In the second quarter (Q2) of 2024, the total investment capital in crypto startups increased by 2.5% to $2.7 billion compared to the first quarter (Q1). However, the total number of successful fundraising deals decreased by 12.5%.

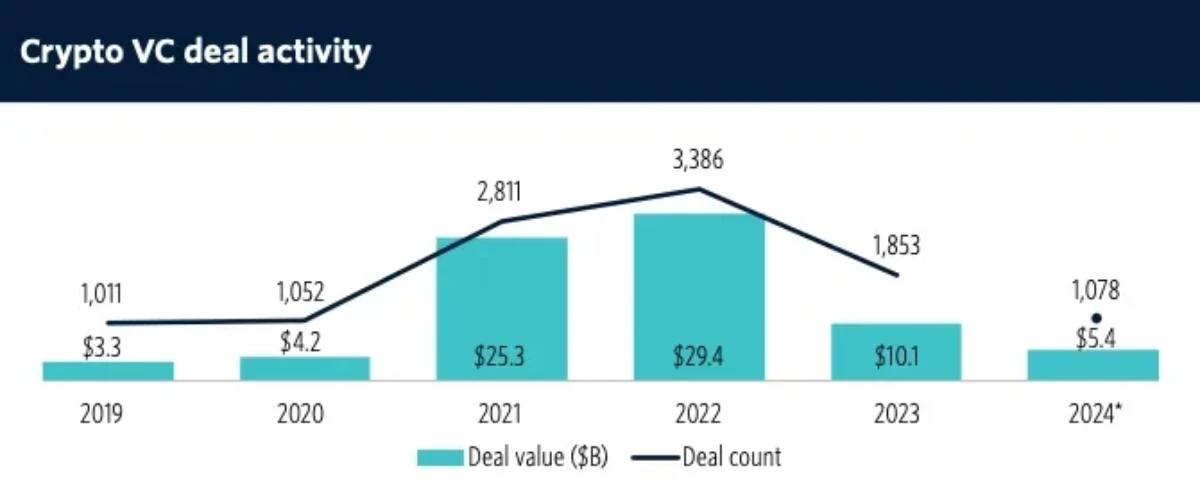

In the first half of 2024, crypto startups successfully raised nearly $5.4 billion through 1,078 fundraising deals, with an average fundraising amount of about $5 million per project.

Pitchbook noted positive signals from institutional investors in the crypto market, stating that investor sentiment is returning to positive territory. They anticipate that investment volumes and pace will continue to increase throughout 2024, barring any unexpected downturn.

Infrastructure projects led the way in terms of capital raised in Q2:

- Monad: A Layer 1 project using Parallel Execution technology, raised $225 million in Series A funding.

- Berachain: A DeFi protocol using a new consensus mechanism called Proof of Liquidity, successfully raised $100 million in Series B funding.

- Babylon: A leading Bitcoin Restaking platform, received $70 million in funding led by Polychain Capital.

- Farcaster: A decentralized social networking protocol (SocialFi) raised $150 million in Series A funding with a valuation of over $1 billion.

- Zentry: A blockchain-based gaming platform raised $140 million in a funding round with participation from Coinbase Ventures & a16z.

In Q2, leading venture capital firms Pantera Capital and Paradigm also planned to raise $1 billion & $850 million, respectively, for new Crypto funds.

According to data from DefiLlama, $102 billion has been invested in crypto startups through 5,400 funding rounds since June 2014. Despite an improvement from 2023, funding for crypto startups in 2024 is still significantly lower than in 2021-2022.