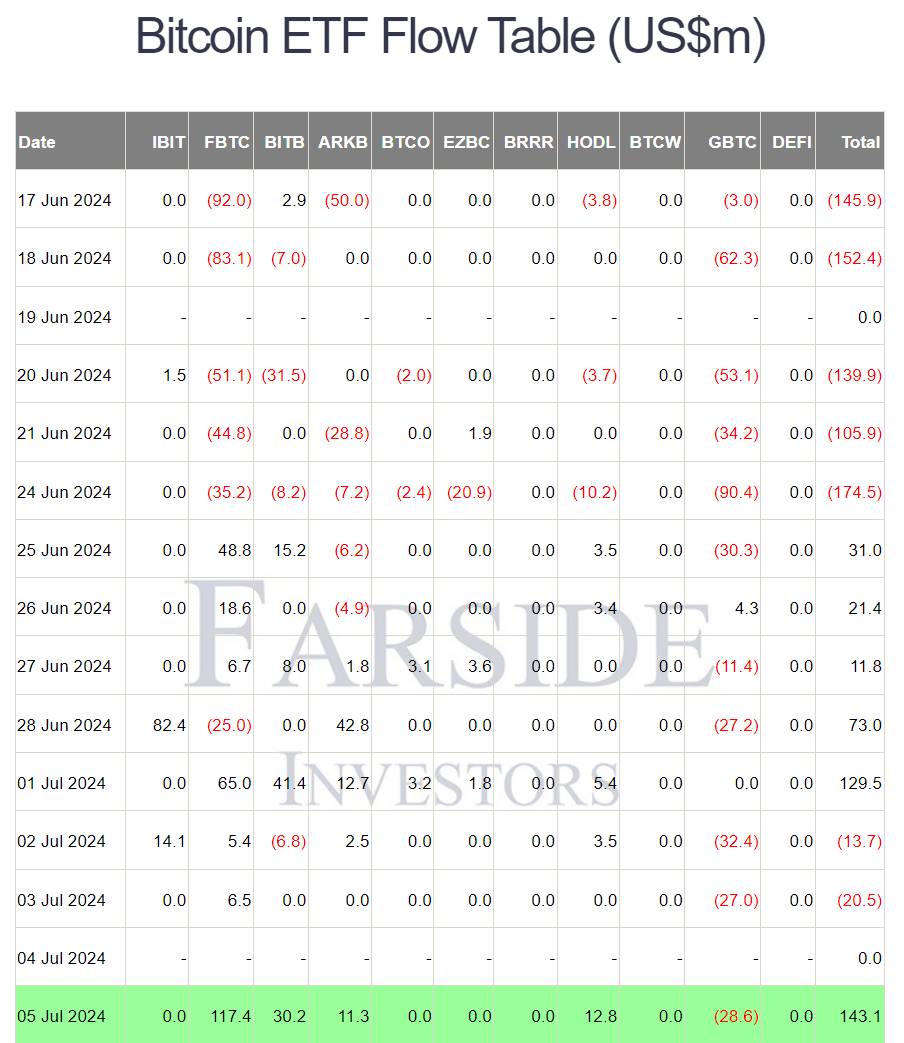

According to data from Farside Investors, on the July 5th trading session (US time), Bitcoin spot ETFs saw inflows totaling $143.1 million.

Fidelity’s FBTC fund led the pack, with inflows reaching $117.4 million, while all other funds had zero or positive inflows, including the largest ETF, BlackRock’s. Similar to previous instances, the only Bitcoin ETF with outflows was Grayscale’s GBTC, which saw $28.6 million being sold off.

This information goes against the expectations of many, as following the crypto market dump on July 5th, which pushed BTC prices to a five-month low of $53,500, investors generally anticipated ETF holders to liquidate assets to avoid further losses.

However, the opposite has occurred. Instead of selling off, Bitcoin ETFs have been buying. One possible explanation could be the ongoing bull run in the US stock market observed in early July.

S&P 500 ends holiday week at all-time high as Nasdaq books 3.5% weekly advance https://t.co/KkfpmNZftt

— MarketWatch (@MarketWatch) July 5, 2024

The buying pressure from Bitcoin ETFs has somewhat alleviated the selling pressure from Germany’s “whales,” consistently offloading BTC over the past two weeks, and Mt. Gox creditors, who have finally started receiving refunds after a 10-year wait.

As reported by Coin68, on July 5th, Mt. Gox announced the beginning of the asset refund process to users in the form of BTC, BCH, and Japanese yen. The refund process is expected to extend over the next three months, implying that Bitcoin and the broader crypto market may face additional selling pressure soon.

On the morning of July 6th, Bitcoin prices were hovering around $56,300, showing a temporary recovery from the previous day’s low of $53,500. However, many investors remain pessimistic about BTC’s prospects, leaning towards scenarios where it could adjust towards $50,000 or even lower.