Shieldeum (SDM) continues to generate significant attention in the cryptocurrency market, driven by recent price movements and strategic developments. As of the latest updates, Shieldeum’s market value stands at approximately $0.166, marking a remarkable 29% increase in the last 24 hours. This surge has highlighted its growing volatility and strong investor interest, with SDM achieving its all-time high of $0.1835 just recently.

Currently, the cryptocurrency holds a market capitalization of about $14 million, with a circulating supply of 84.46 million SDM and a total maximum supply capped at 1 billion tokens. Despite its recent price highs, SDM’s market is still adapting as demand and investor sentiment shift. Additionally, Shieldeum’s functionality within the decentralized physical infrastructure network (DePIN) space remains pivotal. It leverages decentralized computing to support cybersecurity, application hosting, data encryption, and high-performance computing for crypto holders and Web3 enterprises.

Shieldeum’s key strength lies in its AI-powered infrastructure network, which facilitates computing services for over 440 million crypto users worldwide, showcasing a clear vision to address scalability and security concerns within the blockchain ecosystem. Moving forward, Shieldeum continues to be a noteworthy project for both the tech-savvy and crypto-investment community amidst shifting market conditions.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Shieldeum (SDM) development team.

Current Price Performance

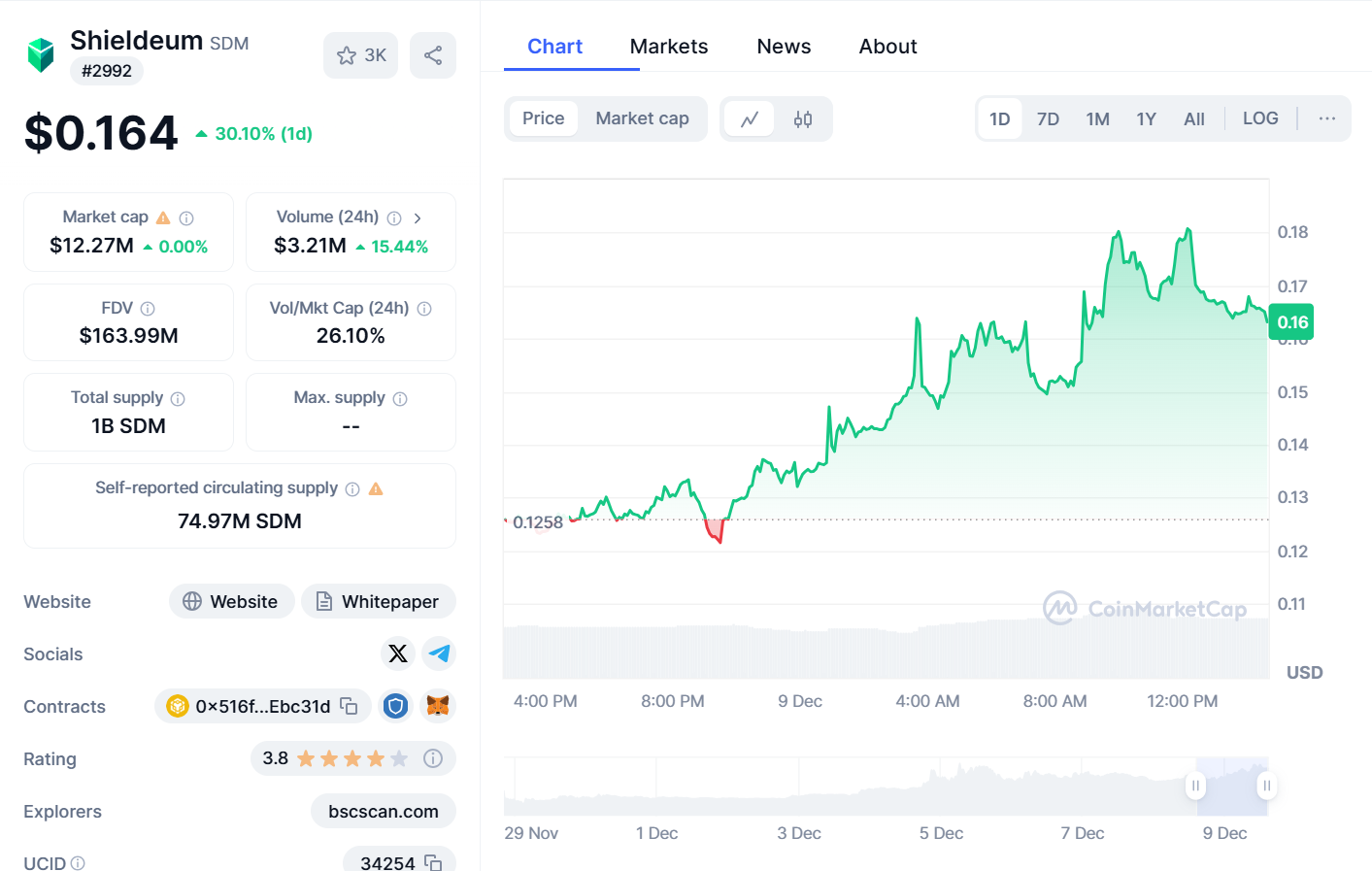

Shieldeum (SDM) is currently trading at $0.164, marking a 10% jump over the past 24 hours. This recent uptick underscores a fresh wave of momentum, fueled by a notable 15.44% spike in trading volume, which has climbed to $3.21 million. While the previous week showcased more moderate growth patterns, this recent trading activity signals renewed investor interest and market enthusiasm for the token.

