Binance’s BNB is facing a correction. The daily chart shows the asset down 0.6% and 5.8% over the past week. Despite the correction, the token has maintained some gains over other time frames. The fifth-largest cryptocurrency by market capitalization is up 2.5% on the 14-day chart, 3.8% on the monthly chart and 135% since November 2023.

As of today, Binance Coin trades at approximately $242, reflecting the broader market trends, including Ethereum and Bitcoin’s surges earlier this month. The focus remains on the upcoming adjustments within the Binance ecosystem and their implications for the token’s value.

Moreover, The Binance Coin ecosystem is undergoing significant transformations this month with the scheduled sunset of the BNB Beacon Chain as part of the ongoing Binance Coin Chain Fusion initiative. This strategic move consolidates the ecosystem’s functionalities onto the BNB Smart Chain (BSC), aimed at improving efficiency, security, and scalability. Users have been urged to migrate their BEP2 and BEP8 tokens to BSC before the Beacon Chain is retired to prevent asset loss. Centralized exchanges are also expected to disable deposits and consolidate assets promptly to ensure a smooth transition.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the BNB development team.

Current Price Performance

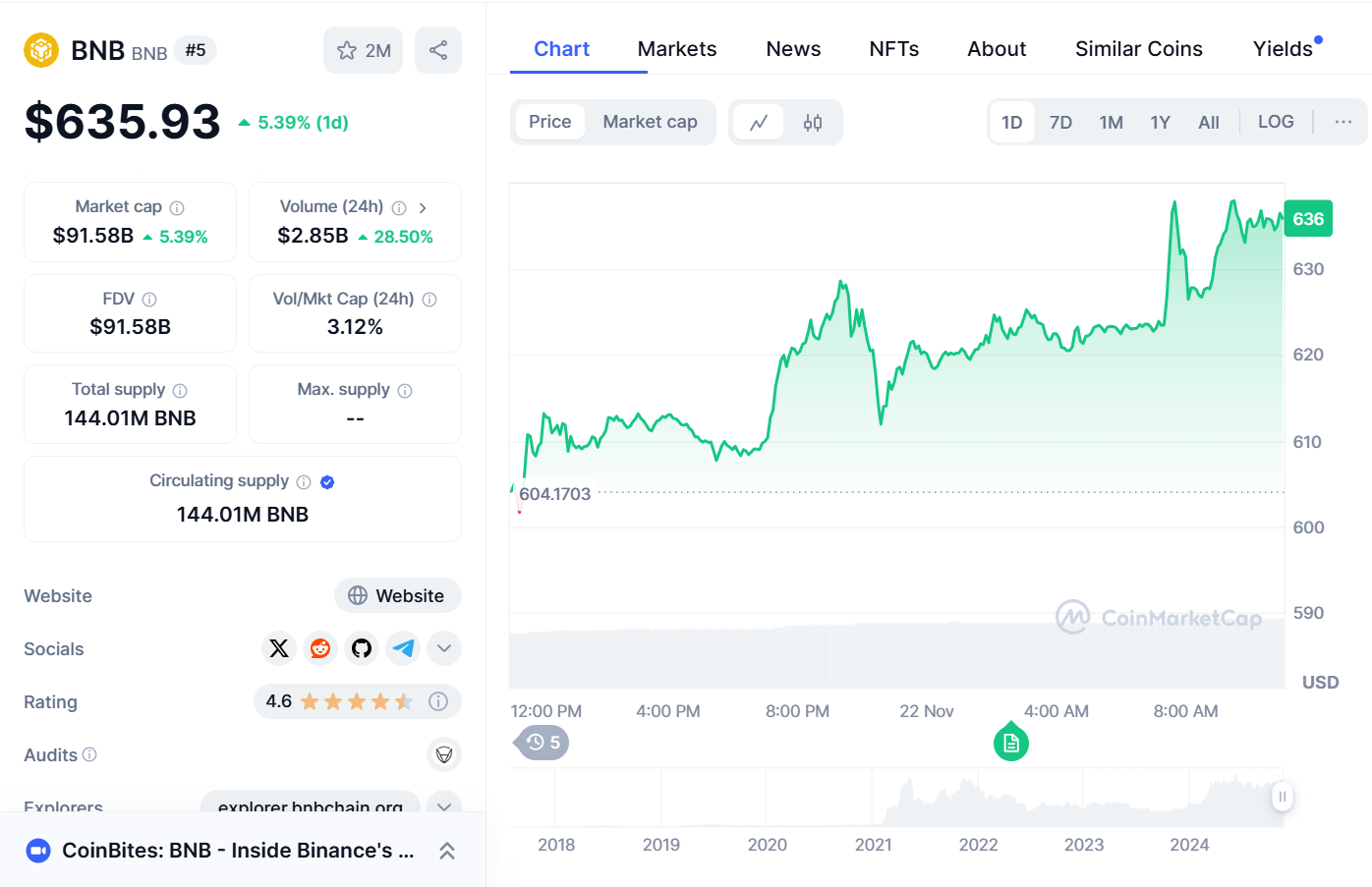

As of November 22, 2024, Binance Coin is trading at $635.93, reflecting a strong daily gain of 5.39% in the past 24 hours. This upward trend has significantly boosted market confidence, particularly in light of broader positive sentiment across the cryptocurrency market. Over the past week, BNB has shown remarkable resilience and steady growth, consolidating its position as a top-performing digital asset.

The market capitalization of Binance Coin now stands at an impressive $91.58 billion, emphasizing its dominance as the fifth-largest cryptocurrency by market cap. This surge in valuation demonstrates increased investor interest and sustained adoption of the Binance ecosystem, further supported by BNB’s expanding use cases in DeFi, trading fees, and staking rewards. The rise in market cap is also reflective of heightened activity across Binance Chain and the broader ecosystem.

In terms of trading volume, the last 24 hours have seen a substantial increase, with $2.85 billion worth of BNB traded globally. This represents a remarkable 28.50% increase in daily trading volume, signaling heightened liquidity and active market participation. The sharp rise in transaction volume suggests renewed interest from retail and institutional investors alike, likely driven by recent bullish market movements and strategic developments within the Binance ecosystem.

BNB’s circulating supply remains at 144.01 million tokens, reinforcing its deflationary tokenomics supported by Binance’s quarterly token burn mechanism. This mechanism, aimed at reducing supply over time, continues to play a pivotal role in driving demand and maintaining price stability. With Binance’s continuous expansion into new markets and products, coupled with its ecosystem upgrades, BNB is positioned as a key asset to watch in the evolving crypto space. This combination of strong fundamentals and market enthusiasm makes it a prime candidate for sustained growth in the coming months.

