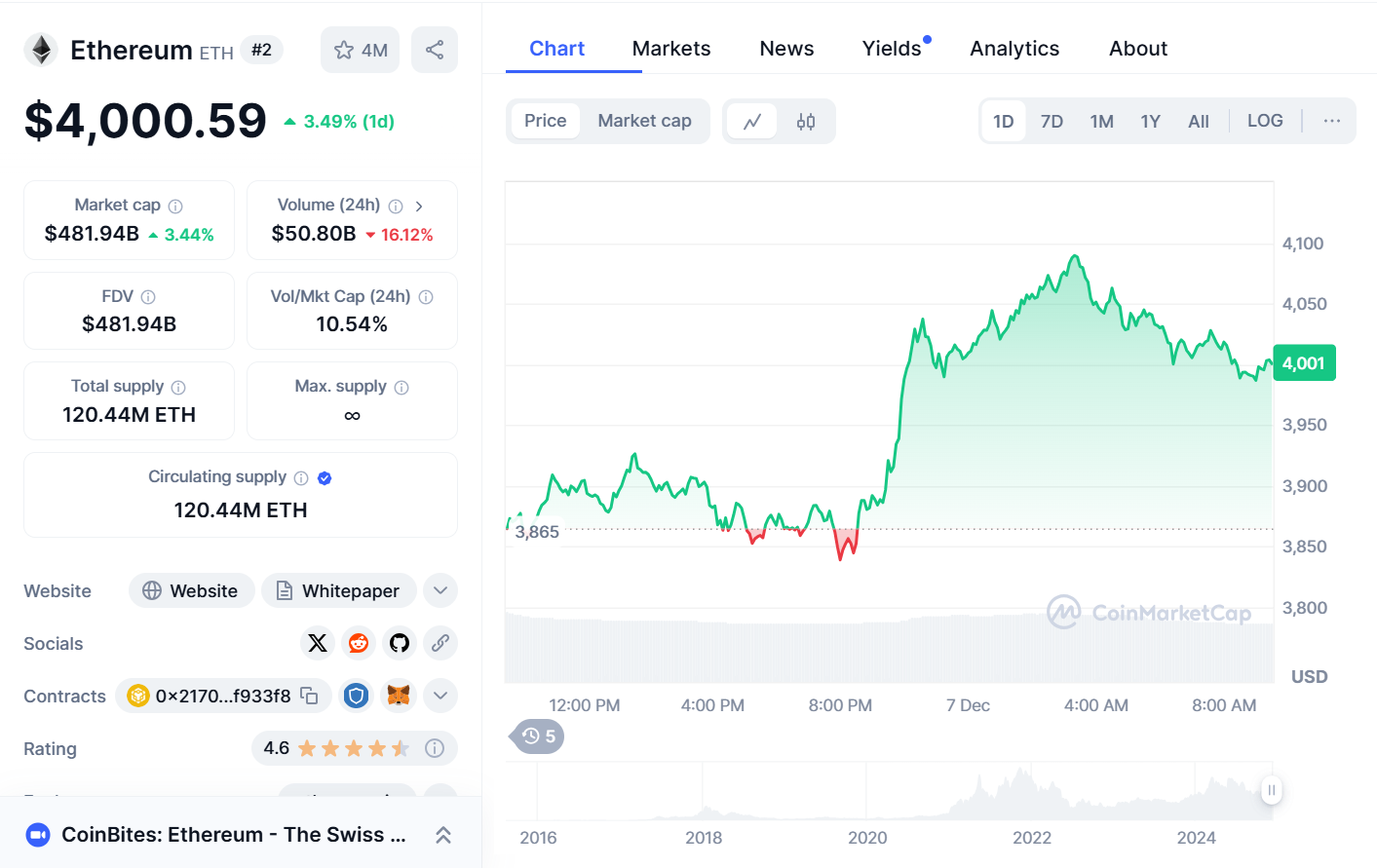

Ethereum (ETH) has surged to its highest price in nearly three years, reaching $4,089 on Thursday, December 6, 2024. This remarkable price movement comes on the back of strong institutional interest, with ETH exchange-traded funds (ETFs) recording their largest single-day inflow of $428.4 million on December 5. Coupled with this unprecedented investor activity, Ethereum has experienced a notable revival, signaling a shift in market sentiment and renewed confidence among institutional investors.

The latest numbers mark ETH’s most impressive performance since 2021, driven primarily by the record-breaking inflows into ETFs. This surge underscores the growing appetite for institutional crypto exposure and reflects a broader trend within the digital asset market.

Institutional Interest in Ethereum ETFs Spurs Price Rally

The dramatic price surge has been largely fueled by a new wave of institutional capital flowing into Ethereum ETFs. Leading this trend are major financial giants such as BlackRock, Fidelity, and others. These companies have driven ETFs into the spotlight, with their contributions propelling the market’s bullish momentum.

