Last week, there was a lot of talk in the crypto community about the sudden withdrawal of the 19b-4 filings for the Spot SOL ETF by VanEck and 21Shares.

The US Securities and Exchange Commission (SEC) has been in discussions with the issuers of the Spot SOL ETFs due to concerns that SOL may be considered a security. This development came just before the CBOE BZX exchange removed the related 19b-4 filings.

The absence of futures ETF products for Solana is also seen as a challenge, as they are often seen as a necessary step before the launch of spot ETFs.

The SEC has previously referred to SOL (Solana) as a security in various court filings, but VanEck argues that SOL should be considered a commodity and operates similarly to BTC and ETH.

Matthew Sigel, VanEck’s director of digital asset research, stated that the registration plan for the Spot SOL ETF will continue as planned, and VanEck intends to file an S-1 for the Spot SOL ETF with the SEC soon. He expressed VanEck’s belief that SOL is a commodity, based on changing legal opinions that recognize certain crypto assets as securities in the primary market but commodities in the secondary market.

Responding to the news, Nate Geraci, president of The ETF Store, suggested that the chances of Spot SOL ETFs getting approved under the current US administration are slim.

Yes…

Solana ETF not happening anytime soon under current administration. https://t.co/z18gRIFzEr pic.twitter.com/zSL5PMjDC6

— Nate Geraci (@NateGeraci) August 17, 2024

James Seyffart, an ETF expert at Bloomberg Intelligence, shared a similar opinion on Twitter, stating that SOL ETFs might only have a chance to launch around 2025 if there are changes in the positions of the US president and SEC chairman.

In the past week, funds investing in Solana saw a significant net withdrawal of up to $39 million, the largest weekly withdrawal ever. James Butterfill, head of research at CoinShares, explained that the main reason for the substantial withdrawal from Solana funds is the recent cooling down of meme coin fever.

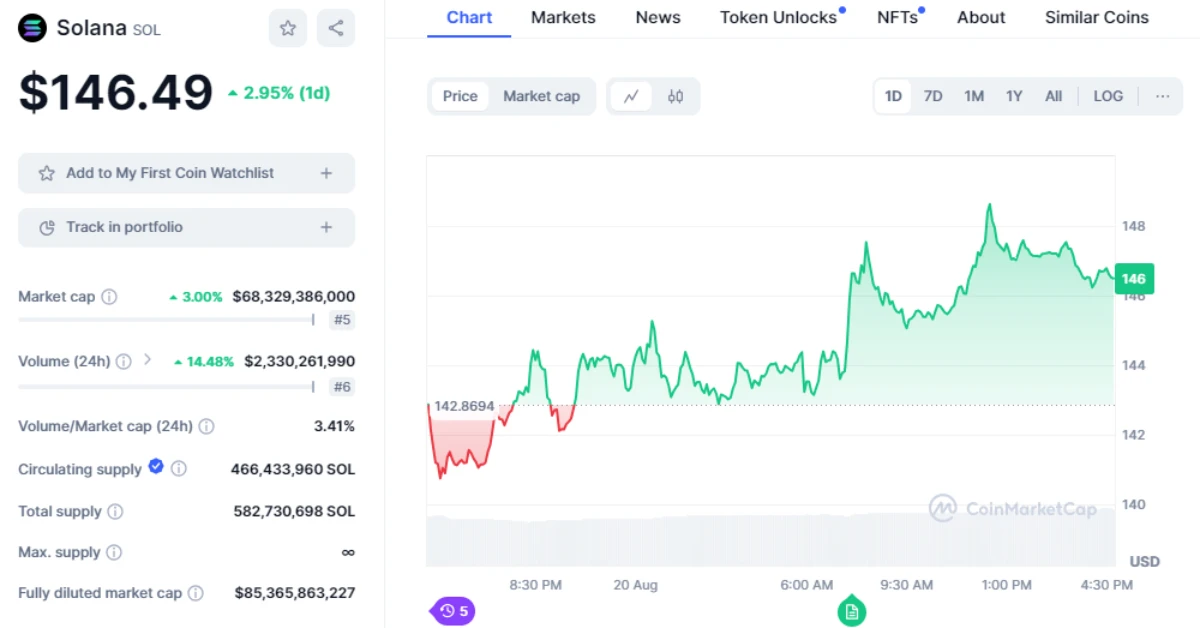

However, the price of SOL did not fluctuate significantly, closing the week with a 0.6% increase and continuing to show positive growth this week. Currently, SOL is trading at around $146, up 2.6% in the past 24 hours.

Related news: Solana Could Return to $200 With This Growth Momentum