Propchain (PROPC) is making waves in the cryptocurrency market as a key player in blockchain-powered real estate investments. Trading between $1.85 and $1.91 in recent hours, the token has a market capitalization of approximately $20.6 million, ranking it #798 among global cryptocurrencies. With a circulating supply of around 11 million tokens out of a total cap of 100 million, Propchain showcases potential for scalability and growth within its niche.

Though Propchain is 65% below its all-time high of $5.31 (achieved in March 2024), it remains significantly above its all-time low, marking a 137% recovery since August. Its recent weekly performance, however, shows a slight decline of 4%, underperforming the general market trend.

The appeal of Propchain lies in its innovative approach to tokenizing real estate, allowing investors to access fractional ownership of high-value properties. This approach simplifies real estate investment processes and aligns with the growing demand for blockchain-based solutions in traditional industries. With its utility-focused design, PROPC continues to draw attention from both crypto enthusiasts and institutional investors.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Propchain (PROPC) development team.

Current Price Performance

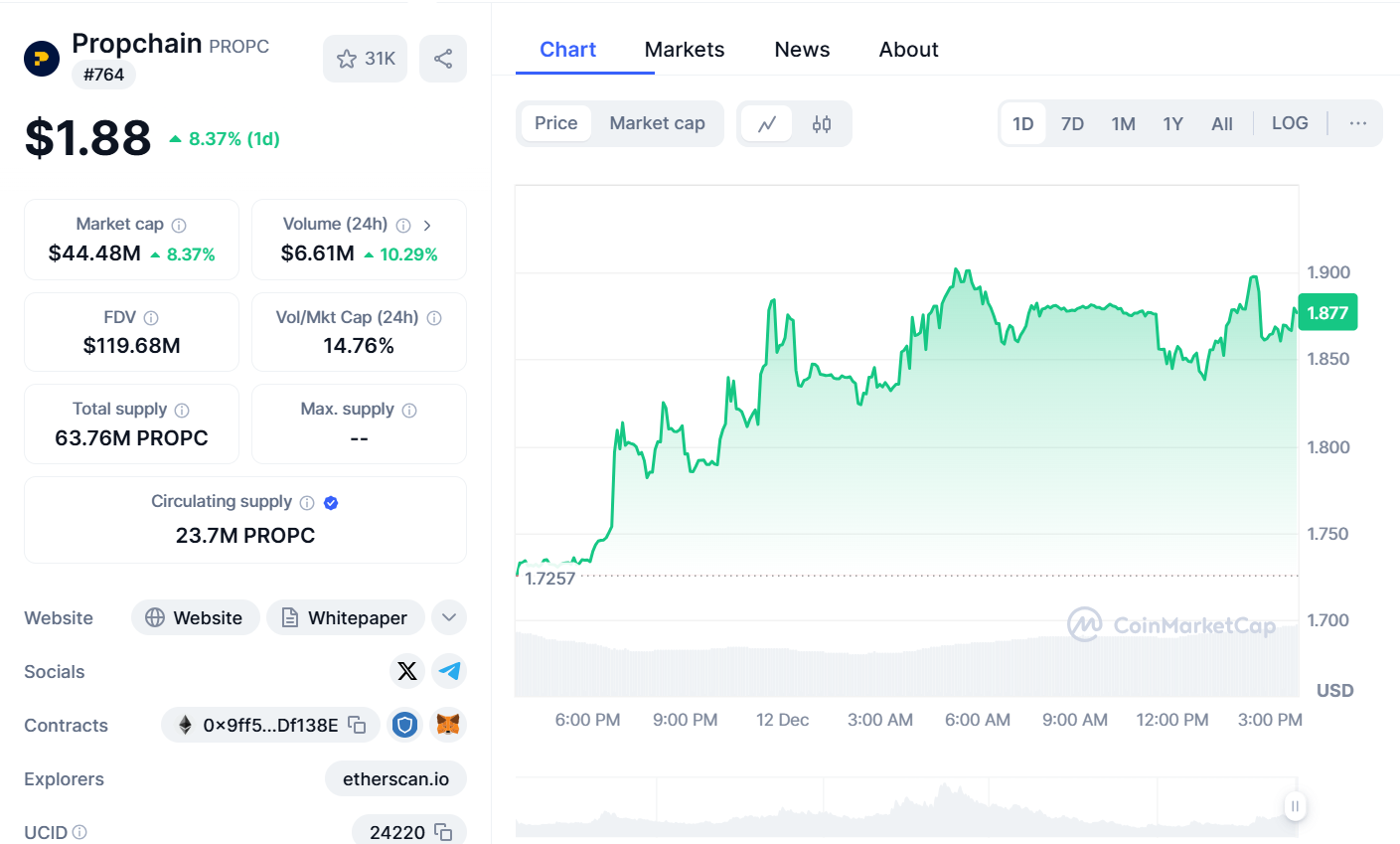

Propchain (PROPC) is making waves in the crypto market today, currently priced at $1.88, reflecting an impressive 8.37% increase over the last 24 hours. This upward momentum has caught the attention of investors, marking it as a standout performer in the market. Over the past week, the token’s performance showcases resilience, riding a wave of optimism despite broader market fluctuations.

