Data analytics company CCData, an FCA-certified entity from the UK, released a remarkable report on the performance of centralized exchanges (CEX) in July.

Trading Volume Increases Again after 4 Months

A positive turning point for CEX exchanges is that global spot trading volume skyrocketed 19% in July, reaching $4.94 trillion.

This is also the first increase in trading volume in the past four months after the crypto market has shown signs of cooling down since BTC (Bitcoin) set a new ATH of $73,800 in March this year.

According to the most recent CCData research, spot trading volume rose by 14.3%, reaching a total of $1.44 trillion. In the meantime, futures trading volume increased by 21% to $3.50 trillion.

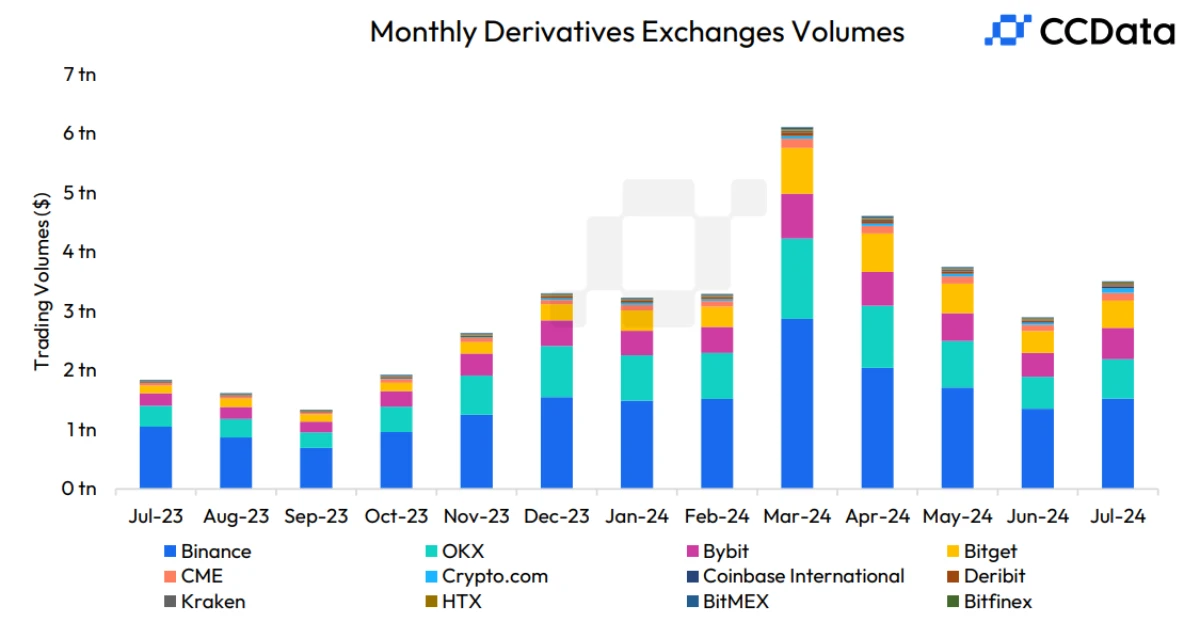

Notably, the market share of the derivatives market has increased to 70.9%, marking the highest level since December 2023. This indicates a rising demand for leverage among traders.

Many crypto users shared that it may be because of the surge in leverage that caused the market to make a historic washout on August 5, causing nearly $1 billion worth of long orders to be liquidated in a short period.

Immediately after a large number of long orders were liquidated, the market recovered as if there was no separation. Specifically, the BTC locomotive has recovered more than 20% from the low of $49,000 to the $61,000 mark at the time of writing.

Overall, CCData’s report explains that the reason for the surge in trading volume in July is the launch of spot ETH ETFs in the United States & positive views from politicians at the Bitcoin 2024 conference in Nashville, Tennessee.

Market Share of CEX Exchanges in July

In the derivatives market, Binance still maintains its leading position with a 43.5% market share in trading volume, followed by OKX with 19% and Bybit with 15.1%.

In terms of performance, Coinbase International and Crypto.com exchanges had the most impressive increases in July with volume increasing by 181% and 102% to $28.3 billion and $75.6 billion, respectively.

For the spot market, the top 3 positions are still held by 3 familiar names in order: Binance, OKX & Bybit.

An interesting highlight of the spot market is that Binance’s market share dropped sharply by 4.9% in July. This reflects the money gradually spreading to other emerging CEX exchanges, including Crypto.com, WhiteBIT, and P2B.

In particular, Bybit’s spot trading volume increased by nearly 23% in July, reaching 132 billion USD. This figure is the third-highest monthly trading volume in Bybit’s history, bringing the exchange’s market share to a record 9.18%.