The Maker (MKR) token has been showing impressive growth in recent months, driven by a robust decentralized finance (DeFi) ecosystem. As of December 2024, MKR is gaining attention due to its strong correlation with DeFi protocols and its essential role in governance within the MakerDAO system, which backs the DAI stablecoin. The coin’s current market cap stands at approximately $2 billion, with a circulating supply of around 930,000 MKR tokens.

MKR has experienced notable volatility recently, with the token trading between $1,845 and $2,250. While the price has seen fluctuations, it has shown significant recovery from its lowest points, reflecting increasing investor confidence. In 2023, Maker demonstrated strong returns with a remarkable 74% increase in the third quarter. This upward trend continued into 2024, bolstered by a positive market outlook and a surge in demand for DeFi products.

As the DeFi space evolves, MKR’s role as a governance token and its ties to real-world assets position it as a key player in the crypto landscape. However, its performance is closely tied to broader market trends, making it essential to monitor key support and resistance levels in the coming months.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Maker (MKR) development team.

Current Price Performance

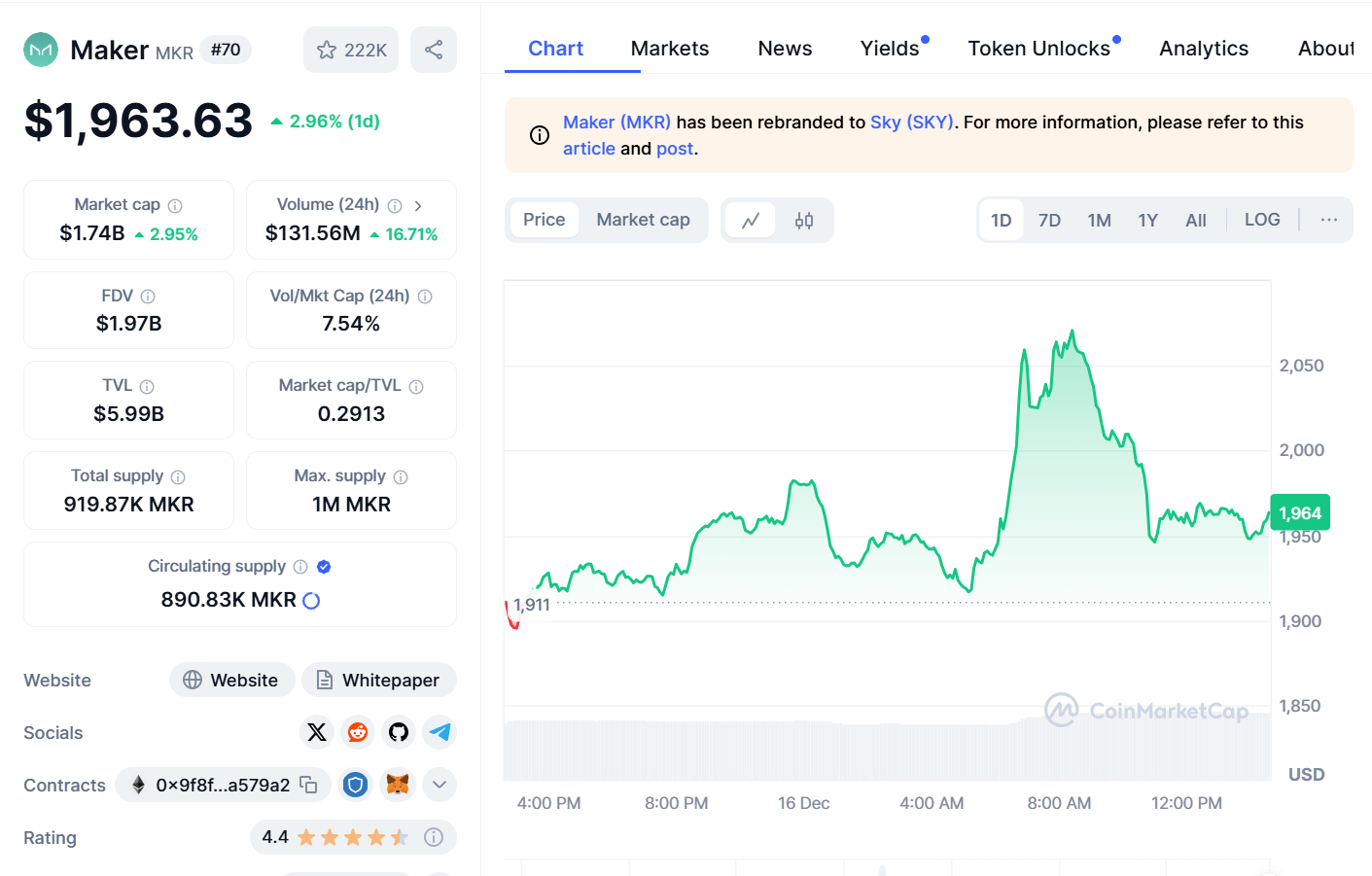

The Maker (MKR) token is showing promising signs of momentum in the crypto market, currently trading at $1,963.63, marking a 2.96% increase over the last 24 hours. Despite minor fluctuations, this uptick highlights growing investor interest in MKR, especially following its rebranding to Sky (SKY), signaling innovation and renewed focus within the ecosystem.

Over the past day, Maker has seen a robust $131.56 million in trading volume, reflecting a significant 16.71% surge in activity, a strong indicator of rising market participation. The token’s market capitalization now sits at an impressive $1.74 billion, placing it among the top assets, reinforcing Maker’s stability and relevance as a key player in decentralized finance (DeFi).

