As the cryptocurrency landscape continues to evolve, investors are constantly seeking the next promising opportunity. One such contender is Ravencoin (RVN), a digital asset designed with a specific focus on the creation and transfer of tokenized assets.

But the question remains: Is Ravencoin a good investment? To answer this, let’s delve into its technology, market performance, community sentiment, and potential risks.

Technology and Purpose: A Niche in Tokenized Assets

Ravencoin was launched with a clear mission – to facilitate the transfer of assets on the blockchain. Unlike other cryptocurrencies like Bitcoin, which primarily serves as a store of value, or Ethereum, which powers a wide range of decentralized applications, Ravencoin is specialized. It is designed specifically for tokenized assets and decentralized finance (DeFi) applications.

This specialization could make Ravencoin particularly appealing to those interested in real-world assets (RWAs) and the broader trend of asset tokenization. As blockchain technology continues to mature, the ability to tokenize assets – ranging from real estate to intellectual property – could see significant growth. Ravencoin’s focus on this niche positions it well to capitalize on these emerging trends.

Market Performance: Steady but Not Top-Tier

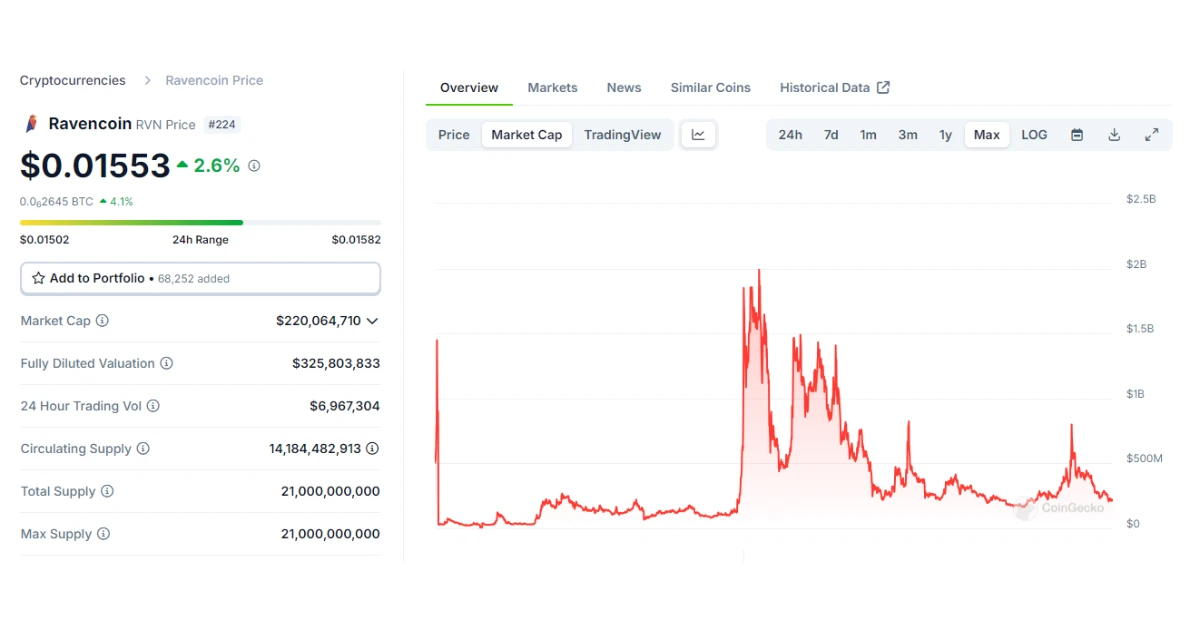

As of August 2024, Ravencoin’s market performance places it in the mid-tier range of cryptocurrencies. With a price of around $0.015 and a market cap of approximately $220 million, it is far from the top contenders but still maintains a stable presence in the market.

While not a major player like Bitcoin or Ethereum, Ravencoin’s market cap suggests a level of resilience. Analysts’ price predictions indicate potential growth, especially if the adoption of tokenized assets continues.

However, as with all cryptocurrencies, RVN’s price is subject to fluctuations, influenced by broader market trends and investor sentiment.

Investment Considerations: Volatility and Adoption

Investing in Ravencoin, like any cryptocurrency, involves navigating a high degree of volatility. Prices can swing dramatically within short periods, leading to significant gains – or losses – for investors. This volatility is a double-edged sword; while it offers the potential for high returns, it also comes with substantial risk.

The success of Ravencoin as an investment largely hinges on its adoption. If tokenization becomes more mainstream and Ravencoin is widely adopted for its intended use cases, its value could rise significantly. However, this outcome is far from guaranteed and depends on various factors, including technological developments and market trends.

Community and Regulation: A Decentralized Approach with Potential Risks

Ravencoin stands out in the crypto space for its community-driven approach. It was launched without a premine, ICO, or developer fund, which may appeal to investors who prioritize decentralization and community control. This grassroots approach has cultivated a dedicated following, but it also means that Ravencoin lacks some of the financial backing and resources of more centrally organized projects.

Regulation is another critical factor to consider. As governments around the world continue to develop frameworks for digital assets, cryptocurrencies like Ravencoin, which are aimed at securities or commodities, could face increased scrutiny. Regulatory changes could impact Ravencoin’s utility and legality in different jurisdictions, posing additional risks for investors.

Conclusion: Weighing the Pros and Cons

So, is Ravencoin a good investment? The answer largely depends on your investment strategy, risk tolerance, and belief in the technology’s future potential.

For speculators, Ravencoin could be an intriguing opportunity if you believe in the long-term potential of tokenized assets. Its focus on a specific niche within the blockchain space could pay off if adoption rates increase and the trend toward asset tokenization continues.

For long-term investors, the key will be to monitor how well Ravencoin’s technology integrates into future financial systems and whether it can maintain its relevance in a rapidly changing market.

As with any investment in the volatile world of cryptocurrencies, thorough research and a diversified portfolio are crucial. Only invest what you can afford to lose, and stay informed about the latest developments in the crypto space to make the most informed decision possible. Ravencoin may hold promise, but like all investments, it comes with its share of risks.

Related: Can Ravencoin Reach $1? RVN Price Prediction 2024 – 2030