Sei (SEI) has recently shown strong growth, maintaining a price of around $0.63 despite a slight 2.61% drop in the past 24 hours. Over the last week, however, the token has experienced a notable 24.29% increase, reflecting ongoing investor optimism. The price of Sei has fluctuated between $0.60 and $0.67 in the past day, showing volatility but also resilience

This volatility follows Sei’s all-time high of $1.14 in March 2024, and the market sentiment remains bullish, with a significant portion of indicators favoring growth. The Fear & Greed Index currently signals “Extreme Greed,” suggesting investor confidence in the coin’s potential. Sei’s performance is backed by its technological strengths, such as high-speed processing capabilities and developer-friendly tools for building decentralized applications (DApps), which continues to attract attention in the decentralized finance (DeFi) space.

Looking forward, market analysts predict that Sei could finish 2024 with a price nearing $0.61, with further growth anticipated in 2025 as the ecosystem expands. The Sei network’s scalability and support for emerging DApps make it an appealing platform for future development and investment.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Sei (SEI) development team.

Current Price Performance

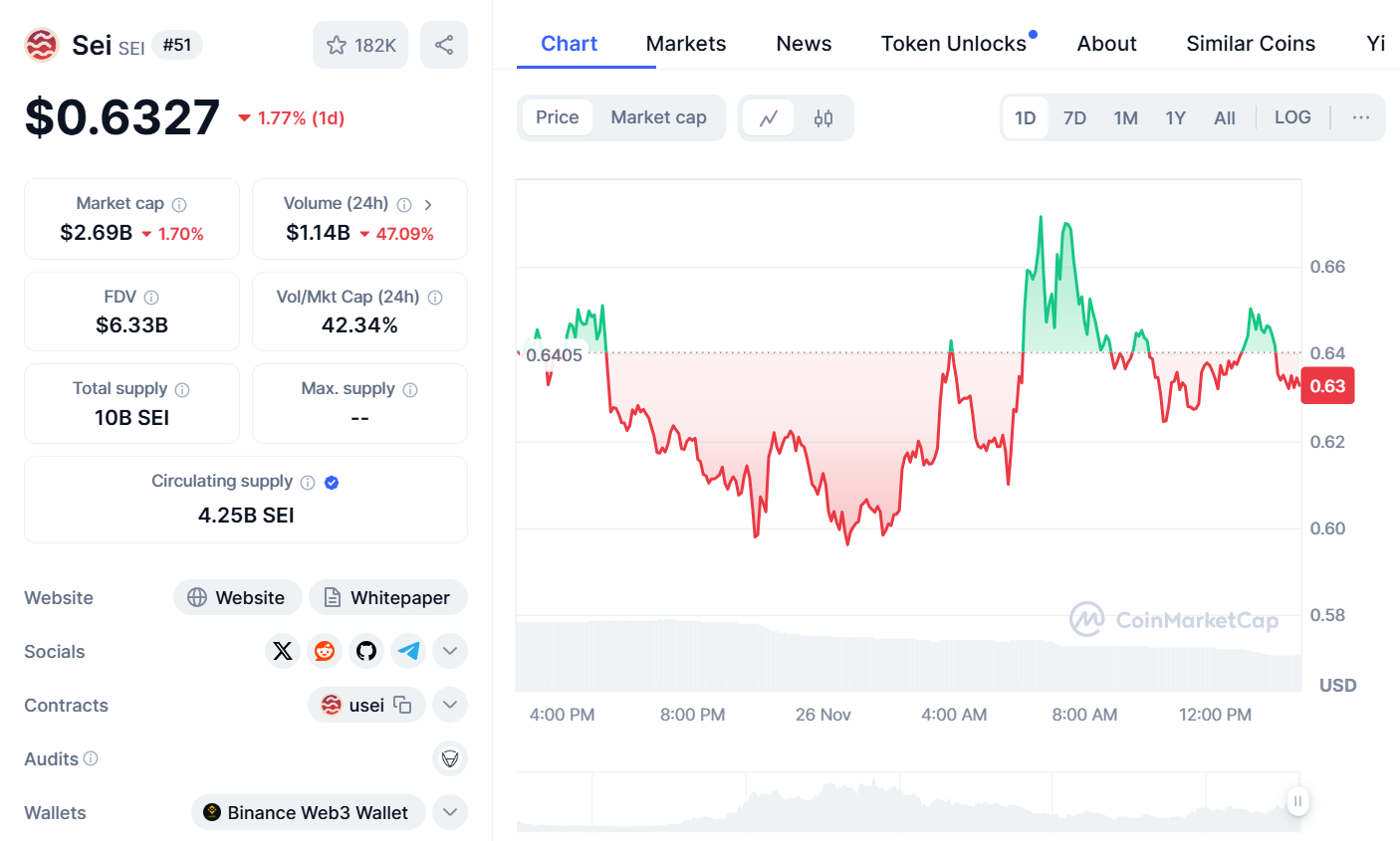

The cryptocurrency Sei is currently trading at $0.6327, reflecting a 1.77% decline over the past 24 hours, showcasing its sensitivity to market dynamics. Over the last week, the token has experienced notable fluctuations, with periods of recovery interspersed by sharp declines, highlighting the volatility that defines much of the crypto market.

With a market capitalization of $2.69 billion, Sei holds its position as one of the top projects in the crypto space, demonstrating significant investor interest and a strong presence in the market. The Fully Diluted Valuation (FDV) stands at $6.33 billion, suggesting the potential market value if the entire supply of 10 billion SEI tokens were in circulation.

Trading volume in the past 24 hours has reached a robust $1.14 billion, accounting for 42.34% of the market cap, indicating active participation and heightened interest among traders. However, this figure represents a sharp 47.09% drop compared to the previous day, signaling a possible cooldown in trading momentum. This decrease in volume could hint at traders taking a cautious stance, possibly awaiting clearer market signals or reacting to broader market trends.

The circulating supply of Sei is currently 4.25 billion tokens, which represents a significant portion of the total supply. This level of circulation underscores the token’s liquidity and accessibility across markets.

