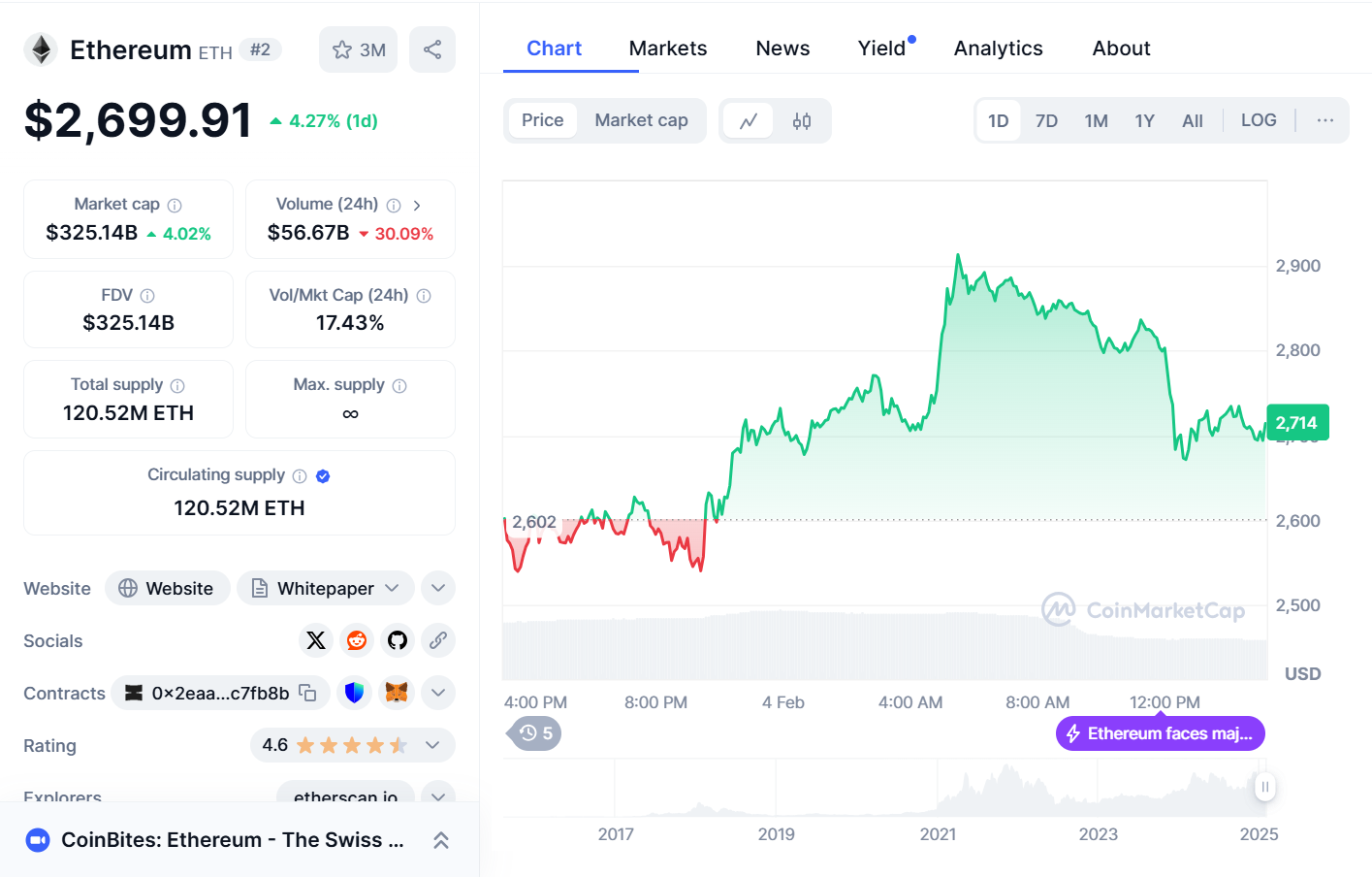

In a significant turn of events, the cryptocurrency market witnessed a robust recovery as Ethereum (ETH) and Solana (SOL) rebounded sharply following President Donald Trump’s decision to extend the tariff pause to Canada. This move, which mirrored a prior agreement with Mexico, alleviated concerns over a potential North American trade war and its economic repercussions.

