On October 3, 2024, Franklin Templeton, a major asset management company, announced that it has expanded its Franklin OnChain US Government Money Fund (FOBXX) to the Aptos blockchain network. This move is significant as it marks the tokenization of traditional financial assets. FOBXX becomes the first money market fund available on the Aptos platform.

The FOBXX fund primarily invests in U.S. government securities, cash, and government-backed repurchase agreements. It currently ranks second in tokenizing U.S. government securities, managing assets worth $420 million. This places it behind BlackRock’s BUIDL fund, which surpassed FOBXX earlier this year with over $520 million in assets under management (AUM).

Before this expansion, Franklin Templeton had already integrated the FOBXX fund across four other blockchains: Stellar, Polygon, Arbitrum, and Avalanche. The move to Aptos, a Layer 1 blockchain developed using the Move programming language, underscores Franklin Templeton’s strategic effort to explore non-EVM (Ethereum Virtual Machine) blockchains.

Mo Shaikh, CEO and founder of Aptos, expressed excitement about the partnership, saying, “We are proud that traditional financial companies (TradFi) are choosing to develop on the Aptos network and bring the benefits of decentralization to their customers.”

Aptos, founded by Shaikh and Avery Ching, who were previously involved in Meta’s Diem project, has completed over 1.7 billion transactions since its launch in October 2022. The network has recently seen a surge in activity, with 7.49 million active wallet addresses recorded in September.

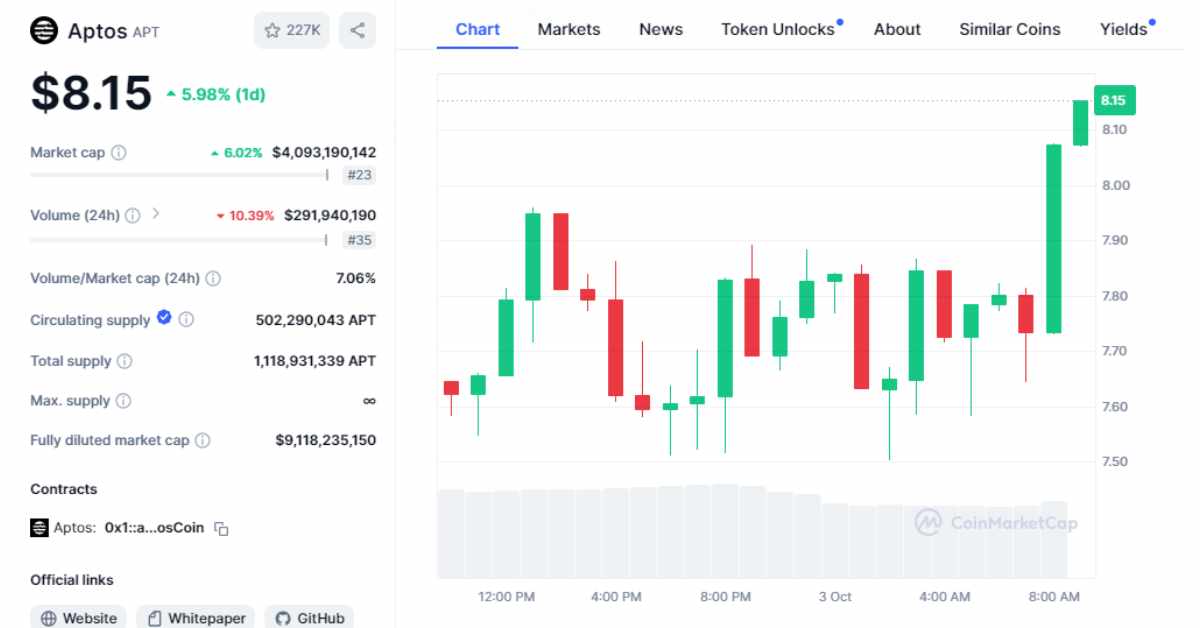

At the time of writing, Aptos’ native token (APT) is trading around $8.15, reflecting a 3% decline in the past 24 hours. Despite a 35% rally between September 17 and September 21, the token has since slowed down, coinciding with broader market corrections led by Bitcoin.

Meanwhile, Aptos’ primary competitor, Sui, has outperformed APT with a 150% surge in September, fueling speculation that Sui could become the “second Solana.” However, the competition between the two Layer 1 networks remains fierce as they vie for dominance in the blockchain space.

With over $1.6 trillion in AUM, Franklin Templeton continues to solidify its position in the digital asset landscape, offering tokenized funds like FOBXX while also issuing BTC and ETH ETFs.

Related news: Plume Network to Tokenize $1.25 Billion in Real-World Assets, Aiming for $3 Billion