Community Sentiment

BNB has been experiencing a positive price trend, recently trading around $635.93, reflecting a notable increase of about 1.86% in the last 24 hours. This upward movement suggests growing confidence among investors, especially as BNB approaches significant resistance levels around $617 and $715.7.

Overall, the current sentiment within the BNB community appears largely optimistic, characterized by rising prices, increased user activity, and strong engagement in governance processes. BNB’s social dominance is steady at 0.757%, suggesting consistent interest from the community. Additionally, an increase in open interest in futures trading indicates that more traders are betting on BNB’s price movements, which often correlates with heightened volatility and potential price increases.

The number of active users on the BNB Chain has surged significantly, reaching approximately 4.5 million weekly active users. This increase in user engagement typically correlates with higher demand for BNB and can positively influence its price trajectory, fostering a more engaged and responsive community.

#BinanceCoin $BNB could be about to break out. I’m waiting for a weekly close above $662 for a potential move to $1,630! pic.twitter.com/RjgjN9n1ro

— Ali (@ali_charts) November 21, 2024

Technical Analysis

Binance Coin (BNB) currently trades at $634.02, showing a modest daily gain of +1.96%. The market sentiment surrounding BNB reflects a cautious but slightly bullish outlook, as indicated by its technical indicators, specifically oscillators and moving averages, which are critical for short-term market assessments.

The oscillators section presents a mixed picture, leaning slightly neutral with some bullish undertones. The Relative Strength Index (RSI) sits at 59.94, reflecting a neutral to mildly bullish sentiment. This value, close to the 60 threshold, indicates BNB is approaching overbought conditions but still retains room for upward movement without triggering a pullback. Other metrics, such as the Commodity Channel Index (CCI) at 73.15, show a positive momentum signal, indicating a potential continuation of recent price increases. However, the MACD Level (9.20) sends a sell signal, suggesting that while the current upward trend holds, it may be prone to correction in the short term.

BNB’s strong performance is bolstered by rising trading volumes, signaling increased market participation and liquidity. The RSI’s neutral zone provides a cushion for additional price appreciation, while the dominance of “Buy” signals in moving averages suggests sustained upward momentum. However, caution is warranted as mixed signals from oscillators like MACD highlight the potential for short-term corrections.

