The sentiment within the Cardano community appears to be mixed, with both positive and negative elements present.

There’s a sense of excitement and optimism among some Cardano supporters. This includes enthusiasm about upcoming developments like the Bitcoin OS, partnerships with projects like Midnight, and the anticipation of Tier 1 exchanges listing Cardano-based tokens (CNT’s). The community also prides itself on being large, dedicated, and having one of the most secure smart-contract platforms in the blockchain space. This positive sentiment is underpinned by a belief in Cardano’s potential for significant upside due to its development and community involvement.

With some community members engaging in personal attacks, mocking, or dismissing others rather than focusing on constructive criticism or addressing real issues. This has led to some frustration, especially from those who feel that the community’s discourse has deteriorated. Additionally, there’s discontent over the narrative that Cardano lacks community support, smart contracts, or development activity, which some perceive as false.

Despite the mixed feelings, the Cardano community remains active. Projects like the “Cardano AI Sentiment Tracker” aim to provide tools for the community to analyze sentiment more effectively, suggesting an ongoing interest in maintaining a positive and informed community atmosphere. Outside of the Cardano community, there seems to be a narrative that Cardano has been “faded” or underappreciated by the broader crypto industry, which might contribute to the community’s defensive posture or desire to prove its worth.

Overall, while there’s a strong base of support and optimism for Cardano’s future, there are also challenges with internal community dynamics that affect sentiment. This mix reflects a vibrant, though at times contentious, community landscape.

Technical Analysis

For Cardano to maintain its upward trajectory, it must hold above the key support levels while overcoming immediate resistance at $0.388 and $0.395. A sustained move above these levels could pave the way for a rally towards $0.420 and beyond, while failure to maintain above $0.350 could lead to further declines in price. Traders should closely monitor these levels along with market sentiment and technical indicators for optimal trading strategies.

Specifically, The current RSI value is 76.006, which indicates that ADA is in overbought territory. ADA has undergone a strong rally recently. Therefore, the price being in the overbought zone indicates that there is a high probability of a downward correction to rebalance the market.

Most of the Oscillators are giving neutral signals. This shows that the bullish and bearish momentum of ADA is in balance. There is no clear trend that is dominant. However, some Oscillators such as Momentum and MACD Level are giving buy signals, indicating that there is some momentum from investors trying to push the price of ADA higher.

Regarding Moving Averages, most of the moving averages are giving buy signals as the current ADA price is above the moving averages, indicating that the medium and long-term trend is still positive. The fact that the short-term moving averages are crossing above the long-term moving averages also reinforces the buy signal.

Cardano (ADA) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $1.778506 – $2.42 | $0.759 | $0.81 |

| 2026 | $3.123 | $0.980 | $2.28 |

| 2027 | $5.19 | $3.4 | $3.42 |

| 2028 | $6.06 | $3.8 | $4.4 |

| 2029 | $7.25 | $2.58 | $4.4 |

| 2030 | $10.32 | $3.54 | $4.89 – $6.06 |

2025 Predictions

While ADA has shown significant potential, future price predictions vary depending on market conditions and technical analysis. Bearish scenarios suggest a modest 119% gain from current levels, reaching a maximum of $0.759. This conservative outlook accounts for potential market corrections and challenges that could impact the cryptocurrency market. A more average scenario predicts ADA to trade around $0.81 in 2025, indicating a moderate growth potential. However, bullish analysts at CoinCodex and CoinPedia are more optimistic, forecasting prices as high as $1.778506 and $2.42, respectively, if favorable market conditions persist.

2026 Predictions

In 2026, a conservative outlook suggests that ADA might stabilize around $0.980, facing potential resistance at this level if broader market conditions deteriorate. An average scenario envisions ADA reaching $2.28, driven by technological advancements and increased adoption. However, a more bullish scenario predicts a price surge to $3.123, fueled by strong market sentiment and successful project developments.

2027 Predictions

Different analysts offer varying predictions for ADA’s future price in 2027. A bearish scenario suggests that ADA might struggle to maintain significant gains, potentially stabilizing around $3.40, influenced by market conditions and competition. An average scenario anticipates a price of approximately $3.42, contingent on continued innovation and ecosystem expansion. However, a bullish scenario envisions ADA reaching as high as $5.19, fueled by strong investor sentiment and widespread adoption.

2028 Predictions

A conservative outlook suggests ADA in 2028 might stabilize around $3.80, as market dynamics may lead to slower growth rates compared to previous years. A more moderate scenario anticipates an average price of approximately $4.40, driven by continued development within the Cardano ecosystem and growing adoption of blockchain technology. However, in a bullish scenario, ADA could reach up to $6.06, fueled by a strong cryptocurrency market and increased utility of its platform.

2029 Predictions

A bearish scenario suggests that ADA might average around $2.58 in 2029, indicating a potential downturn as market corrections take hold. A more moderate, average scenario anticipates a price of approximately $4.40, reflecting resilience in the face of market volatility due to Cardano’s foundational strengths. However, a bullish outlook envisions ADA reaching highs of around $7.25, driven by significant technological advancements and widespread adoption.

2030 Predictions

A pessimistic outlook suggests that ADA might struggle to exceed prices of about $3.54, reflecting ongoing challenges in the crypto landscape in 2030. A more moderate, average scenario anticipates a price range between $4.89 and $6.06, contingent on successful project implementations and favorable market conditions. However, an optimistic scenario envisions ADA reaching as high as $10.32, driven by extensive adoption and potential breakthroughs in technology within the Cardano ecosystem.

Conclusion

The projections for Cardano (ADA) present a compelling case for long-term investment. However, investors should be mindful of the inherent risks associated with cryptocurrencies. The cryptocurrency market is subject to significant volatility, influenced by factors such as regulatory changes, economic conditions, and technological advancements within the broader blockchain ecosystem. To mitigate risks, investors should conduct thorough research and consider diversifying their portfolios. While ADA offers promising potential, it is essential to approach any investment with a balanced perspective and a long-term horizon.

Related news: Bitcoin Price Prediction for 2025 – 2030. Will growth dominate the next five years?