Litecoin (LTC), the cryptocurrency designed as a faster and cheaper alternative to Bitcoin, continues to maintain a significant presence in the digital asset market. Currently priced around $128, LTC has witnessed notable fluctuations, with a price surge of over 90% in recent months.

Litecoin’s technical fundamentals, including its quicker transaction times and lower fees, set it apart from Bitcoin and other major cryptocurrencies. It operates on a unique Scrypt proof-of-work algorithm, offering greater accessibility for miners without the need for expensive equipment.

Despite its historical ups and downs, Litecoin remains a reliable asset in the market, attracting attention from both retail and institutional investors. In the short term, its performance is showing a bullish trend, boosted by the broader market’s recovery.

Experts are optimistic about its potential, with some forecasting that it may reach up to $200 in the coming months. As Litecoin continues to refine its network, including privacy features like the MWEB update, its utility and value proposition in everyday transactions are expected to grow, ensuring its relevance well into the future.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Litecoin (LTC) development team.

Current Price Performance

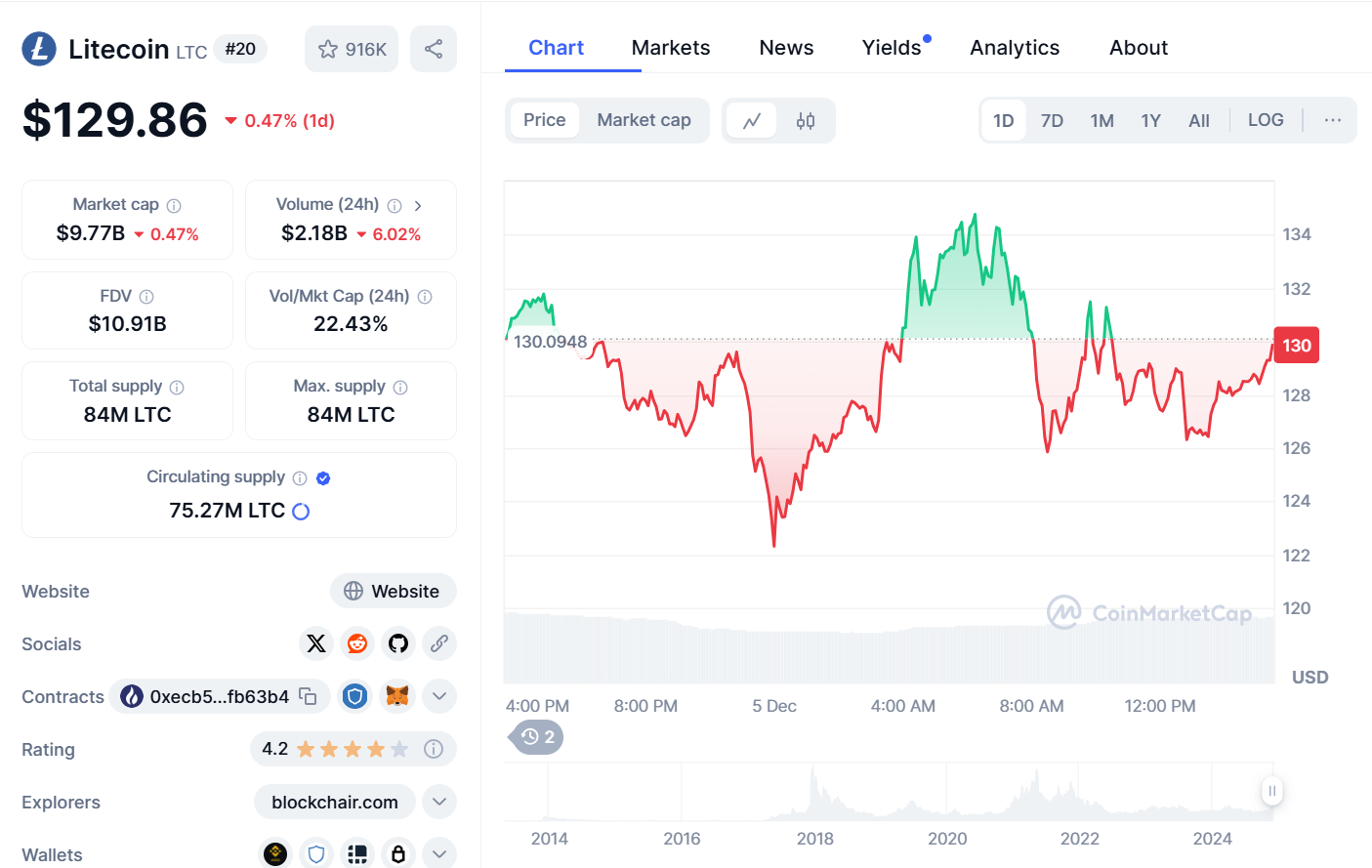

Litecoin (LTC) is currently trading at $129.86, marking a minor 0.47% decline over the last 24 hours. Despite this small dip, Litecoin’s market capitalization remains robust at $9.77 billion, reinforcing its position as one of the top cryptocurrencies in the market. This stability highlights the ongoing investor confidence in LTC, even amid fluctuating market conditions

The 24-hour trading volume of $2.18 billion suggests that there is still significant interest in LTC, although it isn’t as high as some of the larger cryptocurrencies. This moderate trading volume reflects a healthy level of activity, indicating that Litecoin continues to engage traders and investors despite recent price corrections. It also suggests a steady presence in the market, where liquidity remains adequate for both retail and institutional participants. Although the trading volume isn’t at the peak levels of major cryptos like Bitcoin or Ethereum, LTC’s performance still demonstrates solid investor confidence.