The market capitalization now stands at $44.48 million, underscoring the project’s growing appeal and adoption. With a circulating supply of 23.7 million PROPC tokens, the asset is carving out its niche in the competitive landscape. What further solidifies its bullish sentiment is the $6.61 million 24-hour trading volume, which signifies heightened investor activity and confidence.

The Fully Diluted Valuation (FDV) hitting $119.68 million hints at substantial long-term potential, while the 14.76% Volume-to-Market Cap ratio highlights robust liquidity. Today’s price chart demonstrates steady growth, with no signs of cooling off as it approaches new resistance levels.

Community Sentiment

Community sentiment surrounding Propchain (PROPC) is largely positive, reflecting optimism about the project’s growth potential and recent developments. Analysts have described its sentiment as “Very Bullish,” supported by notable market performance, such as a 13.28% price surge that outpaced broader market trends. This performance highlights strong investor confidence in Propchain’s long-term value.

Recent updates have further energized the community, including the integration of OKX Wallet and the introduction of Propchain DAO proposals. Strategic initiatives like token burns are also perceived as steps toward enhancing the project’s sustainability and appeal. Propchain’s focus on tokenizing real estate assets has positioned it as a leader in the Real-World Assets (RWA) segment, offering innovative blockchain-based investment opportunities.

Expansion efforts, including new exchange listings and plans to explore untapped markets, bolster visibility and utility. However, while sentiment remains high, sustained community enthusiasm depends on the project’s ability to deliver real-world applications effectively.

