Outlier Ventures, a well-known investment fund, recently released a detailed report analyzing the price movements of Bitcoin following its Halving events. Historically, these events, which occur approximately every four years, have been crucial moments for Bitcoin, often leading to substantial price surges.

However, the latest data from the 2024 Halving event presents a significantly different situation, raising concerns about the future of Bitcoin’s established 4-year cycle.

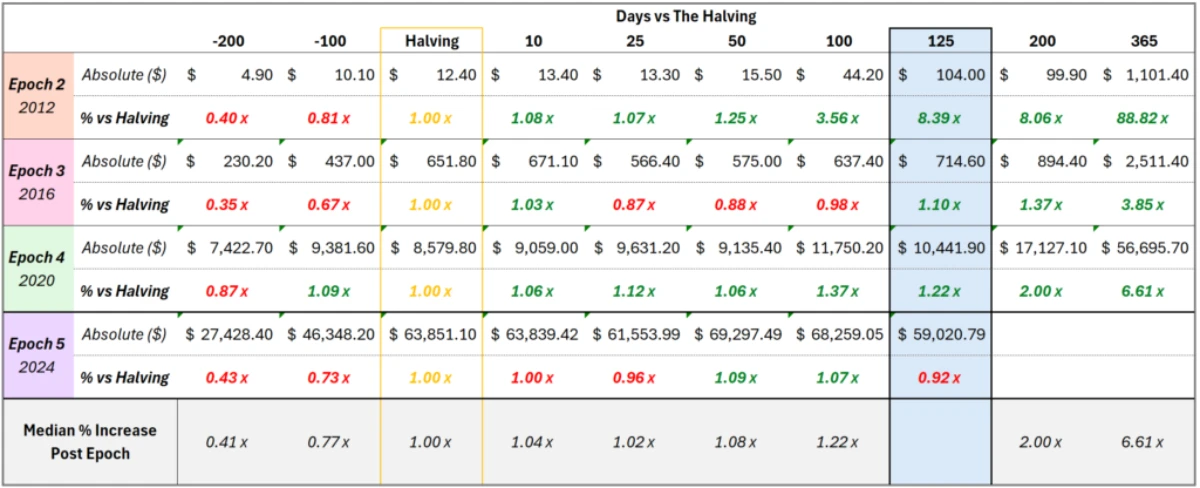

In the past, Bitcoin’s Halvings have been strongly associated with major bull runs. After the 2012 Halving, Bitcoin’s price surged by an impressive 739%. Subsequent Halvings in 2016 and 2020 saw more moderate, yet still positive, increases of 10% and 20%, respectively. These bullish trends helped solidify the belief in a cyclical price surge following Halvings and boosted investor optimism.

However, 2024 has seen a departure from this trend. Bitcoin’s performance post-Halving has been lackluster, with its price declining by 8% within 125 days of the event. This marks the worst post-Halving performance in Bitcoin’s history, with a price-to-performance ratio of 0.92x. In contrast to previous years, the current cycle has been marked by a prolonged downtrend, casting doubt on the long-standing belief in the Halving-triggered bull cycle.

Jasper De Maere, head of research at Outlier Ventures, cautioned investors:

“It’s time for founders and investors trying to time the market to focus on more significant macroeconomic drivers rather than relying on the four-year cycle.”

While acknowledging the psychological impact of Halving events, De Maere stressed the importance of considering other macroeconomic factors and trends when analyzing Bitcoin’s future trajectory.

The most recent Bitcoin Halving took place on April 20, 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. Leading up to this event, Bitcoin reached an all-time high (ATH) of $73,800 in March.

However, the months that followed have been challenging. Bitcoin entered a persistent downtrend, marked by “lower highs and lower lows,” with its price falling to $49,000 by August, the lowest level since February 2024.

As of early September, Bitcoin is trading at around $56,500, reflecting a 2% decrease in just 24 hours. The question on every trader’s mind is: will Bitcoin retest the August low of $49,000?

Keith Alan, founder of Material Indicators, warns that Bitcoin could indeed revisit this price level to form a double-bottom pattern before embarking on a potential medium-term uptrend.

The outlook for Bitcoin in the coming weeks hinges largely on the US Federal Reserve’s upcoming interest rate decision on September 18. Traders are closely watching this development, as it could significantly influence Bitcoin’s price trajectory. According to the CME FedWatch Tool, there’s a 41% chance that the Fed will cut rates by 0.5%, with a 59% probability of a 0.25% cut.

While the 2024 Halving event has shaken faith in Bitcoin’s traditional price cycle, it’s clear that multiple factors, including macroeconomic conditions and global financial trends, will play a crucial role in shaping its future. Investors and traders alike should adopt a more nuanced approach, looking beyond historical patterns and considering the broader context to navigate the unpredictable nature of the cryptocurrency market.

Related news: $287 Million Largest Outflow from Spot Bitcoin ETFs in 4 Months