Over the past month, the crypto investment community has closely monitored Germany’s daily Bitcoin liquidation transactions. Earlier this year, Germany seized 50,000 BTC from criminal activities and sold them in late June.

According to Arkham’s statistics, today, on July 12th, German officials sent 5,848 BTC to exchanges, totaling $330 million. Currently, Germany holds less than $222 million worth of BTC, suggesting their Bitcoin liquidation spree may soon conclude.

LATEST: The German Government just sent another 2300 BTC ($132.61M) to Kraken, 139Po (likely institutional deposit/OTC service), and address bc1qu.

So far today, they have transferred a total of 5848 BTC ($330.00M) to market makers and exchanges.

The German Government now has… pic.twitter.com/fn10uuSDQV

— Arkham (@ArkhamIntel) July 12, 2024

Just as the “nightmare” seemed to end, the crypto community discovered another whale quietly offloading Bitcoin: Genesis Trading, a crypto lending firm that filed for bankruptcy in early 2023.

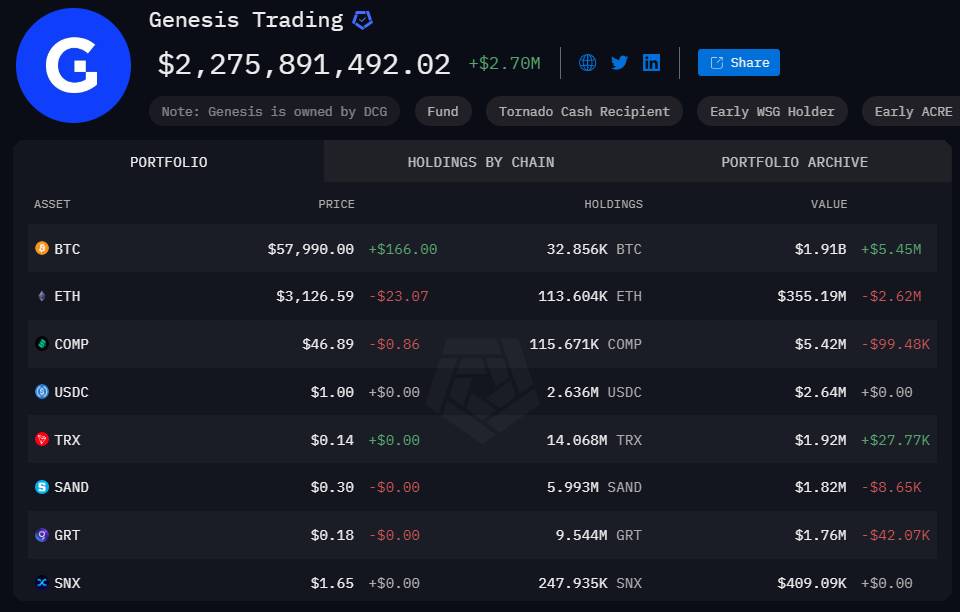

The address marked as “Genesis Trading” by Arkham has transferred a total of 12k BTC to Coinbase in the past month, worth about $760 million. It is suspected to be in bankruptcy liquidation procedures and currently holds about 33,000 BTC, worth $1.9 billion. In May this year,…

— Wu Blockchain (@WuBlockchain) July 12, 2024

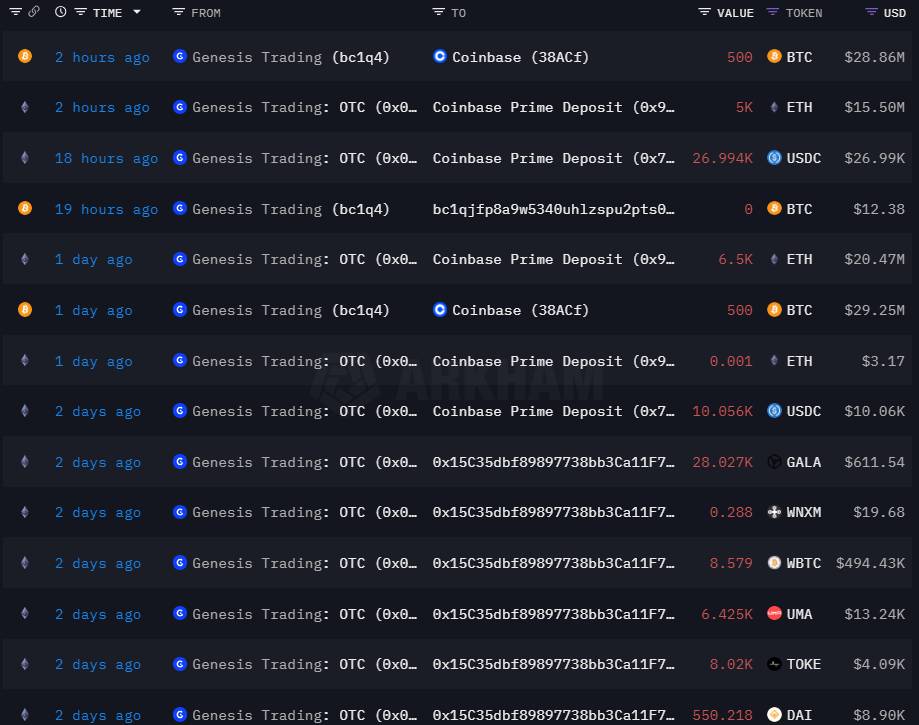

Specifically, Arkham’s data reveals that Genesis has sent 12,691 BTC (~$793 million) to Coinbase over the past month, primarily in transactions ranging from 500 to 700 BTC each.

Genesis’s crypto wallets have also transferred $37.7 million worth of altcoins like ETH, GALA, WBTC, and USDC to exchanges such as Coinbase, Binance, and HTX. This raises their total deposited amount to $830 million, likely for sale.

Arkham’s analysis indicates that Genesis’s crypto assets have decreased from $3.6 billion in mid-June 2024 to $2.2 billion at the time of writing, predominantly held in Bitcoin ($1.9 billion) and Ethereum ($355 million), with various lower-value altcoins making up the rest.

Genesis’s crypto liquidation activities commenced shortly after the company’s bankruptcy plan approval in late May 2024, aimed at returning $3 billion in assets to its clients.

Genesis, owned by Digital Currency Group (also the owner of Grayscale), suffered significant losses during the crypto liquidity crisis in 2022, exacerbated by the collapse of Three Arrows Capital’s fund. This led to opaque internal transactions with Digital Currency Group to maintain stability.

However, Genesis’s financial vulnerabilities came to light in November following the collapse of FTX, affecting even Gemini users who had lent funds to Genesis. Genesis declared bankruptcy in January 2023, with Gemini as its largest creditor, holding over $900 million in Earn users’ assets.

Subsequently, Gemini filed lawsuits against Digital Currency Group and its CEO, Barry Silbert, exposing misconduct within these entities. This legal battle attracted the attention of the New York Attorney General’s Office and the U.S. Securities and Exchange Commission (SEC). Genesis agreed to pay fines of $8 million and $21 million to these regulatory agencies. Since early 2024, the company has converted assets into GBTC shares back to Bitcoin, valued at $2 billion.

Apart from Germany and Genesis, the crypto market continues to witness several other whales poised to sell tokens, notably Mt. Gox, with over $8 billion in Bitcoin beginning its user repayment process in early July, and the Golem project, with over $650 million in Ethereum.

This ongoing liquidation activity underscores the evolving dynamics and challenges within the cryptocurrency ecosystem, impacting global markets and investor sentiment.

Related news: Germany’s $3B Bitcoin Selling Spree Is Done