The cryptocurrency market has recently experienced significant volatility due to a series of adverse developments surrounding the selling of Bitcoin by the governments of Germany and the United States, coupled with the official announcement by Mt. Gox to repay its debts in BTC and BCH, further pushing market sentiment towards the negative.

Since June 19, the governments of the United States and Germany, along with the Mt. Gox exchange, have transferred 17,788 BTC, equivalent to over $1 billion, according to Lookonchain’s data aggregation.

Since June 19, the #German Government, the #US Government, and #MtGox have transferred a total of 17,788 $BTC($1.08B).

In particular, the #German Government has transferred $BTC every day since July 1.

They hold 396,210 $BTC($22.78B) currently.

German Government, 41,226… pic.twitter.com/NZJvaQQ17Y

— Lookonchain (@lookonchain) July 5, 2024

Data from the on-chain analytics platform Arkham has revealed that certain governments hold a significant amount of BTC, totaling approximately $17.8 billion at current Bitcoin market prices.

Related news: Bitcoin Price Stable Despite Massive BTC Transferred to Exchanges

However, the amount of BTC these governments have recently moved onto exchanges represents only a tiny fraction of their total holdings. Importantly, this isn’t the first time national governments have held large amounts of Bitcoin. In the past, on-chain data has shown that countries like the UK, China, and Ukraine have also possessed substantial BTC reserves in their wallets, most of which were eventually auctioned off.

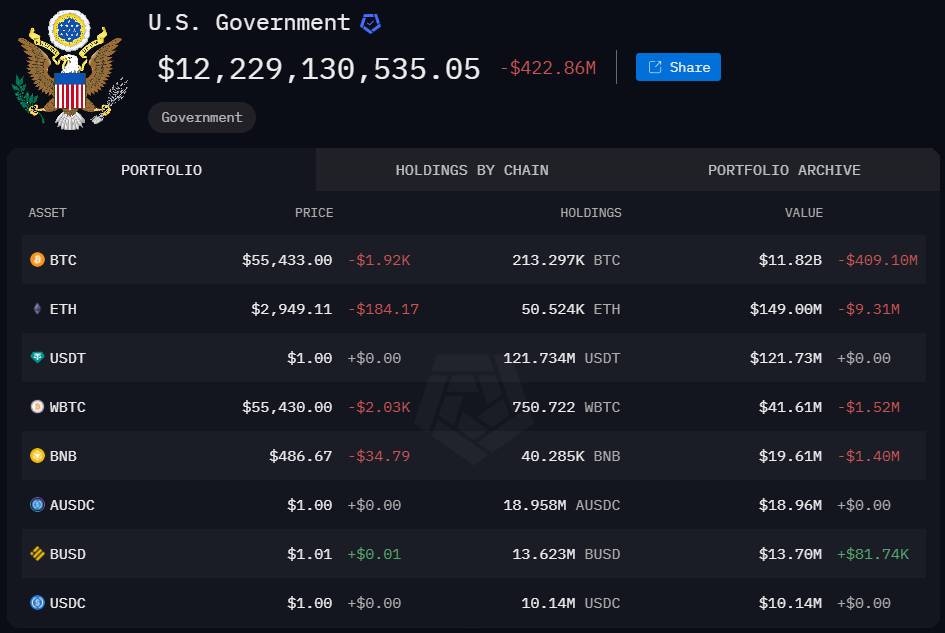

United States – $12.22 Billion in Bitcoin

The US government leads in holding the most significant amount of Bitcoin, currently totaling 213,297.03 BTC, valued at approximately $12.229 billion at the time of writing, along with various significant altcoins like ETH, WBTC, USDT, BNB, totaling over $409 million.

Most of these crypto assets are believed to have been seized from notorious criminal operations involving crypto, such as the Silk Road 2013, involving Silk Road operator James Zhong, the Bitfinex exchange hackers, and similar campaigns like Banmeet Singh earlier this year.

The US has a tradition of auctioning off seized Bitcoin through the US Department of Justice, with such events dating back to 2014. The most recent auction occurred in March 2023, where authorities liquidated over 9,800 BTC, fetching over $261 million. While the US announced plans for more auctions in 2023, they did not materialize, leading to resumed liquidation efforts in 2024. The US Department of Justice recently signed a custody agreement with Coinbase, possibly signaling a return to Bitcoin sales soon.

However, recent reports indicate a shift towards market-based liquidation methods, including OTC transactions. The schedule for future Bitcoin auctions remains to be determined, as the government typically avoids disclosing plans to prevent market manipulation.