The cryptocurrency market, by nature, is highly volatile, and Litecoin is no exception. While recent price fluctuations might concern short-term investors, it is important to take a broader view of the market’s long-term potential. Litecoin has always been recognized for its fast transaction speeds and low fees, which have allowed it to remain relevant in the ever-changing crypto landscape.

Community Sentiment

As of December 2024, the sentiment in the Litecoin (LTC) community is largely bullish, with a mix of cautious optimism and strong belief in its future potential. Price predictions for Litecoin are quite optimistic, with some analysts forecasting a rise to anywhere between $500 and $5,000 in the long run.

This optimism stems from Litecoin’s unique features, such as its fast transaction speeds and low fees compared to other cryptocurrencies like Bitcoin. These attributes position Litecoin as a highly practical cryptocurrency, appealing to those looking for efficient and cost-effective options for everyday transactions.

The community is also seeing strong confidence from long-term holders, often referred to as “diamond hand holders.” These individuals are not eager to sell at current prices, instead holding on to their assets in anticipation of future growth. This sentiment suggests that a significant portion of Litecoin’s supply is being held off the market, which may help drive up its value as demand increases over time.

Technical Analysis

The current market sentiment for Litecoin (LTC) presents a cautiously bearish outlook. While indicators like the Awesome Oscillator and MACD hint at potential bullish momentum, most signals suggest a bearish bias dominating the market.

The Relative Strength Index (RSI) at 73.01 is nearing the overbought zone, reflecting strong buying pressure on LTC, yet it’s not deeply entrenched in this territory, indicating that upward momentum could remain intact.

Moving averages present a mixed picture. Short-term averages are above long-term ones, suggesting an uptrend, but recent price action has caused these averages to flatten, signaling a possible loss of momentum and a consolidation phase ahead. The Stochastic RSI, indicating overbought conditions, aligns with the potential for a price correction, further complicating the picture. The divergence between oscillators and moving averages suggests uncertainty among traders, positioning LTC as a highly volatile asset in the short term.

Litecoin (LTC) Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $82.10 – $191.06 | $73.41 – $133 | $134 |

| 2026 | $225.75 | $131 | $180 |

| 2027 | $280 | $150 | $210 |

| 2028 | $330 | $175 | $250 |

| 2029 | $375 | $200 | $300 |

| 2030 | $410.55 | $172 | $350 |

2025 Predictions

The Litecoin price forecast for 2025 shows a range of possibilities. In a bullish scenario, prices could reach between $82.10 and $191.06, potentially rising to $250 if it breaks the critical Fibonacci level of $132.23. In a bearish scenario, LTC might stabilize between $73.41 and $133, with a maximum of $180, due to market corrections and increased competition. The average price is projected to be around $134, reflecting a cautiously optimistic outlook.

2026 Predictions

The Litecoin price forecast for 2026 shows potential for moderate growth. In a bullish scenario, LTC could reach around $225.75, supported by market recovery and technological improvements. In a bearish scenario, prices may dip to around $131 due to regulatory challenges and market volatility. The average projected price is approximately $180, reflecting a moderate growth expectation as the market stabilizes.

2027 Predictions

For 2027, Litecoin’s projected price shows a positive outlook. In a bullish scenario, LTC could rise to around $280, driven by increasing adoption and favorable market sentiment. In a bearish scenario, prices might fall to about $150 due to market corrections or negative regulatory news. The average expected price for 2027 is around $210, reflecting a balance between optimism and potential challenges.

2028 Predictions

By 2028, Litecoin’s price forecast shows promising growth. In a bullish scenario, LTC could reach as high as $330, supported by continued adoption and technological advancements. In a bearish scenario, prices may stabilize around $175 due to increased competition or regulatory hurdles. The average projected price for 2028 is approximately $250, indicating strong performance despite potential challenges.

2029 Predictions

In 2029, Litecoin’s price forecast shows a range of possibilities. In a bullish scenario, LTC could peak around $375, driven by strong market conditions and increased use cases. In a bearish scenario, prices might fall to about $200, reflecting ongoing market volatility. The average projected price is around $300, indicating steady growth despite potential setbacks.

2030 Predictions

For 2030, Litecoin’s price forecast suggests strong potential. In a bullish scenario, LTC could reach up to $410.55, driven by ongoing technological innovation and wider acceptance within financial systems. In a bearish scenario, prices may not exceed $172, especially if market conditions worsen or regulatory scrutiny intensifies. The average projected price is around $350, reflecting a positive outlook tempered by realistic concerns about market dynamics.

Conclusion

Litecoin’s future price trajectory from 2025 to 2030 showcases significant variability based on market conditions, technological advancements, and regulatory environments. While bullish scenarios paint an optimistic picture of substantial growth, bearish predictions highlight the inherent risks associated with cryptocurrency investments. Investors should consider these diverse perspectives when evaluating Litecoin’s potential in the coming years.

Related news: Could Simon’s Cat (CAT) Reach New Heights? Price Prediction for 2025-2030