In a newly released analysis on September 12, financial experts from VanEck and StoneX raised their price valuation for Ethereum (ETH), predicting the cryptocurrency could hit $12,000 by the end of 2030. This significant update reflects growing confidence in the Ethereum network’s potential to generate substantial free cash flow and drive market value.

VanEck, a globally respected investment fund known for its Spot Bitcoin (BTC) and Ethereum (ETH) ETFs, collaborated with StoneX Digital, a US NASDAQ-listed financial brokerage firm, to provide these insights.

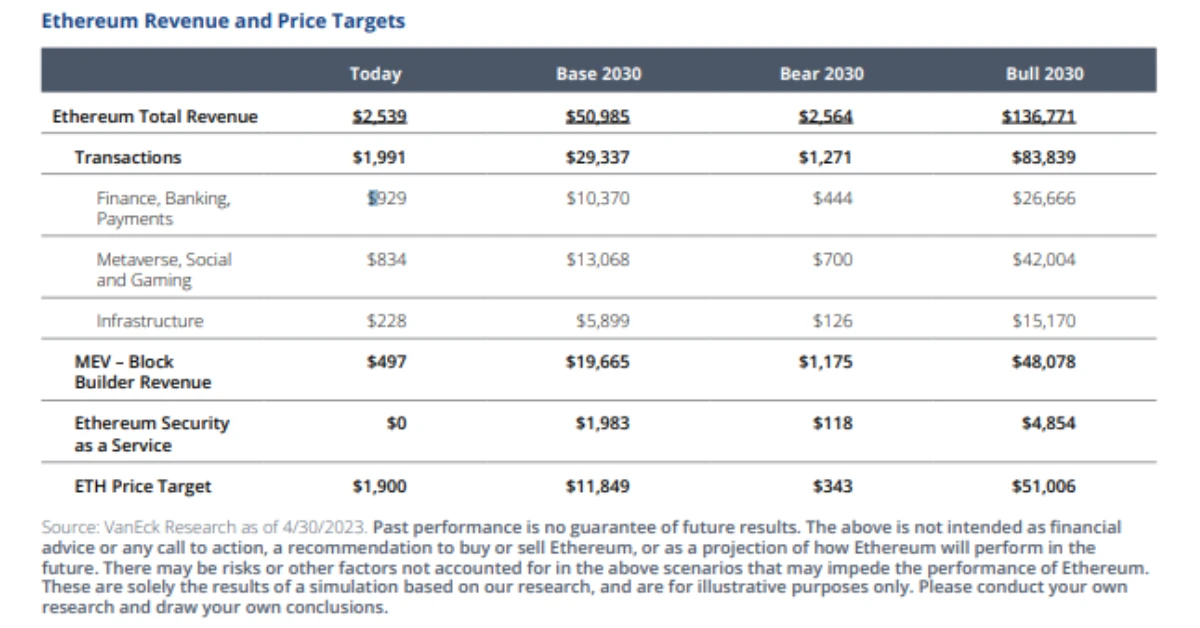

According to Matthew Sigel, Director of Digital Asset Research at VanEck, the Ethereum network could produce up to $42.90 billion in annual free cash flow by the end of this decade, pushing ETH’s price to $11,849 in a “Base Case” scenario.

VanEck’s report also outlines various market scenarios. ETH could reach as high as $51,006 in a highly bullish outlook. Conversely, if conditions deteriorate, the price could drop to as low as $343 in a bearish scenario.

Sigel emphasized Ethereum’s growing dominance in global transactions, noting that the network has processed $5 trillion in payment volume in 2023, positioning it close to industry giant Visa. Despite a challenging market environment, stablecoin transactions on Ethereum have reached an all-time high of $1.46 trillion, more than double the $650 billion recorded at the start of the year.

David Kroger, a data scientist from StoneX, echoed Sigel’s optimism at a conference on September 10, forecasting that ETH could rise to $4,600 within the next 18 months and potentially reach $12,600 by the end of the decade, driven by upcoming technological upgrades.

Although ETH has underperformed compared to Bitcoin (BTC) since the beginning of 2024—up less than 1% compared to BTC’s 36% surge—both Sigel and Kroger remain confident in Ethereum’s long-term recovery potential. ETH has declined 34% over the past 90 days, while BTC saw a 15% drop in the same period.

One contributing factor to ETH’s underperformance could be the sluggish trading activity of ETH ETFs in the US, with daily trading volumes dropping to under $200 million, a stark contrast to the $1 billion volumes seen on the ETFs’ launch day.

In addition to financial forecasts, Sigel also expressed political concerns, suggesting that a potential victory for Donald Trump in the upcoming US presidential election would be favorable for the crypto market. Conversely, a win by Vice President Kamala Harris could boost Bitcoin dominance (BTC.D) but negatively impact other altcoins, including ETH.

Related news: Nearly $300 Million Liquidated as Ethereum Hits 2024 Low and Bitcoin Declines