Earlier in the week, the crypto market faced substantial downturns due to escalating geopolitical tensions. President Trump’s announcement of imposing tariffs on major trading partners, including Mexico, Canada, and China, instilled fears of rising inflation and stricter monetary policies. This led to a significant sell-off, with Bitcoin (BTC) plummeting to a three-week low of $94,476.18 and Ethereum dropping to $2,135 during Asian trading hours, marking its steepest single-day decline since May 2021.

Ethereum and Solana Lead Market Recovery

The market turmoil resulted in over $2.2 billion in crypto derivatives liquidations, marking one of the most severe downturns in the industry’s history. Analysts attributed this to investor panic triggered by the geopolitical tensions and the anticipated economic impact of the proposed tariffs.

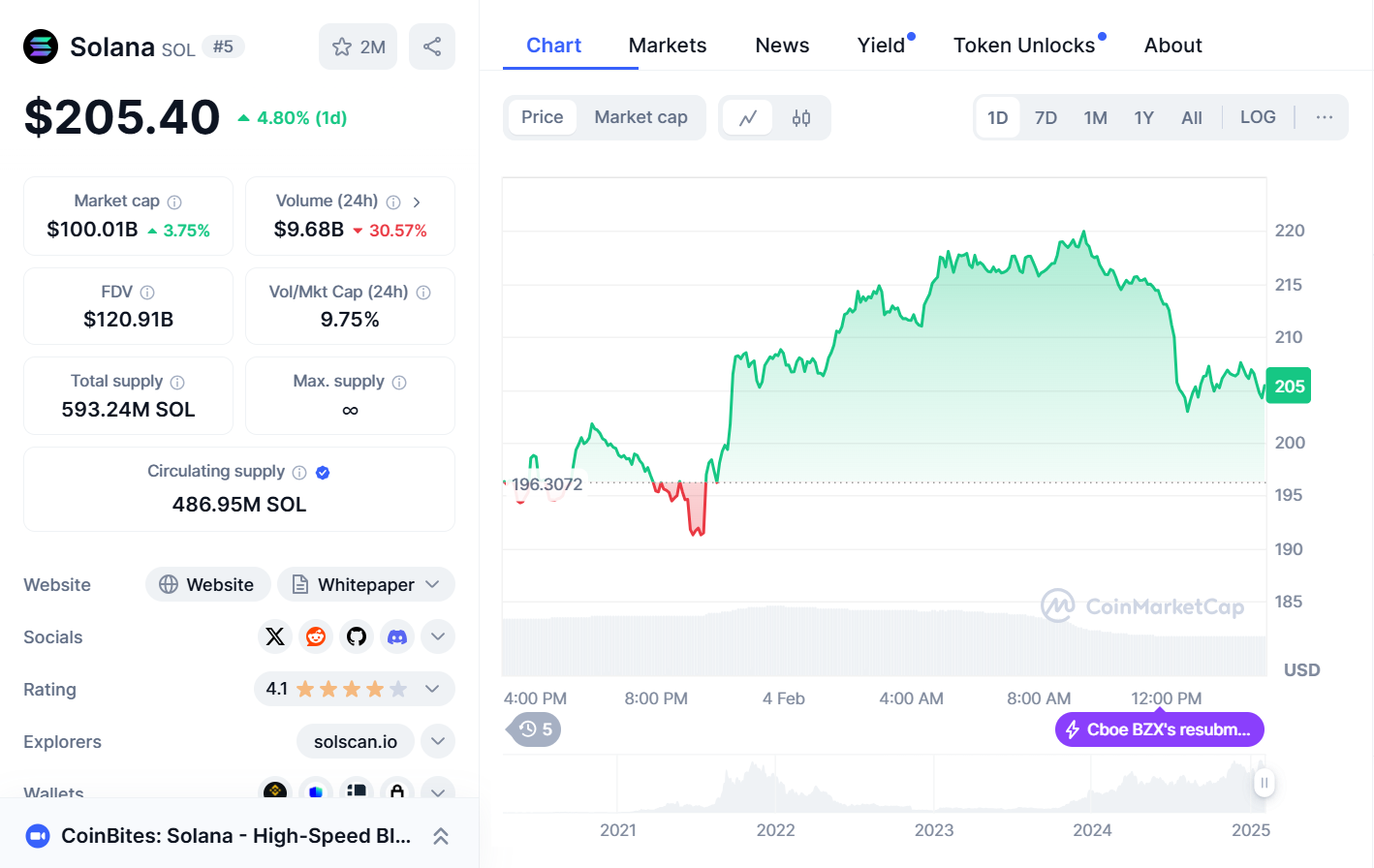

However, the subsequent decision to pause tariffs for both Mexico and Canada provided a much-needed boost to the market. Ethereum rebounded to $2,881, recovering from its earlier plunge. Similarly, Solana demonstrated remarkable resilience, climbing 13.5% to $216 from its intraday low of $190. This recovery outpaced Ethereum’s gains, highlighting Solana’s growing strength in sectors such as meme-coin trading and decentralized finance. Trading volume for SOL swelled by 27% on the day, indicating increased investor interest.

Min Jung, an analyst at Presto Research, noted, “Strong performers this cycle, such as SOL and XRP, led the recovery, as AI-related tokens, which were among the worst performers yesterday, rebounded.” Jung further added that the pause on tariffs for Mexico and Canada “provided an additional bid for SOL.”

Crypto Market Plummets Amid Trade War Fears

In a related development, Eric Trump, the president’s son, expressed bullish sentiment towards Ethereum. He tweeted, “In my opinion, it’s a great time to add ETH,” which was interpreted by many as an endorsement of the cryptocurrency. Notably, the tweet was later edited to remove the phrase, “You can thank me later,” suggesting a more measured stance.