In summary, Sei’s price performance today underscores a phase of correction, aligning with broader market sentiment. Its high trading volume, despite recent declines, coupled with a robust market cap, reflects strong underlying fundamentals. For investors and enthusiasts, Sei remains a dynamic player worth monitoring closely as it navigates the complexities of the crypto landscape.

Community Sentiment

The sentiment surrounding Sei appears largely positive, marked by significant growth, technical achievements, and community engagement within its ecosystem. The Sei community has expanded substantially, now featuring over 100 ecosystem projects, demonstrating a dynamic and active development environment. This growth reflects a healthy interest in Sei’s blockchain capabilities, with numerous updates and deployments supporting its continued evolution.

Technically, Sei has garnered praise for its impressive performance metrics, including one of the fastest finality times at 416ms and low transaction fees averaging $0.04. Additionally, the platform’s substantial NFT trading volume further highlights its efficiency and cost-effectiveness, indicating widespread satisfaction with its infrastructure.

Community involvement has also seen remarkable progress, with nearly 500,000 members on Discord, millions of transactions, and a growing number of unique wallet users. This surge in engagement underscores the strong interest and commitment from both users and developers in Sei’s future.

Looking forward, excitement around upcoming developments, particularly the mainnet, signals optimism about Sei’s potential for further growth within the crypto space. However, some concerns have emerged, particularly regarding competition. Some in the community have noted that Sei may be losing ground to competitors like Sui (SUI), though many still believe Sei has room for recovery and growth if market trends remain favorable.

Technical Analysis

The current technical analysis of Sei reveals a market in consolidation, with a neutral sentiment dominating most oscillators. This suggests that the price is stabilizing, showing no clear directional bias at the moment. The Stochastic RSI, however, is slightly leaning towards the oversold region, indicating some potential selling pressure, although the overall market sentiment remains neutral. The Relative Strength Index (RSI) is in the overbought territory, with a value of 66.2771, suggesting that upward momentum could be slowing down, and a price correction may be on the horizon.

