Aerodrome Finance (AERO) emerges as a pivotal player in the decentralized finance (DeFi) landscape on the Base network, designed to enhance liquidity and trading efficiency.

In this article, we’ll dive into Aerodrome Finance’s price predictions, market trends, and what the future might hold for this emerging cryptocurrency.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Aerodrome Finance development team.

Current Market Overview

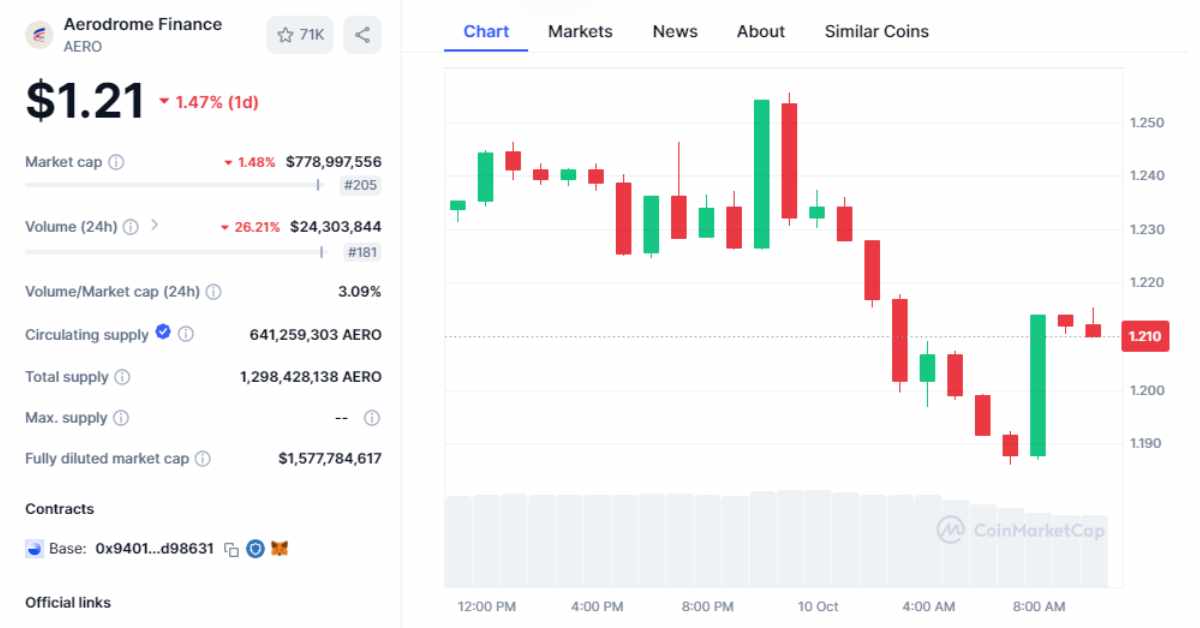

Aerodrome Finance is currently trading in the range of $1.1859 to $1.2554, reflecting a slight 1.47% decrease in the last 24 hours, but a promising 16.72% rise over the past week. This volatility points to potential short-term gains, as well as corrections, which investors should be mindful of. With a market cap fluctuating between $760.62 million and $805.07 million, Aerodrome Finance ranks 205 on CoinMarketCap, signifying moderate but growing interest. The coin’s 24-hour trading volume stands around $24.3 million, further highlighting active participation.

Community Sentiment

The Aerodrome Finance community is currently bullish, with predictions of the price reaching between $8 to $10 by Q2 2025. These optimistic views are driven by the coin’s growing market performance and its dominance on the Base blockchain.

However, while the community is hopeful, there is also cautious recognition of potential market volatility and the importance of sustainable growth strategies. This duality—optimism tempered with caution—suggests a well-informed investor base, aware of the inherent risks in cryptocurrency markets.

Technical Analysis

From a technical standpoint, Aerodrome Finance presents a mixed outlook.

Technical Indicators:

- Oscillators: Current oscillator readings are neutral, indicating that the market is neither overbought nor oversold. This neutrality could signal a potential consolidation or correction phase, where prices stabilize before the next major move.

- Moving Averages: Aerodrome Finance’s price remains above key moving averages, indicating a strong buy recommendation. This suggests that while short-term volatility may occur, the longer-term trend remains bullish.

Key Levels:

- Support: Critical support levels for Aerodrome Finance are $1.07, $0.998, and $0.951. These points may attract buying interest if the price dips, providing potential entry points for investors.

- Resistance: On the upside, immediate resistance levels are seen at $1.18, $1.23, and $1.29. Should the price approach these thresholds, significant selling pressure might push it down, creating potential selling opportunities for short-term traders.

AERO Price Prediction

| Year | Bearish | Bullish | Average |

| 2024 | $0.43 | $1.45 | $1.19 |

| 2025 | $1 | $2 | $1.50 |

| 2026 – 2030 | $2.50 – $3.86 | $3.09 – $10 | $2.50 – $3.86 |

2024 Prediction

- Bullish Scenario: Positive momentum could see AERO approaching $1.45 by the end of 2024, fueled by growing adoption, increased trading volume, and favorable market sentiment.

- Bearish Scenario: In the event of negative market sentiment or broader cryptocurrency downturns, AERO might drop to $0.43, representing a significant correction.

- Average Scenario: AERO could maintain a middle ground, trading around $1.19 by the year’s end, with fluctuations based on market cycles, yet sustained by its ecosystem’s growth.

2025 Prediction

- Bullish Scenario: If the current trajectory continues, AERO could hit $2 in 2025, supported by its expanding ecosystem, broader market adoption, and favorable crypto trends.

- Bearish Scenario: Should obstacles like regulatory hurdles or increased competition emerge, AERO may remain around $1.

- Average Scenario: The average price prediction for AERO in 2025 is approximately $1.50, reflecting steady growth despite potential market volatility.

2026 – 2030 Prediction

- Bullish Scenario: Community optimism suggests that AERO could reach as high as $8-$10 by 2025. If this growth continues through 2030, prices could range between $3.09 and $5.17, assuming successful ecosystem expansion and increased traction.

- Bearish Scenario: On the conservative side, technological challenges, market shifts, or regulatory issues could limit growth, keeping AERO closer to $2.50 – $3.86 by 2030.

- Average Scenario: In a more balanced scenario, AERO could steadily rise to around $2.50 by 2028 and reach an average of $3.86 by 2030, reflecting cautious but steady growth.

Conclusion

Aerodrome Finance presents an intriguing opportunity for investors, characterized by both potential gains and risks. While short-term volatility and resistance levels suggest the possibility of corrections, the coin’s overall upward trajectory is backed by positive community sentiment and technical indicators. Investors should keep an eye on key support and resistance levels and consider both optimistic and cautious outlooks as they plan their strategies for the future.

Related: Can Zilliqa Reach $1? ZIL Price Prediction for 2025