BNB Price Prediction

| Year | Bullish | Bearish | Average |

| 2025 | $951.44 | $634.29 | $831.54 |

| 2026 | $1,192.75 | $795.17 | $993.96 |

| 2027 | $1,216.97 | $811.32 | $1,014.15 |

| 2028 | $1,377.88 | $918.58 | $1,148.23 |

| 2029 | $1,703.71 | $1,135.80 | $1,419.75 |

| 2030 | $2,121.84 | $1,414.56 | $1,768.20 |

2025 Predictions

The price prediction for Binance Coin in 2025 shows a wide range of possibilities based on differing market conditions. A bearish scenario suggests a price of $634.29, driven by continued regulatory challenges and market volatility, which could reduce investor confidence and demand for Binance Coin. On the other hand, a bullish outlook points to a price of $951.44, driven by factors like the increased adoption of Binance Smart Chain (BSC) and the growth of the DeFi sector, both of which could lead to higher usage and value for Binance Coin. An average price of $831.54 represents a balanced view, accounting for both positive and negative influences, with expectations for gradual growth as the market stabilizes over time.

2026 Predictions

The price prediction for Binance Coin in 2026 reflects varying market dynamics. In a bearish scenario, the price could fall to $795.17, as ongoing regulatory scrutiny and increased competition from other blockchain platforms might limit BNB’s growth potential. Conversely, a bullish outlook sees Binance Coin reaching $1,192.75, driven by successful new partnerships and innovations within the Binance ecosystem, which could significantly boost its value. The average price of $993.96 indicates moderate growth, with the market adjusting to evolving conditions while still acknowledging the continued utility of BNB.

2027 Predictions

The price prediction for Binance Coin in 2027 presents a range of outcomes depending on market conditions. In a bearish scenario, the price could be $811.32, with market corrections or negative sentiment potentially keeping prices subdued. On the other hand, a bullish outlook sees Binance Coin reaching $1,216.97, driven by optimistic scenarios like significant technological advancements in Binance Smart Chain (BSC) that attract more developers and users. The average price of $1,014.15 suggests a cautious but positive outlook for the year, reflecting moderate growth as the market navigates evolving challenges and opportunities.

2028 Predictions

For 2028, Binance Coin’s price could see a range of outcomes influenced by various factors. In a bearish scenario, the price might settle at $918.58 due to potential economic downturns or adverse regulatory changes that could hinder price growth. On the other hand, a bullish prediction suggests a price of $1,377.88, driven by a thriving DeFi ecosystem and increased transaction volumes on Binance Smart Chain (BSC), both of which could boost demand and push prices higher. The average price of $1,148.23 indicates expectations of steady growth, as the market adapts to fluctuating conditions while recognizing the continued potential of BNB.

2029 Predictions

In 2029, BNB’s price could fluctuate based on several key factors. In a bearish scenario, the price might fall to $1,135.80, as ongoing competition from other cryptocurrencies could limit BNB’s market share. Conversely, a bullish prediction sees the price reaching $1,703.71, driven by Binance’s continued innovation and global expansion, which could significantly enhance demand and usage. The average price of $1,419.75 reflects a strong performance, supported by both increasing demand and technological advancements within the Binance ecosystem.

2030 Predictions

For 2030,Binance Coin’s price could experience diverse outcomes based on market conditions. In a bearish scenario, the price might settle at $1,414.56, as market saturation or negative regulatory impacts could hinder further price growth. In a bullish scenario, the price could soar to $2,121.84, fueled by Binance Coin becoming integral to various blockchain applications and maintaining significant market dominance. The average price of $1,768.20 suggests a robust outlook, driven by continued adoption and integration of Binance Coin into various financial systems, ensuring a positive long-term trajectory.

Conclusion

Overall, Binance Coin’s future appears promising, with strong potential for both innovation and market dominance in the coming years. While bearish scenarios reflect concerns such as regulatory challenges, market corrections, and increased competition, the bullish outlooks highlight the potential for significant growth driven by technological advancements, global expansion, and the increasing adoption of Binance Smart Chain. As the market continues to mature, Binance Coin is expected to experience steady growth, with fluctuations along the way.

Related news: Bonk (BONK)Surpasses DogWifHat and Hits ATH Post-Upbit Listing: What Lies Ahead in the Next 5 Years?