The Solana blockchain has shown remarkable resilience and growth, maintaining its position as a leading platform for decentralized applications (dApps) and decentralized finance (DeFi). In November 2024, decentralized exchange (DEX) volumes on Solana surpassed $100 billion, signaling its significant role in the DeFi ecosystem.

One of the most exciting recent developments is Solana’s surge in the memecoin market, with new tokens driving fresh capital into the ecosystem. Additionally, the ongoing improvement of Solana’s infrastructure, including updates to the transaction scheduler and networking protocols, is designed to address congestion and enhance the overall user experience. This constant innovation has kept Solana competitive against other Layer 1 blockchains like Ethereum.

The platform’s developer ecosystem is also expanding, with projects like Anza and Jito Labs contributing to Solana’s continued growth. Solana’s robust validator network, which spans multiple countries, further solidifies its decentralized nature and ability to scale globally.

Overall, Solana’s growing DeFi dominance, continuous network improvements, and increasing developer engagement position it for continued success in the blockchain space, making it a strong contender for future blockchain adoption.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Solana (SOL) development team.

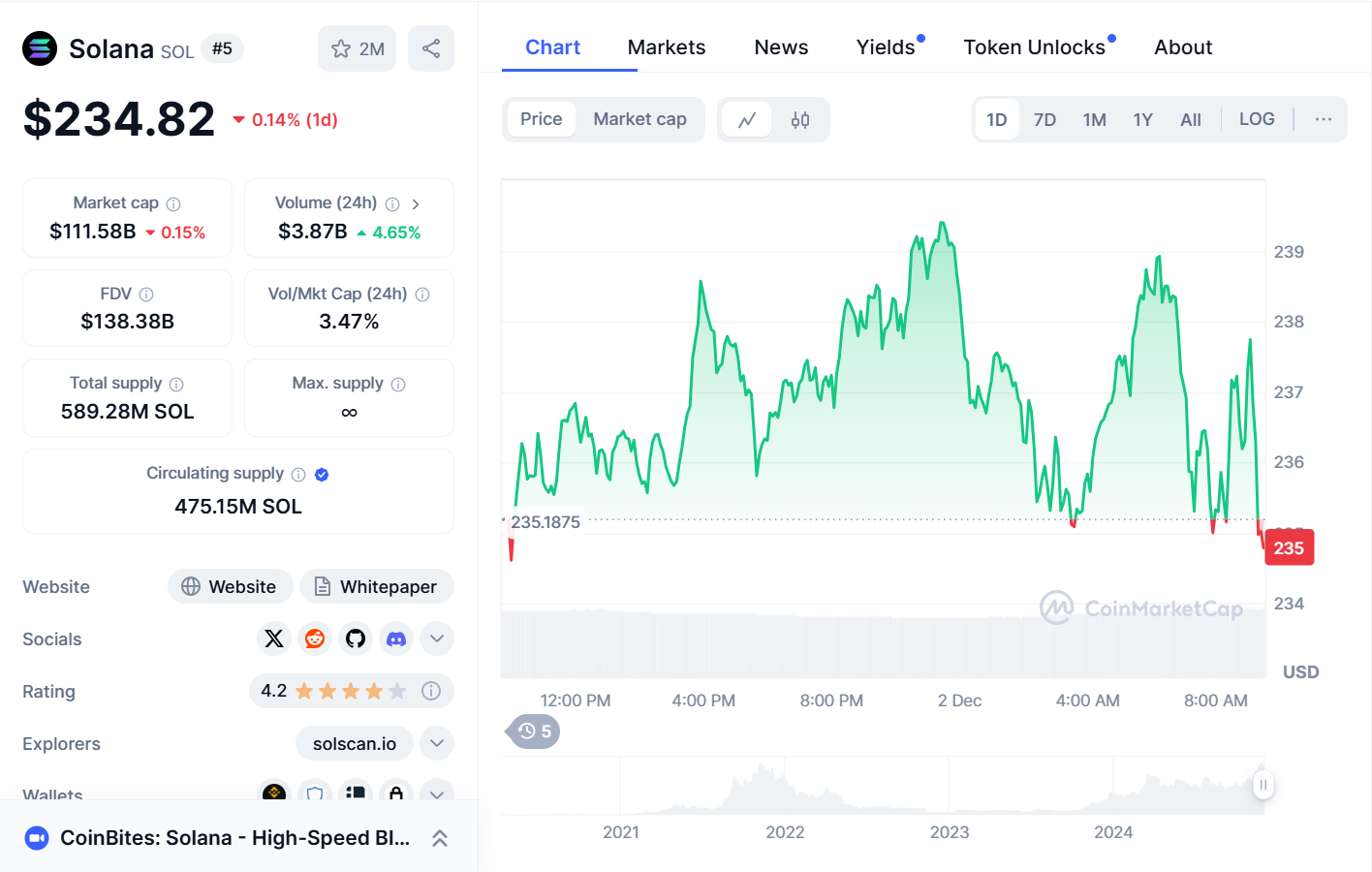

Current Price Performance

As of now, Solana (SOL) is trading at $234.82, reflecting a marginal 24-hour dip of 0.14%, yet showcasing resilience amidst market fluctuations. Over the past week, SOL has demonstrated mixed performance, balancing volatility while sustaining interest from investors.

Solana’s market capitalization currently stands robust at $111.58 billion, underscoring its position as a leader in blockchain innovation and adoption. The total 24-hour trading volume has surged to $3.87 billion, marking an impressive 4.65% increase, indicative of heightened trading activity and growing liquidity in the market. This uptick in daily volume could signify renewed investor confidence or preparation for a major price movement.