Technical Analysis

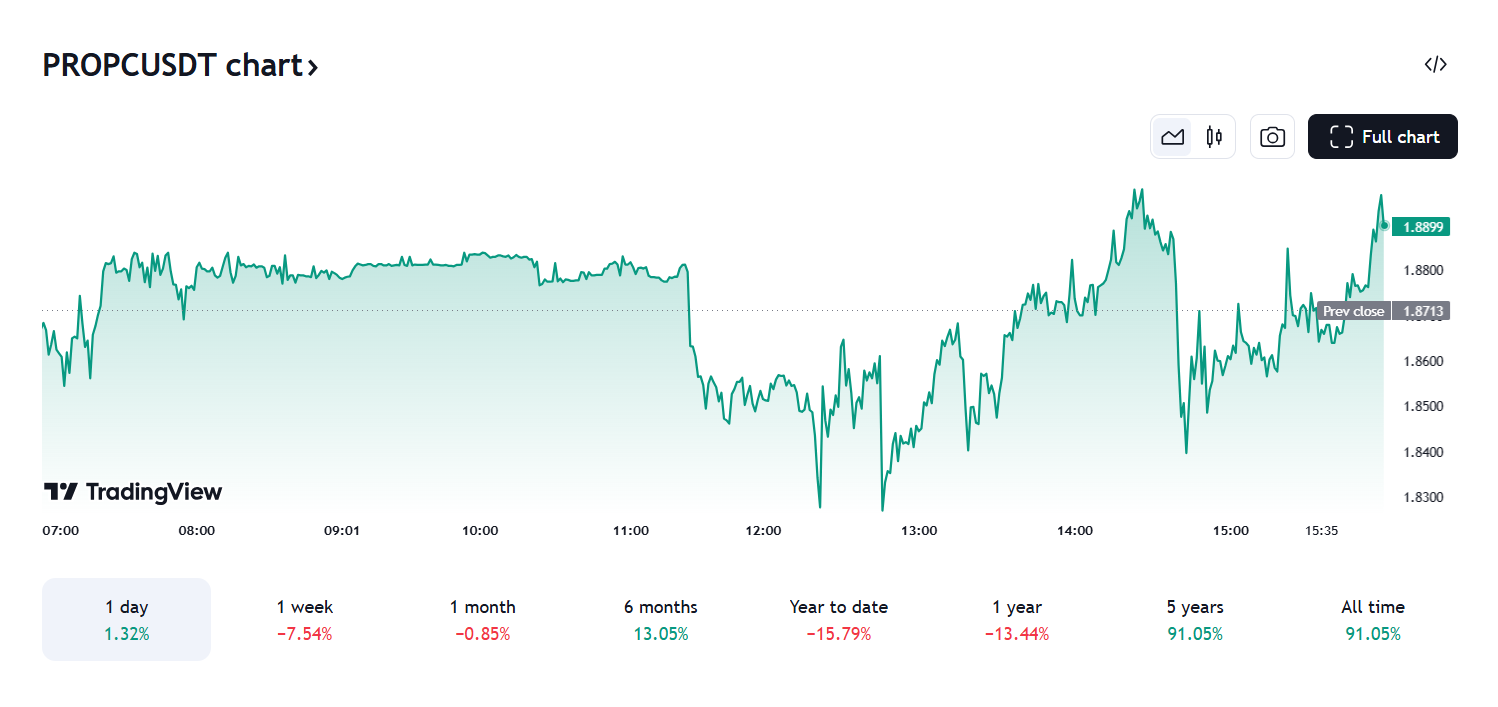

Propchain (PROPC) is navigating a dynamic market environment, with its price currently at $1.8888, reflecting a modest 0.94% gain on the day. Oscillators are signaling a mixed sentiment, leaning towards neutral, with key metrics like the Relative Strength Index (RSI) at 53.62. This value suggests the asset is neither overbought nor oversold, implying a balanced market sentiment.

On the other hand, Moving Averages present a more optimistic outlook, with multiple long-term indicators showing a “Buy” signal. The Exponential Moving Average (50) and the Simple Moving Average (100) demonstrate bullish momentum, hinting at strong support levels in the medium to long term. The market’s interplay between oscillators and moving averages illustrates a tug-of-war between bulls and bears.

Overall, the indicators reveal a nuanced picture: while short-term fluctuations and resistance levels may temper immediate price gains, the strength in long-term moving averages suggests that Propchain remains poised for potential upward momentum, provided it breaks through near-term hurdles. This delicate balance makes PROPC a fascinating asset to watch, especially for investors keen on leveraging both technical signals and market sentiment.

Propchain (PROPC) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $5.33 | $2.13 | $3.50 |

| 2026 | $6.64 | $1.89 | $4.00 |

| 2027 | $8.22 | $1.06 | $2.37 |

| 2028 | $5.59 | $1.65 | $3.00 |

| 2029 | $12.51 | $4.70 | $8.00 |

| 2030 | $11.97 | $1.98 | $5.83 |

2025 Predictions

In 2025, Propchain (PROPC) could reach $5.33 in a bullish market, driven by strong investor confidence and favorable conditions. In a bearish scenario, the price may drop to $0.34–$2.13 due to regulatory pressures or market corrections. The average price is projected at $3.50, indicating moderate growth amid potential volatility.

2026 Predictions

For 2026, Propchain (PROPC) could reach $6.64 in a bullish scenario, fueled by growing adoption and sustained positive market sentiment. In a bearish scenario, the price might decline to $1.89, reflecting reduced investor interest and challenging market conditions. The average forecast for 2026 is around $4.00, indicating moderate growth, though less robust compared to earlier years.

2027 Predictions

By 2027, Propchain (PROPC) could achieve a bullish peak of $8.22, driven by recovery and sustained growth in the cryptocurrency market. In a bearish scenario, the price may drop as low as $1.06, influenced by unfavorable economic conditions or market instability. The average forecast for the year is $2.37, reflecting a balance between potential highs and lows throughout the year.

2028 Predictions

In 2028, Propchain (PROPC) could reach a bullish high of $5.59, driven by advancements in blockchain technology and expanding use cases. In a bearish scenario, the price may decline to $1.65, reflecting challenges like reduced investor confidence or adverse market conditions. The average price forecast is $3.00, suggesting cautious optimism while accounting for ongoing market volatility.

2029 Predictions

By 2029, Propchain (PROPC) could achieve a bullish high of $12.51, driven by expanded adoption and strong market growth. In a bearish scenario, the price might stabilize around $4.70, reflecting cautious investor sentiment amidst market uncertainties. The average projection for the year is $8.00, indicating robust performance compared to prior years while acknowledging potential market fluctuations.

2030 Predictions

In 2030, Propchain (PROPC) could peak at $11.97 in a bullish scenario, fueled by technological advancements and widespread adoption of cryptocurrencies across sectors. In a bearish scenario, the price might drop to $1.98, reflecting regulatory challenges or shifts in market sentiment. The average price for the year is projected at $5.83, indicating potential for significant growth while accounting for volatility over the decade.

Conclusion

Propchain (PROPC) is positioned to experience significant growth and fluctuations over the coming years, with price forecasts spanning from a potential bullish high of $12.51 in 2029 to a more cautious $5.83 in 2030. The token’s focus on real estate tokenization and its ability to adapt to the evolving cryptocurrency landscape will be key drivers of its performance. While market volatility is expected, Propchain’s strong community support and innovative approach could allow it to capitalize on favorable conditions, leading to moderate growth in the years ahead.

Related news: Movement (MOVE) Price Trends: A Deep Dive Through 2025-2030