The Render (RENDER) is the native utility token of the Render Network, a decentralized GPU rendering platform designed to connect creators who need intensive graphical rendering capabilities with individuals or entities willing to rent out their idle GPU power.

As we analyze its price trajectory, RENDER stands out not just for its current market performance but for its unique value proposition within industries like AI, machine learning, and high-end graphics.

This prediction will explore the short- and long-term price possibilities for RENDER, considering market trends, technical indicators, and broader crypto industry developments.

Render Current Price

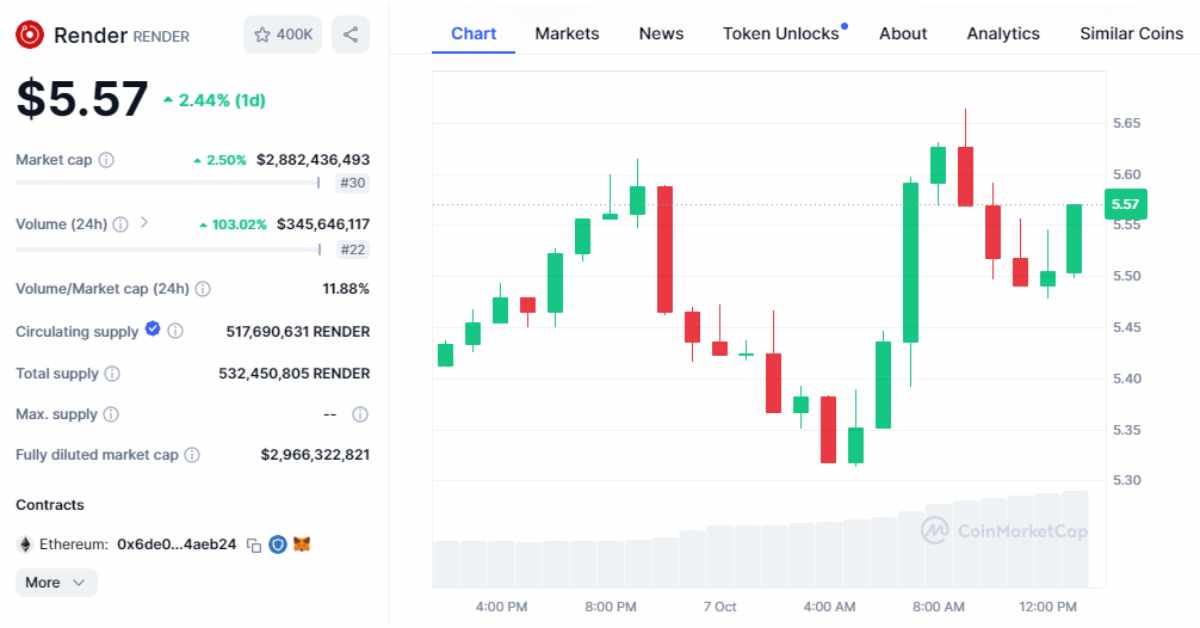

As of October 7, 2024, Render’s price fluctuates between $5.314 and $5.66, reflecting a 2.44% increase in the last 24 hours, although it has seen a more significant decrease of 16.54% over the past week.

With a market capitalization ranging from $2.75 billion to $2.93 billion, Render holds the 30th position on CoinMarketCap, indicating its prominence in the cryptocurrency market.

A robust 24-hour trading volume of $345.6 million highlights a dynamic and liquid trading environment for Render, suggesting strong investor interest and activity.

Community Sentiment

On platforms like X (formerly Twitter), the sentiment surrounding Render is largely positive, with discussions focusing on its utility and growth potential. Many community members view the token as undervalued at the $5 mark, citing its essential role in GPU rendering solutions as a unique advantage in the tech space.

The recent transition of Render to the Solana blockchain is seen as a significant step towards improving scalability and transaction speeds, aligning the project with growing demands for decentralized GPU computing, particularly in AI, machine learning, and high-end graphics.

With Render positioned as a key player in the decentralized GPU rendering niche, broader adoption in industries requiring intensive computational power could further fuel price growth. Positive sentiment among its community and strategic investors could lead to sustained buying interest, making RENDER a strong contender for future price appreciation, particularly if the broader market remains stable or bullish.

Technical Analysis

The Relative Strength Index (RSI) measures the speed and change of price movements. It’s typically used to gauge overbought or oversold conditions.

As for Moving Averages, there’s mention of RENDER moving above the 50-day Simple Moving Average (SMA), indicating a bullish signal in the short term. The focus is on breaking past the 100-day SMA for further confirmation of an uptrend.

Support levels have been identified in the $4 to $5.7 range, showing resilience and potential for a bounce-back. On the resistance side, levels are noted at higher thresholds like $6.60, with significant interest in breaking past $7.5 and $8.2. These technical points suggest a market in a testing phase, looking for solid breakout or breakdown signals to define its next major move.

Render Price Prediction

| Year | Bearish | Bullish | Average |

| 2024 | $6.17 | $8.10 | $7.32 – $7.89 |

| 2025 | $8.10 | $62.80 | $7.93 |

| 2026 – 2030 | $20 | $173.31 | $40.00 |

2024 Prediction

Average Price: The analysis suggests an average price hovering around $7.32 to $7.89, with some optimism pushing towards higher peaks due to developments like partnerships and tech integrations (e.g., with Apple Vision Pro).

Bullish Scenario: Price could reach up to $8.10 or even higher if market conditions are exceedingly favorable, potentially driven by increased demand for GPU services and crypto market trends.

Bearish Scenario: If the market sees a downturn or if Render fails to capitalize on its technological integrations, we might see lows around $6.17 or even dip below if broader market conditions are poor.

2025 Prediction

Average Price: Predictions suggest an increase, with averages around $7.93, climbing due to broader adoption and technological advancements.

Bullish Scenario: With successful roadmap execution and increased GPU demand, prices could soar towards $62.80, though this seems very optimistic and might be influenced by broader crypto market bull runs.

Bearish Scenario: If the crypto market faces regulatory hurdles or technological setbacks, the price might struggle, potentially staying around or slightly above 2024 levels.

2026 – 2030 Prediction

General Trend: Analysts predict a gradual increase with significant fluctuations. By 2030, the average price might stabilize due to maturity in both the crypto and tech markets.

- 2026: Average around $11.45 to $19.13, considering post-halving effects on crypto and assuming Render’s utility grows.

- 2028: Analysts might expect $34.30 to $40.00 if previous growth trends and adoption continue.

- 2030: Predictions vary widely, but a more conservative estimate might place it around $23.59, while highly optimistic scenarios (factoring in hyper-growth of AI and GPU demand) could see figures like $173.31, though this would require exceptional market conditions and Render’s dominant position in its niche.

Bullish Scenario by 2030: If Render becomes integral to global GPU rendering services, leveraging AI and VR/AR growth, we could see maximum peaks, potentially even challenging the higher estimates due to scarcity and utility value.

Bearish Scenario by 2030: If alternative technologies emerge or if Render faces scalability issues or regulatory challenges, growth could be stunted, keeping prices potentially below $20.

Conclusion

Render Token’s price predictions highlight its potential as a key player in the decentralized computing space, especially in GPU rendering solutions. With a strong market presence, positive community sentiment, and growing demand for decentralized GPU power, RENDER appears poised for significant growth in both the short and long term.

However, like all cryptocurrencies, it remains subject to the volatility of the broader market, making it crucial for investors to stay informed of both technical and market trends.