Moving averages paint a more bullish picture, as the majority are signaling a “buy,” indicating a positive long-term trend. However, the convergence of short-term and long-term Exponential Moving Averages (EMAs) hints at the potential for a short-term price correction. Combining these signals, the outlook suggests a period of consolidation, where the price may remain range-bound as buyers and sellers compete for control. Despite the slight bearish bias indicated by the RSI and the converging EMAs, the overall bullish sentiment from the moving averages suggests that any decline might be temporary.

In conclusion, while Sei is currently experiencing a neutral to slightly bearish phase, the long-term outlook remains positive. Investors should remain cautious, monitoring for any signs of a trend reversal while being aware that the overall sentiment continues to favor upward movement.

Sei (SEI) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | 1.130$ | 0.927$ | 0.960$ |

| 2026 | 1.620$ | 1.350$ | 1.400$ |

| 2027 | 2.340$ | 1.970$ | 2.030$ |

| 2028 | 3.330$ | 2.920$ | 3.000$ |

| 2029 | 4.940$ | 4.160$ | 4.280$ |

| 2030 | 7.240$ | 5.650$ | 5.870$ |

2025 Predictions

In 2025, Sei could experience a range of outcomes. In a bearish scenario, it might fall to $0.927 due to market corrections. A more stable outlook predicts a price of $0.960, reflecting steady, cautious growth. However, if adoption and performance improvements drive the token forward, the price could reach $1.130 in an optimistic scenario.

2026 Predictions

Looking ahead to 2026, the price of Sei could range widely depending on market dynamics. In a bearish scenario, the price might drop to $1.350 due to market volatility. A more conservative estimate predicts a steady price of $1.400, reflecting consistent growth as Sei expands its applications and user base. However, in a bullish scenario, the price could surge to $1.620, suggesting significant technological advancements and a strong market presence.

2027 Predictions

By 2027, Sei could experience a range of price outcomes depending on market conditions and adoption trends. In a more cautious scenario, the price could fall to $1.970, influenced by potential setbacks in the broader crypto market. A balanced outlook anticipates steady growth, with Sei possibly reaching around $2.030 as its ecosystem continues to expand. On a more optimistic note, if Sei strengthens its market presence and technological advancements, the price could surge to $2.340.

2028 Predictions

For 2028, Sei could see different price outcomes. In a bearish scenario, it may reach $2.920, reflecting potential challenges. A stable outlook predicts $3.000, as Sei matures and strengthens its market position. In a bullish case, technological progress and user engagement could push the price to $3.330.

2029 Predictions

By 2029, Sei could experience various price movements. In a bearish scenario, the price may reach $4.160, suggesting that while growth continues, it may not be as explosive as anticipated. A more balanced outlook sees the price at $4.280, reflecting steady performance and favorable market conditions. In the most optimistic scenario, the price could rise to $4.940, driven by high confidence in Sei’s long-term viability and deeper market penetration.

2030 Predictions

In 2030, Sei could see varied outcomes depending on market conditions and its continued development. In a bearish scenario, the price could drop to $5.650, reflecting a conservative estimate should market dynamics shift unfavorably. A more balanced outlook predicts a price of $5.870, showing strong confidence in Sei’s future success as it gains wider global recognition. On the more optimistic side, the price could rise to $7.240, suggesting that Sei could become a significant player in the cryptocurrency ecosystem by 2030.

Conclusion

Sei demonstrates a promising outlook with a range of price trajectories from 2025 to 2030, reflecting its potential to grow steadily within the cryptocurrency market. While bearish predictions highlight challenges such as market volatility or competition, average projections suggest consistent growth driven by SEI’s ecosystem expansion and technological advancements. Bullish scenarios present an ambitious vision of Sei becoming a significant player in the crypto space, with substantial market penetration and innovation.

Related news: Pessimistic SPX6900 Price Forecast 2025-2030: Will It Skyrocket 10x or Fade Into Oblivion?