The financial world is witnessing a historic shift as Bitcoin ETF options trading, led by BlackRock’s IBIT ETF, makes a staggering debut. With over $425 million in options trades recorded on its first day, this market has not only captured investor attention but also cemented Bitcoin’s growing role in mainstream finance.

At the first day of Bitcoin ETF options trading, BlackRock’s IBIT ETF set a new benchmark, with volumes surpassing $425 million. By mid-afternoon, IBIT’s overall trade volume exceeded $3 billion—a remarkable feat compared to the $1 billion threshold considered strong just a week earlier. According to Eric Balchunas, a Bloomberg ETF analyst, this volume is heavily skewed towards bullish sentiment, as reflected in the Put-Call ratio of 0.17. This means for every bearish option, nearly six bullish options are being placed, signaling strong investor confidence in Bitcoin’s trajectory.

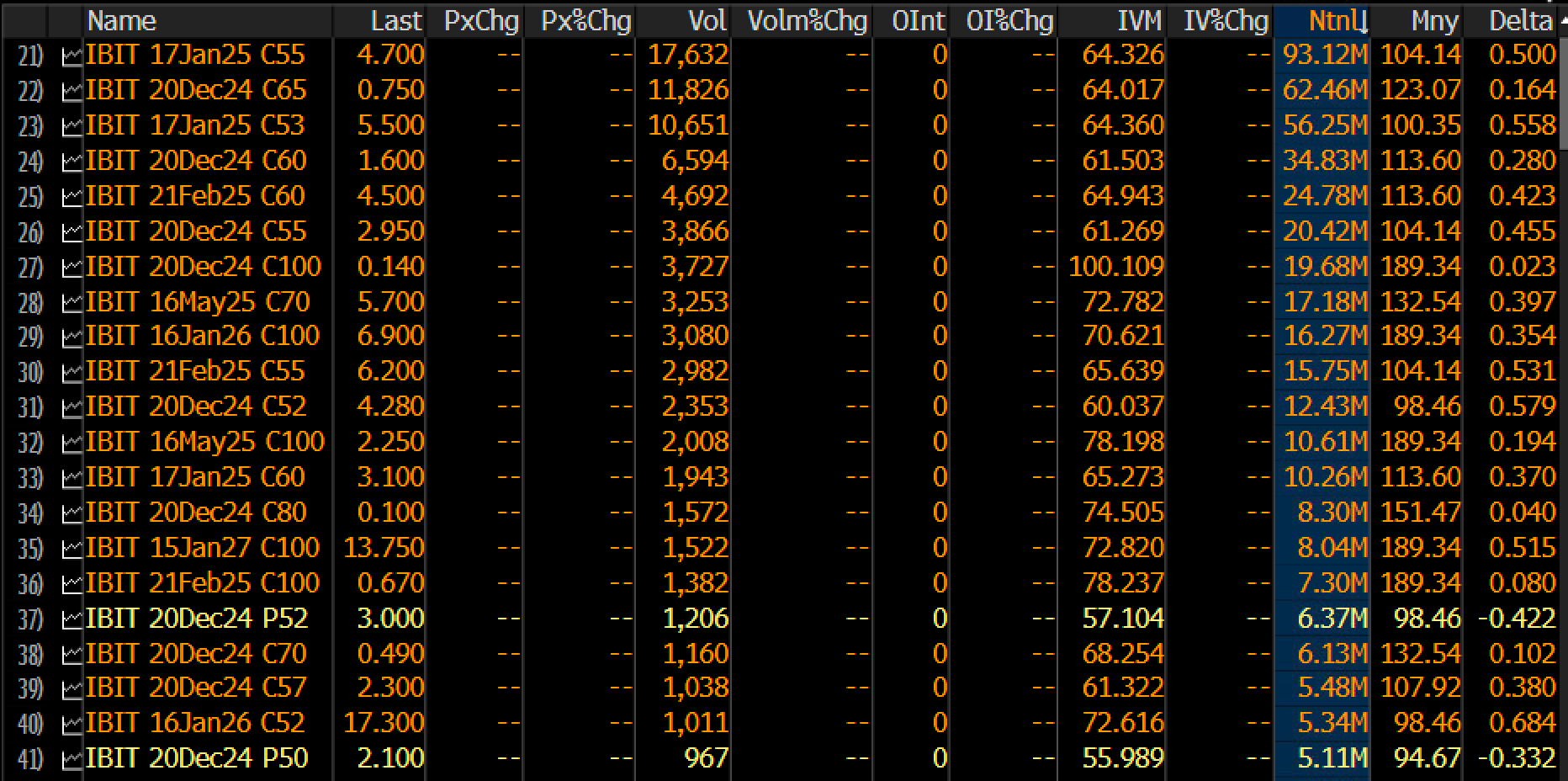

One of the most notable contracts has been the December 20 Call at $100,000, indicating bets that Bitcoin’s price could double within a month. Such optimism is fueled by Bitcoin’s recent rally, where the cryptocurrency hit an all-time high of $94,000, and the broader anticipation of more institutional inflows.

The Options Clearing Corporation (OCC)’s approval of Bitcoin ETF options trading has opened the floodgates for a new era of crypto investment. Options trading allows for more sophisticated market strategies, appealing to institutional and retail investors alike. It also provides a hedging mechanism, making Bitcoin ETFs a more attractive and manageable asset for risk-averse players.

The approval coincided with an impressive $816.4 million inflow into Bitcoin ETFs on the same day that BTC reached its record high. This synergy between spot and options markets has amplified Bitcoin’s appeal, drawing attention from traditional financial institutions and crypto enthusiasts alike.

BlackRock’s Strategic Bitcoin ETF Acquisition

BlackRock has further solidified its leadership in the Bitcoin ETF space by purchasing over 1,000 BTC since Monday, contributing to a collective 2,800 BTC acquired by U.S. ETF issuers within the same timeframe. ETF issuers now control more than 5% of the total Bitcoin supply, underscoring their growing influence on the cryptocurrency market.

This aggressive accumulation strategy not only showcases BlackRock’s confidence in Bitcoin’s future but also positions the firm as a key driver of market liquidity and stability. The company’s ability to integrate Bitcoin into its broader asset management portfolio sets a precedent for other financial giants to follow.

While BlackRock has dominated the spotlight, other players like Grayscale are also making moves to capture market share. Grayscale’s proposed covered-call Bitcoin ETF is an innovative approach aimed at attracting income-focused investors. However, the overwhelming interest in BlackRock’s IBIT suggests that the market is currently favoring well-established names with robust infrastructure and credibility.

BlackRock’s record-breaking debut in Bitcoin ETF options trading represents a watershed moment in the evolution of cryptocurrency investments. With over $425 million in trades on Day One and a bullish outlook dominating the market, the IBIT ETF has set a high bar for competitors. This development not only underscores the increasing maturity of the Bitcoin market but also paves the way for broader adoption across traditional financial systems.

As Bitcoin continues to break records and redefine financial norms, the success of BlackRock’s ETF options is a testament to the transformative potential of digital assets. Investors, regulators, and market participants alike will be closely monitoring this space as it reshapes the future of finance.

Related news: Solana DApps Hit Record Transaction Fees of Over $11 Million as Memecoin Frenzy Returns