Maker’s performance in the last 7 days also reflects steady upward movement, with prices rallying above the $1,900 mark and briefly crossing the $2,050 threshold earlier today, a clear indication of bullish momentum. With its TVL (Total Value Locked) at $5.99 billion and supply circulation reaching 890.83K MKR, the fundamentals remain solid.

Community Sentiment

The sentiment within the Maker (MKR) community is shaped by multiple factors, particularly its governance role within MakerDAO. MKR holders can vote on important protocol decisions, such as stability fees and collateral types, which fosters a strong sense of engagement and ownership.

This influence often aligns with positive sentiment, especially when key decisions align with community interests. Notably, the approval to use tokenized real-world assets as collateral for DAI loans in 2020 resulted in a price surge, reflecting bullish sentiment.

Additionally, proposals like the “Endgame” manifesto have sparked debates about the protocol’s decentralization, influencing community views. Social media platforms, including X and Reddit, provide further insight into sentiment trends, with recent discussions indicating a generally optimistic outlook. Technical analyses also point to a potential bullish trajectory, suggesting confidence in MKR’s future growth.

Technical Analysis

The Maker (MKR) token is currently trading at $1,963.09, marking a significant 4.25% decline in the last session. This pullback reflects increased market volatility, influenced by a mix of technical indicators and investor sentiment.

Oscillator metrics reveal a mixed outlook, with the Relative Strength Index (RSI) standing at 52.44, signaling a neutral zone. This suggests that MKR is neither overbought nor oversold, leaving room for further price movement in either direction.

The Moving Averages paint a more divided picture. The shorter-term Exponential Moving Average at $1,996.88 and Simple Moving Average at $2,002.94 both reflect “Sell” signals, highlighting bearish short-term sentiment as MKR struggles to maintain momentum above key resistance zones.

The conflicting signals between oscillators and moving averages underline the current market uncertainty, with MKR traders weighing profit-taking pressures against its long-term fundamentals. The trading volume over the past 24 hours remains robust at $131.53 million, reinforcing liquidity despite the sell-off. If bulls can regain control, MKR may rebound toward the $2,000 psychological level. However, a failure to hold support could see the price test lower moving average levels, presenting a key battleground for traders in the coming sessions.

Maker (MKR) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $8,250.15 | $1,346.35 | $6,980.94 |

| 2026 | $11,220.45 | $3,261 | $9,785.60 |

| 2027 | $9,643.35 | $6,045.20 | $7,855.00 |

| 2028 | $8,600.50 | $5,258.35 | $7,090.21 |

| 2029 | $12,020.45 | $7,500.50 | $10,285.60 |

| 2030 | $14,520.45 | $11,934.13 | $12,085.60 |

2025 Predictions

For 2025, Maker (MKR) price predictions vary significantly. A bearish scenario could see the token dropping to around $1,346.35, impacted by market corrections or unfavorable regulations. Conversely, an optimistic forecast suggests MKR could reach $8,250.15, driven by the growth of decentralized finance (DeFi) and positive regulatory shifts. The average price is expected to settle near $6,980.94, reflecting overall positive market sentiment.

2026 Predictions

By 2026, the price of Maker (MKR) is expected to experience considerable volatility. A bearish prediction suggests a potential dip to around $3,261, reflecting market corrections after the previous year’s highs. On the other hand, a bullish outlook forecasts a maximum price of $11,220.45, driven by continued advancements in the Maker protocol and further expansion of the DeFi ecosystem. The average price is projected to be around $9,785.60, indicating strong growth potential for MKR in the market.

2027 Predictions

In 2027, Maker (MKR) is projected to undergo a period of market correction. A bearish scenario suggests a drop to around $6,045.20, as profit-taking and valuation adjustments may occur. On the optimistic side, the maximum price could rise to $9,643.35, driven by sustained interest in decentralized finance (DeFi) and Maker’s integral role in that space. The average price is expected to be approximately $7,855.00, indicating a moderate recovery following previous lows.

2028 Predictions

Looking forward to 2028, Maker (MKR) could experience continued volatility. A bearish scenario suggests prices might fall to around $5,258.35, as market participants reassess their positions and external economic factors impact sentiment. However, in a bullish outlook, the price could rise to approximately $8,600.50, assuming the DeFi sector continues to grow and attract new users. The average trading price for MKR is projected to stabilize around $7,090.21, reflecting a period of adjustment after previous fluctuations.

2029 Predictions

For 2029, Maker (MKR) could experience significant price fluctuations. A bearish scenario suggests a dip to around $7,500.50, reflecting potential market saturation or heightened competition within the DeFi space. On the bullish side, MKR could reach as high as $12,020.45, driven by renewed interest in cryptocurrencies and advancements within Maker’s ecosystem. The average price is expected to be approximately $10,285.60, indicating a strong recovery as the market matures.

2030 Predictions

For 2030, Maker (MKR) is expected to maintain strong value even in a bearish scenario, with a minimum price of around $11,934.13. In an optimistic view, MKR could reach up to $14,520.45, driven by broader adoption and integration into financial applications. The average price for the year is projected to be around $12,085.60, reflecting a positive outlook as blockchain and DeFi technologies continue to develop

Conclusion

Maker (MKR) is expected to experience significant price fluctuations between 2025 and 2030, driven by market dynamics and developments within the DeFi ecosystem. While bearish scenarios predict price drops to $1,346.35, the token’s governance role and growing adoption could lead to bullish predictions as high as $8,250.15 by 2025. Over the following years, MKR could reach between $5,258.35 and $14,520.45, with an average price of $6,980.94 in 2025 and stabilization around $12,085.60 by 2030. As the DeFi space matures, MKR’s long-term outlook remains strong, supported by its essential position in decentralized finance.

Related news: Solycat (SOLYCAT) Price Prediction and Future Outlook: A Bright Path to 2025-2030