The blockchain gaming sector has seen a significant surge in interest, with Axie Infinity (AXS) leading the charge as one of its most prominent projects. As we look toward the future, predicting the price trajectory of AXS involves analyzing current trends, technological developments, and broader market sentiment. Here’s a speculative overview based on various analyses and community insights as of late 2024.

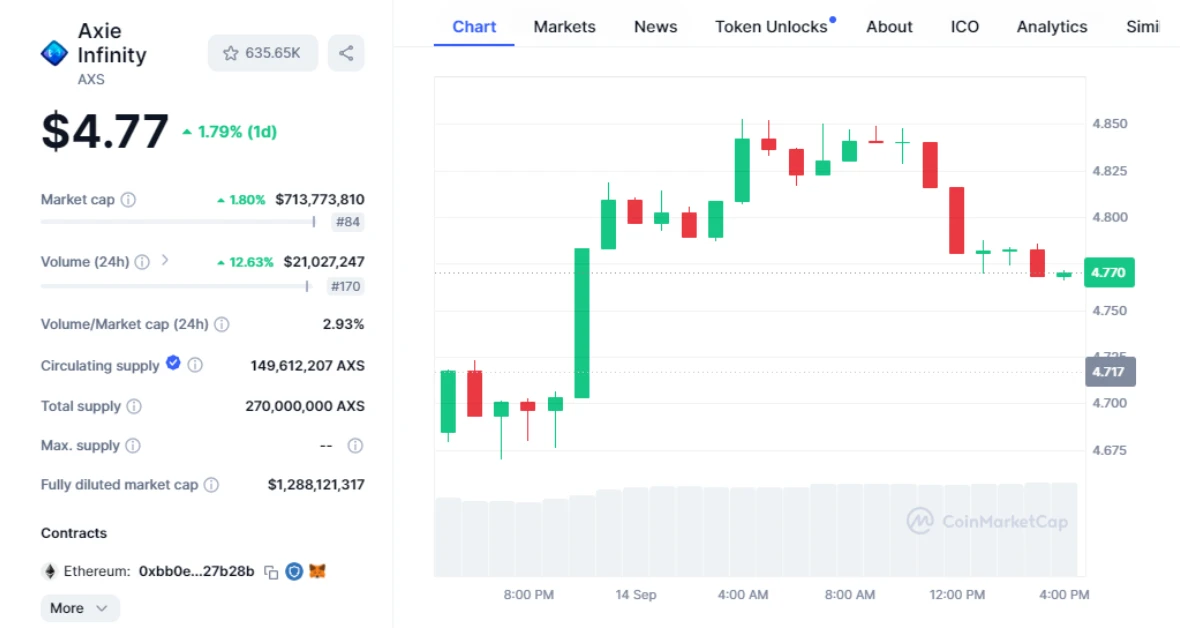

AXS Current Price

As of 2024, Axie Infinity, the native token of the popular blockchain-based game Axie Infinity, is trading at around $4.77. While the token has seen tremendous highs during the 2021 bull market, the overall crypto market correction in 2022 significantly impacted AXS, pulling its price down from its all-time high of over $165 in 2021. The current price reflects market-wide trends and specific challenges related to the game and its ecosystem.

Current Market Sentiment

The general sentiment around AXS has been fluctuating in recent months. The broader crypto market has faced various challenges, including regulatory pressures, increasing competition in the blockchain gaming space, and shifting interest from players and investors. However, there are pockets of optimism, especially among long-term investors who believe that Axie Infinity still holds the potential to lead the GameFi (Game + DeFi) revolution.

The sentiment within the GameFi sector is a mixed bag. Some view Axie Infinity as the pioneer of play-to-earn (P2E) gaming, with a solid foundation, but others have expressed concerns about its declining user base and profitability issues related to the game’s economic model.

Technical Analysis

From a technical standpoint, AXS has displayed a period of consolidation following its steep decline after 2021. Key resistance and support levels can offer insight into its future movement:

- Support levels: AXS has found strong support in the $3 – $5 range. This support zone has held up multiple times, reflecting investor confidence in the long-term prospects of the project.

- Resistance levels: On the upside, AXS is facing strong resistance around the $12 – $15 range, which it will need to break to confirm a bullish reversal.

- Moving Averages (MA): AXS’s 50-day moving average has recently crossed below the 200-day MA, signaling a bearish trend. However, if it manages to break past the short-term resistance levels, this could reverse.

- Relative Strength Index (RSI): The RSI for AXS is hovering around 52.49, indicating that it’s neither in overbought nor oversold territory. A significant spike in volume or a catalyst could push it in a more decisive direction.

Price Predictions

2024: In the short term, market sentiment and broader market conditions will heavily impact AXS’s price movement. As Axie Infinity continues to innovate, the token could see moderate recovery, but it will likely stay within the $8 – $15 range for most of the year.

2025: The GameFi sector is expected to grow significantly by 2025 as blockchain games evolve and attract mainstream gamers. If Axie Infinity can sustain its user base and introduce new features, AXS may experience growth, potentially trading in the $25 – $40 range.

2026: By 2026, if Axie Infinity remains competitive, AXS could benefit from broader adoption of blockchain gaming. It’s possible that AXS could test the $50 – $75 range. However, this will depend on whether the game can address scalability and ecosystem challenges.

2027 – 2030: Looking further out, the future price of AXS is highly speculative. If Axie Infinity evolves into a leading platform in the metaverse and GameFi space, AXS could see a price of $100 or higher. However, if the ecosystem fails to retain players and developers, it could stagnate or decline. Conservative estimates would place AXS within a range of $50 – $100 by 2030, while more bullish predictions could see it surpassing $150.

Risks and Considerations

While AXS has potential, there are several risks to consider:

- Regulatory Risks: The increasing scrutiny of the crypto and blockchain gaming industry could impact AXS. Regulatory bodies worldwide are looking more closely at digital assets and P2E gaming models.

- Competition: As more blockchain games and metaverse platforms launch, Axie Infinity faces stiff competition. Projects like The Sandbox, Decentraland, and others are vying for market share, which could dilute Axie’s user base.

- In-game Economy: Axie Infinity’s economic model has faced challenges, particularly around sustainability. If it doesn’t manage its tokenomics effectively, the in-game economy may suffer, affecting the value of AXS.

- Market Conditions: AXS’s price is also tied to the broader crypto market. If Bitcoin or Ethereum, the bellwethers of the market, face downturns, AXS may struggle to decouple from overall market sentiment.

Conclusion

Axie Infinity and its native token AXS remain at the forefront of the blockchain gaming sector. While the token has faced significant price drops from its all-time highs, its potential for recovery exists, especially with continued development in the GameFi space. By 2030, AXS could either become a leading asset in a thriving blockchain gaming ecosystem or stagnate due to increased competition and in-game economic challenges.

Related: Baby Doge Coin Price Prediction 2024 – 2030. Can BabyDoge Hit ATH again?