Bitcoin’s surge has driven Marathon Digital’s groundbreaking move, solidifying its position as a leader in the BTC industry. On December 4, 2024, the company announced the successful completion of an $850 million convertible note offering at a 0% interest rate. The funds, along with an additional $150 million option for initial purchasers over the next 13 days, are designated for acquiring more Bitcoin, settling existing debts, and supporting operational expenses.

The strategic use of these proceeds highlights Marathon’s confidence in BTC’s future. Notably, $48 million will be allocated to repurchase approximately $51 million of its convertible notes due in 2026, while the bulk will drive new BTC acquisitions, reinforcing the company’s long-term vision of leading in the crypto mining space.

Marathon Digital upsizes note offering to $850M to buy more #Bitcoin, solidifying its position as the second-largest corporate $BTC holder with 34,794 BTC valued at $3.3B. pic.twitter.com/d4FyOB7yD9

— mracrypto (@MRA_crypto) December 3, 2024

Riding the Bitcoin Wave

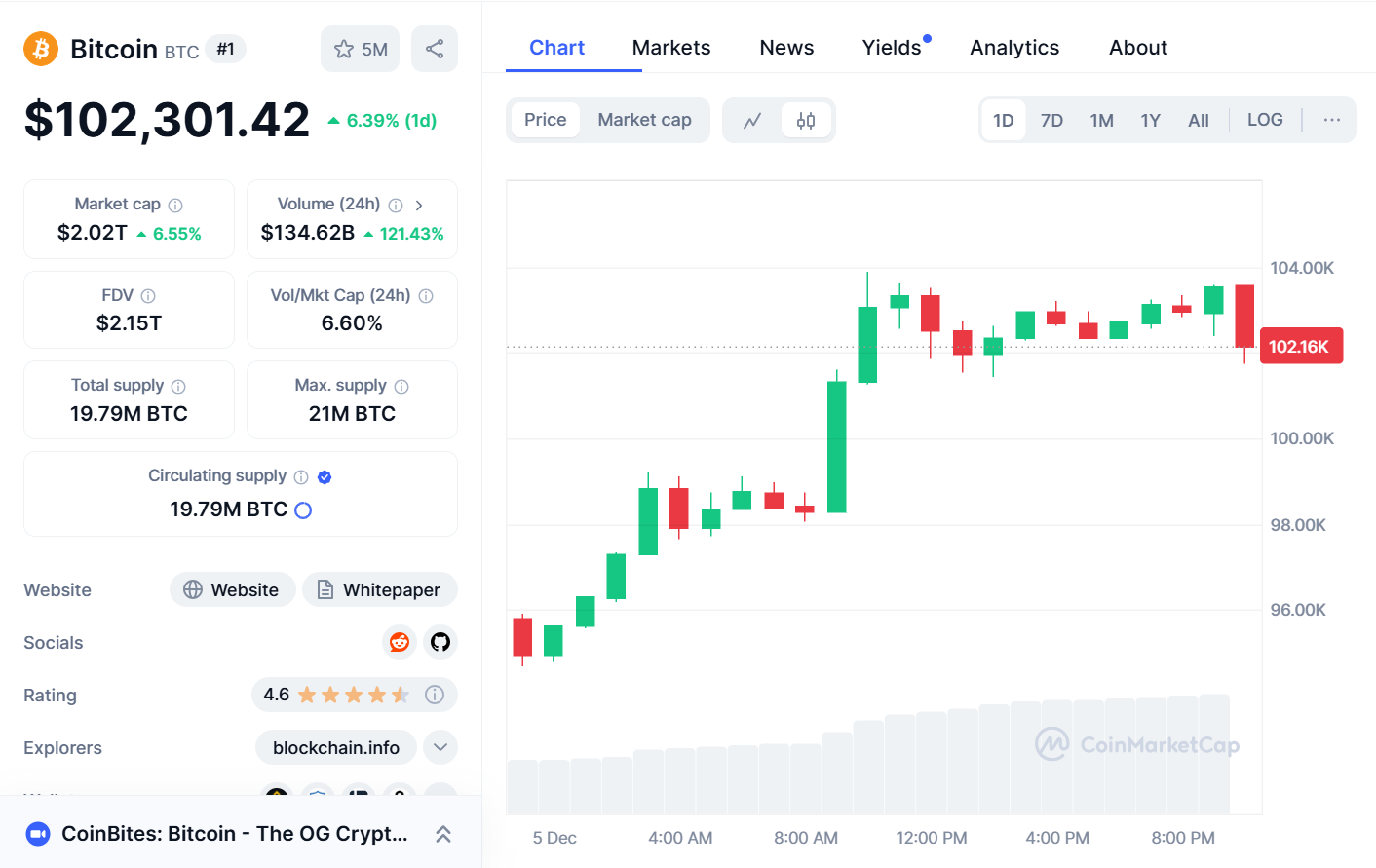

The announcement coincides with BTC achieving a historic $100,000 milestone earlier this week, a rally fueled by growing institutional interest and favorable market conditions. Analysts predict Bitcoin could reach $125,000 before the year’s end, supported by increasing inflows from institutional buyers and innovative companies like Marathon Digital.

Marathon’s aggressive accumulation strategy is evident in its recent activity. Between October 1 and November 30, 2024, the company added 6,484 Bitcoins to its reserves, as detailed in its latest filing with the Securities and Exchange Commission (SEC). This brings Marathon’s total Bitcoin holdings to an impressive 34,959, solidifying its position as one of the largest Bitcoin holders globally, albeit trailing behind MicroStrategy’s staggering 279,420 BTC stash.

MARA Stock Soars Amid Market Optimism

Marathon’s strategic advancements and BTC’s bullish momentum have significantly boosted its stock. Over the past month, MARA shares surged by a remarkable 59%, reflecting growing investor confidence. The rally is attributed not only to Bitcoin’s ascent but also to broader market optimism following Donald Trump’s recent victory in the U.S. presidential elections. The crypto-friendly policy environment anticipated under the new administration is expected to further benefit companies like Marathon Digital.