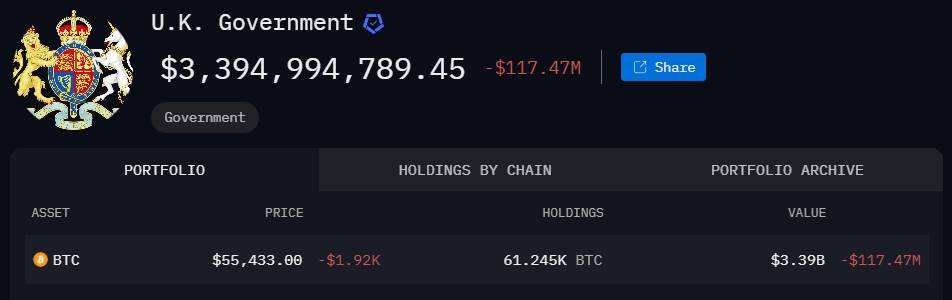

United Kingdom – $3.3 Billion in Bitcoin

The United Kingdom government ranks second on the list, holding approximately $3.3 billion worth of Bitcoin. A significant portion of this may be attributed to various law enforcement activities.

In 2021, the Metropolitan Police (UK) reported seizing £180 million (about $250 million) in cryptocurrency as part of a money laundering investigation.

Although the UK government needs to be more forthcoming about its plans for these illegally obtained digital assets, the national tax authority – HM Revenue and Customs (HMRC) – conducted auctions of seized cryptocurrency in 2019.

Details regarding future Bitcoin auction events remain restricted, making it difficult for market observers to speculate on the UK’s long-term strategy regarding these assets.

Germany – $2.28 Billion in Bitcoin

The German government’s Bitcoin reserve is ranked third, holding approximately 41,226 BTC valued at around $ 2.28 billion, which has recently garnered significant attention.

In February 2024, the German government announced plans to sell around 1 billion EUR (equivalent to $1.08 billion) of seized cryptocurrencies, primarily Bitcoin. The strategy involves gradual OTC transactions to minimize market impact, marking a notable shift from their previous approach of holding onto seized digital assets.

Since the initial transfer on June 19, officials’ wallets in Germany have moved 3,650 BTC to exchanges. This is part of the 50,000 BTC seized from the illicit movie streaming website Movie2k. FundsFunds transferred to exchanges on July 4 will likely also be used for liquidation, similar to transactions on July 1, June 26, 25, and 20.

This move represents one of the largest cryptocurrency liquidations by a government to date, closely monitored by market participants and other governments holding seized digital assets.

El Salvador – $314 Million in Bitcoin Treasury Reserves

While not seized, El Salvador’s $314 million Bitcoin treasury reserve remains noteworthy.

Unlike other countries, El Salvador’s Bitcoin treasury is part of a national strategy initiated by President Nayib Bukele.

During his first term, Nayib Bukele gained regional fame in Latin America for his aggressive campaign against criminal gangs. However, his most significant achievement was making El Salvador the first country in the world to adopt Bitcoin as legal tender on September 7, 2021.

Since then, El Salvador has used its national treasury to invest in this asset. With a dollar-cost averaging strategy, the Central American nation’s Bitcoin portfolio has seen gains exceeding $35.3 million.

Bukele has mentioned that his country not only buys BTC but also accumulates it from various sources, including selling passports, converting currency for businesses, mining, and other government services. Specifically in mining operations, El Salvador has mined 473.5 Bitcoin using geothermal energy from the Tecapa volcano.

Currently, El Salvador offers tax exemptions on foreign-source income investments, aiming to attract more FDI and offering global citizenship benefits.

Other Countries That Have Previously Held Large Amounts of Bitcoin

In addition to the governments of the US, Germany, UK, and El Salvador listed by the on-chain analytics platform Arkham, the governments of China, Ukraine, Finland, and Georgia are also countries that have held substantial amounts of Bitcoin but have mostly sold them in the past, according to data from Bitcoin Treasuries.

The Chinese government once held 194,000 Bitcoin, valued at $10.82 billion, representing nearly 1% of the total Bitcoin supply of 21 million, recorded as of November 2022. This amount was seized from the multi-level scam project PlusToken during 2019-2020.

The Ukrainian government previously owned 46,351 BTC, surpassing the current holdings of the German government, valued at approximately $2.58 billion at the time of writing. Most of these Bitcoins were secretly held by over 700,000 state officials in Ukraine. This number only came to light when the government enacted a policy to publicly disclose all holdings, including digital currencies, with a significant portion of crypto holders working in city councils, the Ministry of Defense, and the Ukrainian National Police.

In early 2022, Finland also held 1,981 BTC seized in criminal investigations by Finnish Customs. Digital asset companies Coinmotion and Tesseract, based in Finland, subsequently auctioned these assets.