On December 5, BlackRock’s ETHA fund and Fidelity’s FETH were at the forefront of the inflow activity, leading the US ETH ETFs to their largest weekly net inflow since their launch in July 2023. This cumulative investment represents a total weekly inflow of $752.9 million, marking a historic peak even before the close of the trading week.

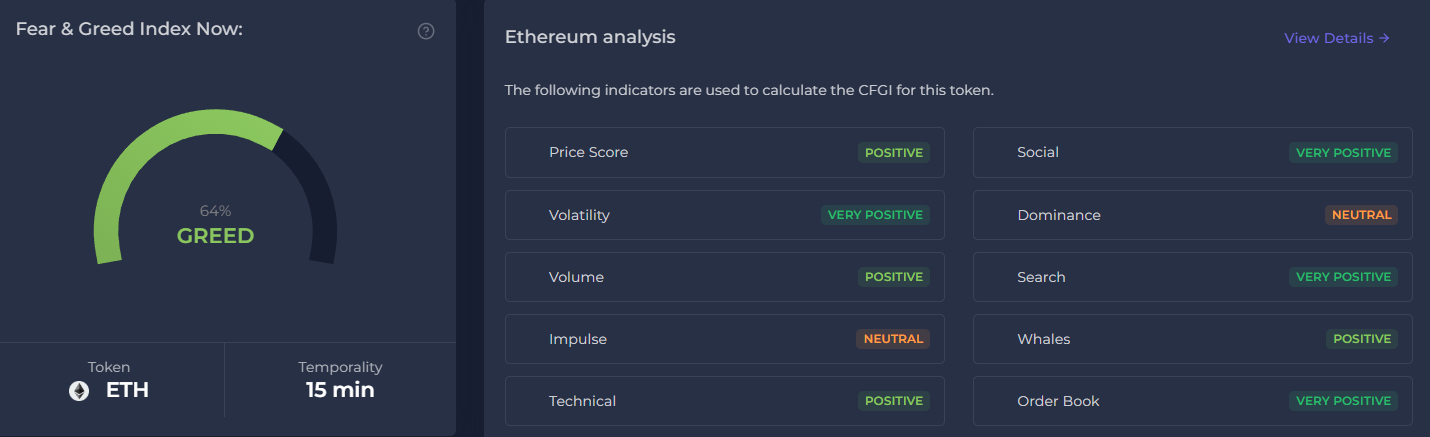

This strong investment wave not only signifies renewed confidence from traditional financial institutions but has also pushed market sentiment into positive territory. According to the fear and greed index, investor sentiment has shifted to “greed,” with the index now at a score of 65. This is indicative of increasing investor optimism, fueled by solid institutional backing and growing market confidence.

Spot Ethereum ETFs just saw their largest daily inflows ever.

It’s time for utility coins to pump. pic.twitter.com/avK2jo8a6b

— The DeFi Investor 🔎 (@TheDeFinvestor) December 6, 2024

Ethereum ETFs’ Journey: From Slow Starts to Record Growth

While Bitcoin ETFs have experienced faster adoption in the US, ETH ETFs are now emerging as key players in the market. Initially, these funds had a modest start, with only a single week of positive inflows in their first month. However, November brought a turning point as monthly inflows exceeded $1 billion for the first time, signaling a growing shift in investor interest.

Currently, the nine active ETH ETFs account for $12.5 billion in total assets. This represents approximately 2.7% of Ethereum’s total supply, highlighting a growing institutional footprint within the market. Despite their slower start compared to Bitcoin ETFs, ETH ETFs are now demonstrating their potential to reshape market dynamics and establish themselves as an integral part of institutional investment portfolios.

The recent surge in inflows further confirms that the market is evolving and that large financial players are committed to gaining exposure toETH through regulated and structured financial products. With record-breaking weekly inflows, ETH ETFs are set to play a key role in Ethereum’s price trajectory and long-term stability.

The ETF Market Expands Beyond Ethereum: Altcoins Enter the Spotlight

While ETH is at the forefront of this recent ETF boom, other altcoins are beginning to join the race for ETF adoption. Financial firms such as VanEck, 21Shares, and Grayscale have already filed for Solana ETFs, reflecting growing institutional interest in a variety of blockchain projects beyond Ethereum and Bitcoin.

Additionally, other firms like WisdomTree and Bitwise are in the process of seeking regulatory approval for XRP ETFs. This expansion highlights that the ETF market is not solely limited to Bitcoin and Ethereum but is evolving to include a diverse array of blockchain-based assets. As the US regulatory landscape adopts a more crypto-friendly approach, these developments could lead to an ETF market expansion that offers greater exposure to a variety of digital assets.

The ETF market’s evolution suggests that institutional investors are broadening their strategies and looking for diversified digital asset investments. This diversification will likely bring more liquidity into the market while increasing opportunities for innovation and market development.

Related news: Terra ($LUNA) Coin Soars 18%: Analysts Predict Explosive Breakouts Ahead