Some analysts suggest MARA’s performance is outpacing that of MicroStrategy (MSTR), another major player in the Bitcoin investment arena. With Marathon focusing on strategic debt management and Bitcoin accumulation, it has positioned itself as a potential outperformer in the crypto sector.

Institutional Investments on the Rise

The surge in BTC’s value and institutional interest reflects a broader shift in market dynamics. As reported by Standard Chartered Bank, institutional investors have collectively purchased 683,000 BTC year-to-date through U.S. BTC ETFs and direct acquisitions by companies like MicroStrategy and Marathon Digital. Remarkably, 245,000 of these inflows occurred after the U.S. presidential elections in November, underscoring the role of political and economic stability in driving investor confidence.

Standard Chartered forecasts BTC to double its value and reach $200,000 by 2025, bolstered by continued institutional investments. Analyst Geoff Kendrick notes that this growth trajectory is supported by robust year-on-year inflows and ambitious acquisition strategies from key market players. “MicroStrategy is running ahead of its USD 42 billion three-year plan, and we anticipate 2025 purchases will match or exceed those of 2024,” Kendrick stated.

Adding to the optimism, President-elect Donald Trump recently nominated Paul Atkins as the next SEC Chair. Atkins, known for his market-friendly stance, is expected to create a regulatory environment conducive to cryptocurrency growth. This development has further fueled confidence in the crypto market, with BTC breaking the $100,000 barrier shortly after the announcement.

As 2024 draws to a close, all eyes are on Marathon Digital and its counterparts to see how they navigate the dynamic crypto environment. With Bitcoin’s value soaring and institutional interest at an all-time high, the next chapter in this unfolding saga promises to be both exciting and transformative.

Related news: Dogecoin Soars After Bitcoin Breaks $100K Barrier: What’s Next for the Meme Coin Market?