Despite these encouraging trends, SDM’s market capitalization remains modest at $12.27 million, emphasizing its standing as a small-cap cryptocurrency. This context points to its potential for further price volatility in the near term, particularly as market trends shift.

The recent increase in trading activity could stem from a variety of catalysts, such as emerging partnerships, innovative product launches, or broader market movements. However, the cryptocurrency market is notoriously volatile, and investors should approach this dynamic landscape with caution. Given the unpredictable nature of price movements, conducting comprehensive research and consulting with financial professionals is highly recommended before making any investment decisions.

Community Sentiment

The community sentiment surrounding Shieldeum (SDM) is predominantly positive, driven by several key factors. SDM has experienced notable price movements, including reaching new all-time highs post-launch, which has sparked investor optimism. User engagement has also been strong, with active participation on the Telegram Node Rewards App. The user base has grown significantly, from 100,000 to 160,000, without relying on paid marketing efforts, highlighting organic community growth and interest.

Adding to this optimism is the announcement of a major airdrop of at least one million SDM node rewards, which has further incentivized community participation. Furthermore, Shieldeum’s listing on prominent exchanges like KuCoin, MEXC, Gate.io, and PancakeSwap, along with its trending mentions on CoinMarketCap, reflect its growing market visibility. The project’s strategic partnerships, including its connection with ChainGPT, reinforce confidence in its technological advancements and role as a key player in the decentralized physical infrastructure network (DePIN) space.

Technical Analysis

Shieldedum (SDM) has demonstrated impressive momentum, rising by +2.40% to reach $0.162529 on the KUCOIN exchange. The market is currently in a bullish phase, indicated by key technical indicators. However, other oscillators such as the RSI (Relative Strength Index) remain unlisted, leaving room for speculation about SDM’s strength in terms of overbought or oversold conditions.

The moving averages tell a compelling story, leaning towards a “Buy” recommendation overall. Exponential Moving Averages (EMA) across key timeframes (10, 20, and 30 periods) support bullish sentiment, with values like 0.119531 and 0.118777 consistently supporting the current price. This alignment across multiple moving averages reinforces confidence in SDM’s sustained upward trajectory.

Market volume adds to this bullish narrative, with over 1.12 million SDM traded today, signaling robust market interest. Coupled with a staggering 1,704.19% growth across both monthly and quarterly performance metrics, SDM is undoubtedly on the radar of traders seeking high-momentum assets.

Shieldeum (SDM) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $0.4039 | $0.139 – $0.14 | $0.33 |

| 2026 | $0.54 | $0.06 | $0.19 |

| 2027 | $0.72 | $0.07 | $0.155 |

| 2028 | $0.72 | $0.11 | $0.366 |

| 2029 | $0.86 | $0.30 | $0.74 |

| 2030 | $1.15 | $0.12 | $0.38 |

2025 Predictions

- Bearish Scenario: The minimum price could drop to around $0.14. Some predictions suggest that under unfavorable market conditions, SDM might see a low of $0.139.

- Bullish Scenario: Optimistic forecasts indicate that SDM could rise as high as $0.40 or even $0.4039, reflecting a significant increase from current levels.

- Average Price: The average trading price is expected to stabilize around $0.33, which represents a moderate growth trajectory within the year.

2026 Predictions

- Bearish Scenario: Prices may decline to a minimum of $0.06, indicating potential volatility in the market.

- Bullish Scenario: A positive outlook suggests SDM could reach up to $0.54, marking a substantial recovery and growth from previous years.

- Average Price: Analysts predict an average price of approximately $0.19, reflecting cautious optimism amid market fluctuations.

2027 Predictions

- Bearish Scenario: The price may hover around a low of $0.07, indicating possible stagnation in growth due to market pressures.

- Bullish Scenario: Forecasts suggest SDM could achieve highs of around $0.72, driven by increased adoption and market interest.

- Average Price: The expected average price is projected at about $0.155, suggesting moderate growth during this period.

2028 Predictions

- Bearish Scenario: In a less favorable market, SDM might see prices dip to around $0.11.

- Bullish Scenario: On the upside, SDM could potentially reach a maximum of $0.72, benefiting from heightened investor interest and market dynamics.

- Average Price: The average forecast for 2028 is around $0.366, illustrating potential for significant upward movement during this year.

2029 Predictions

- Bearish Scenario: Under adverse conditions, the minimum price might stabilize at approximately $0.30.

- Bullish Scenario: Optimistic projections suggest SDM could reach up to $0.86, reflecting strong market demand and investor confidence.

- Average Price: Analysts expect an average trading price around $0.74, indicating steady growth over the year.

2030 Predictions

- Bearish Scenario: The lowest expected price could be around $0.12, suggesting potential volatility in the cryptocurrency market.

- Bullish Scenario: Forecasts indicate that SDM might achieve highs of approximately $1.15, marking a significant milestone in its price journey.

- Average Price: The average trading price is projected to be about $0.38, reflecting an overall positive trend despite potential dips.

Conclusion

The predictions for Shieldeum (SDM) from 2025 to 2030 illustrate a range of possibilities influenced by market conditions, investor sentiment, and broader economic factors. While bullish forecasts are optimistic about substantial growth, bearish scenarios highlight the inherent risks associated with cryptocurrency investments.

Related news: Uniswap’s Long-Term Outlook: Is UNI Set for Explosive Growth by 2030?