On September 18, Arthur Hayes, CEO of Maelstrom and founder of BitMEX, warned that risky assets, including cryptocurrencies, might face a sharp downturn once the Federal Reserve (FED) implements its first interest rate cut since 2020.

Speaking at the Token 2049 conference in Singapore, Hayes pointed out that the upcoming rate decision could have severe consequences for the global financial markets, especially for crypto.

Global investors are closely watching the FED’s anticipated rate cut, which is expected to be announced today, marking a pivotal moment in economic policy. According to the CME FED Watch tool, there is a 65% chance the FED will lower rates by 0.5%, with a smaller 35% expecting a 0.25% cut. This level of uncertainty, the first since 2020, signals hesitation among traders, potentially leading to significant volatility in the markets.

Hayes expressed concerns that the rate cut could reignite inflation and cause a surge in the Japanese yen (JPY), exerting massive selling pressure on cryptocurrencies. He argued:

“I think that the Fed is making a colossal mistake cutting rates at a time when the US government is printing and spending as much money as they ever have in peacetime,“

He also highlighted the narrowing interest rate gap between the US and Japan, which could strengthen the yen. This would threaten risk assets by triggering the unwinding of Carry Trade positions, a phenomenon that could prove disastrous for crypto markets.

The market has seen this dynamic in play before. On August 5, Bitcoin (BTC) fell to $49,000 after the Bank of Japan raised short-term interest rates. With the FED now expected to lower rates, Hayes predicts similar market turbulence ahead, believing the central bank could eventually drop rates to near zero in the future.

Despite his warnings, Hayes remains optimistic about certain crypto tokens, revealing that he holds Ethereum (ETH), Pendle Finance (PENDLE), and Ethena Labs (ENA) tokens.

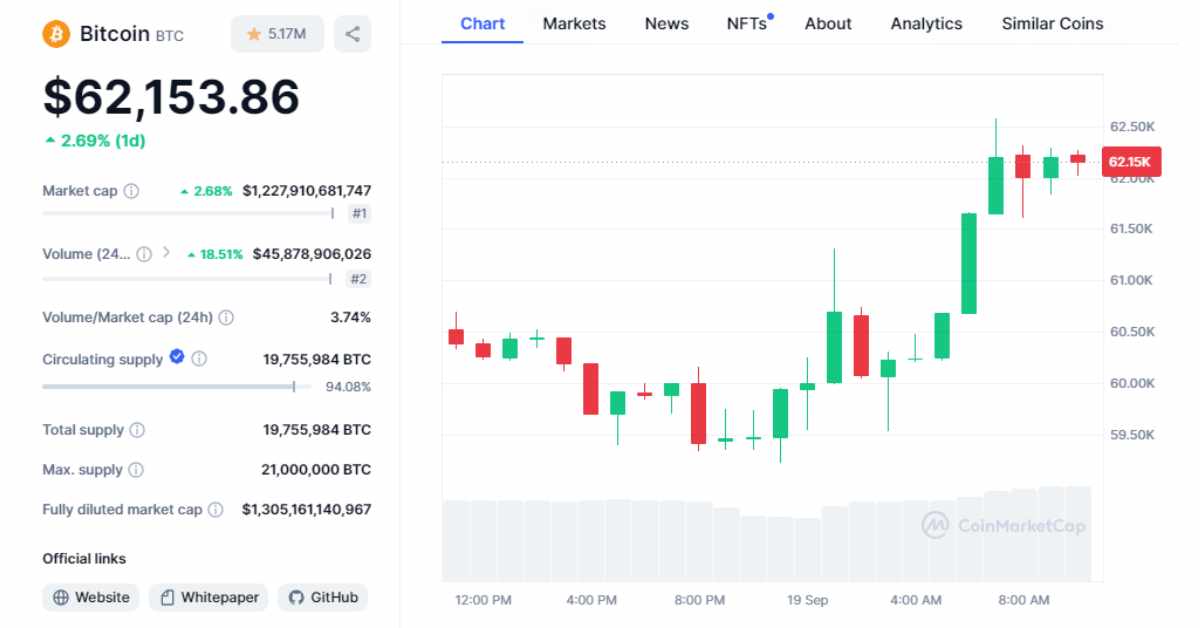

As of this report, Bitcoin is trading at around $62,000, up more than 2.5% in the last 24 hours, but the broader outlook for risk assets remains clouded by uncertainty. If the FED’s decision leads to inflationary pressures, the financial markets could face another stormy period similar to past crises in 2001 and 2007.

Related news: MicroStrategy Announces $700 Million Bond Offering to Acquire More Bitcoin