Concurrently, World Liberty Finance, a decentralized finance project backed by the Trump family, executed significant wallet transfers. In synchronized transactions, the project’s Gnosis Safe Proxy moved approximately $60 million, with $55.69 million in Ethereum and $5 million in USDC. Most of these transfers were directed to Coinbase Prime deposits, with the largest single transfer amounting to $28 million. These movements have raised questions within the crypto community regarding the project’s strategic intentions.

Absolutely brutal

Trump makes everyone believes in 25% Tariff, only to realize now it’s Trump political game to push for agreements he wants with Mexico, Canada. The result with China will likely be similar although harder

While Eric Trump is buying mountains of ETH at the lows… https://t.co/tA6s8y2ymG

— Nachi (@alphawifhat) February 4, 2025

The Role of World Liberty Finance in Crypto Markets

World Liberty Financial, helmed by Eric Trump and Donald Trump Jr., has been making significant strides in the crypto space. The platform aims to provide decentralized financial services, allowing users to conduct transactions without traditional banking intermediaries. This initiative aligns with the broader trend of decentralized finance (DeFi), which seeks to democratize access to financial services through blockchain technology.

The recent market movements underscore the intricate interplay between geopolitical decisions and the cryptocurrency landscape. The initial announcement of tariffs led to a sharp decline in crypto valuations, reflecting investor apprehension about potential economic slowdowns and increased inflation. However, the subsequent tariff pauses acted as a catalyst for recovery, highlighting the market’s sensitivity to policy decisions.

Solana’s impressive performance during this period is particularly noteworthy. The platform has been gaining traction due to its high throughput and low transaction fees, making it a preferred choice for decentralized applications and meme-coin trading. The recent surge in SOL’s price and trading volume indicates growing investor confidence in the platform’s potential.

Related news: Trump Orders Creation of U.S. Sovereign Wealth Fund, $1B+ TikTok Acquisition