On September 5, the U.S. Commodity Futures Trading Commission (CFTC) charged Uniswap Labs, the organization behind the decentralized exchange (DEX) Uniswap, with illegally offering derivatives trading on its platform. This is a significant regulatory hurdle in the decentralized finance (DeFi) space.

The CFTC’s enforcement action is focused on alleged violations of the Commodity Exchange Act (CEA), specifically regarding U.S. users’ trading of leveraged coins on the Uniswap platform. Uniswap Labs was violated and a $175,000 fine was imposed to settle the case. In response, Uniswap Labs agreed to cease all derivatives trading services on its platform.

Ian McGinley, CFTC’s Director of Enforcement, stressed the importance of enforcing compliance in the evolving DeFi sector, stating that “DeFi project operators must be vigilant to ensure that their activities comply with the law.”

Despite the regulatory scrutiny, Uniswap Labs has cooperated in addressing the issue. Katherine Minarik, Uniswap Labs’ Chief Legal Officer, expressed satisfaction with the outcome, referring to the $175,000 fine as a “very small” amount and expressing relief at concluding the legal process amicably.

However, the settlement with the CFTC might not be the end of Uniswap’s legal challenges, as the state of New York has initiated its investigation into the exchange and requested information from two major investors in Uniswap.

In addition to the CFTC case, Uniswap has also been under the radar of the U.S. Securities and Exchange Commission (SEC), which sent a Wells Notice to Uniswap Labs in April 2024, signaling the possibility of future enforcement actions.

Despite these legal challenges, Uniswap continues to be a major player in the DeFi space, ranking as the largest DEX on the Ethereum network with a total value locked (TVL) of $3.5 billion, according to DeFi analytics platform DefiLlama.

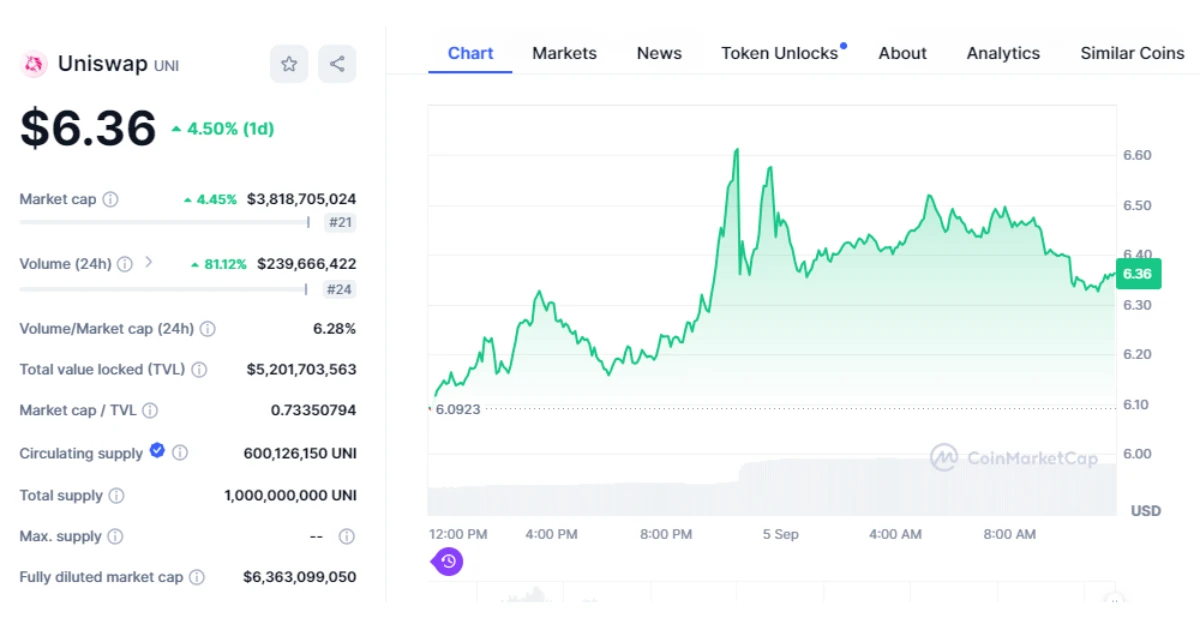

Interestingly, despite its legal issues, the UNI token has performed well, gaining nearly 4.5% in the past 24 hours, while the broader market has been experiencing downward pressure.

As Uniswap navigates a complex legal landscape, the future regulatory environment for DeFi projects like Uniswap remains uncertain due to ongoing investigations from both federal and state authorities.

Related news: AVAX Up 10% After Receiving Good News From Grayscale and Franklin Templeton