The circulating supply of Solana is recorded at 475.15 million SOL, out of a total supply of 589.28 million SOL, further reflecting its deflationary tokenomics. With the FDV (Fully Diluted Value) reaching $138.38 billion, the network’s long-term growth potential remains a compelling narrative for both retail and institutional investors.

Community Sentiment

The sentiment within the Solana (SOL) community is a mix of optimism and cautious awareness. Enthusiasm runs high as the community celebrates milestones in user engagement, product development, and resilience.

Posts on X highlight Solana’s ability to overcome past challenges, including network issues and bear market pressures, fostering a sense of pride among its supporters. The platform’s scalability and speed remain key drivers of positive sentiment, with bullish indicators like the Moving Average Convergence Divergence and RSI signaling potential for further price growth.

However, there’s an undercurrent of caution as some community members and analysts monitor market dynamics, including competition from Ethereum and broader market conditions. Discussions also acknowledge lingering concerns around network stability and the importance of ongoing innovation.While social sentiment leans bullish, the community balances its optimism with vigilance, ensuring a thoughtful approach to Solana’s evolving position in the crypto ecosystem.

Technical Analysis

Solana (SOL) is currently trading at $234.60, reflecting a slight daily decline of 0.99%. This movement underscores ongoing price pressure, influenced by both technical indicators and broader market sentiment. The Relative Strength Index (RSI) stands at 56.08, indicating a neutral zone with neither overbought nor oversold conditions. This neutrality suggests the market remains undecided, waiting for significant momentum or news to drive SOL’s price in either direction.

Analyzing the oscillators, most indicators reflect a neutral stance, including the Stochastic %K and Commodity Channel Index, signaling consolidation in price action. However, the Momentum (10) and MACD (12, 26) levels both indicate a sell signal, highlighting a potential weakening of upward pressure in the short term.

When examining the Moving Averages, the picture becomes mixed. While several short-term exponential and simple moving averages, such as the EMA and SMA (10), point to sell signals, medium to longer-term averages, including the EMA and SMA (30, 50, and beyond), suggest a buy. This divergence reflects uncertainty, where short-term traders might anticipate further downside, while long-term investors remain confident in SOL’s broader trajectory.

The overall market sentiment combines cautious optimism with heightened vigilance. With Solana’s trading volume at $3.86 billion, any breakout or breakdown from current levels will likely see substantial follow-through, emphasizing the importance of monitoring both technical and macroeconomic factors shaping its near-term direction.

Solana (SOL) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $184 – $555 | $159 | $450 |

| 2026 | $329 – $704 | $180 – $200 | $450 |

| 2027 | $420 – $480 | $300 | $450 |

| 2028 | $710 – $990 | $500 | $850 |

| 2029 | $1,250 | $800 | $1,000 |

| 2030 | $1,250 – $2,000 | $1,000 | $1,500 |

2025 Predictions

- Bullish: $184 to $555

- Bearish: Below $159

- Average: Approximately $450

In 2025, analysts expect Solana to experience significant volatility. The bullish outlook suggests that SOL could find strong support around $184 and potentially reach highs of $555, with some predictions extending up to $750 if market conditions are favorable. Conversely, bearish scenarios indicate that if the market falters, SOL could drop below $159, marking a strategic entry point for investors.

2026 Predictions

- Bullish: $329 to $704

- Bearish: Around $180 to $200

- Average: Approximately $450

The year 2026 is anticipated to be challenging for Solana as it may face a continuation of bearish trends from 2025. Analysts predict a potential decline of over 55% in the first half of the year, with prices stabilizing between $180 and $200. However, if adoption increases and market conditions improve, SOL could rise to around $704 by year’s end.

2027 Predictions

- Bullish: $420 to $480

- Bearish: Below $300

- Average: Approximately $450

Following a challenging 2026, 2027 is expected to mark the beginning of recovery for Solana. Analysts predict that after hitting lows in the previous year, SOL could rebound and trade between $420 and $480 as bullish momentum returns. However, if market conditions remain unfavorable, it could struggle to maintain these levels.

2028 Predictions

- Bullish: $710 to $990

- Bearish: Below $500

- Average: Approximately $850

By 2028, the outlook becomes increasingly optimistic with predictions suggesting that Solana could reach between $710 and $990. This bullish sentiment is supported by expectations of increased adoption and technological advancements within the ecosystem. However, there remains a risk of falling below the $500 mark if market dynamics shift negatively.

2029 Predictions

- Bullish: Around $1,250

- Bearish: Below $800

- Average: Approximately $1,000

The year 2029 is projected to be pivotal for Solana as it aims for significant price milestones. Analysts forecast that SOL could reach approximately $1,250 amid a recovering market. However, bearish scenarios suggest that if broader market trends decline, prices might dip below $800.

2030 Predictions

- Bullish: Peak around $1,250 to $2,000

- Bearish: Below $1,000

- Average: Approximately $1,500

Explanation: By 2030, analysts suggest that Solana could peak between $1,250 and potentially as high as $2,000 if widespread adoption occurs. This peak would signify a culmination of growth throughout the preceding years. Nonetheless, there remains a risk of falling below the critical support level of $1,000 if market conditions deteriorate significantly.

Conclusion

The price predictions for Solana from 2025 to 2030 illustrate a landscape filled with potential volatility and opportunity. While bullish forecasts suggest significant growth driven by technological advancements and increased adoption, bearish scenarios highlight the risks inherent in cryptocurrency markets. Investors should remain vigilant and consider both sides of these predictions when strategizing their investments in SOL.

Related news: From $0.00004 to $0.0004: Starri’s Five-Year Price Outlook