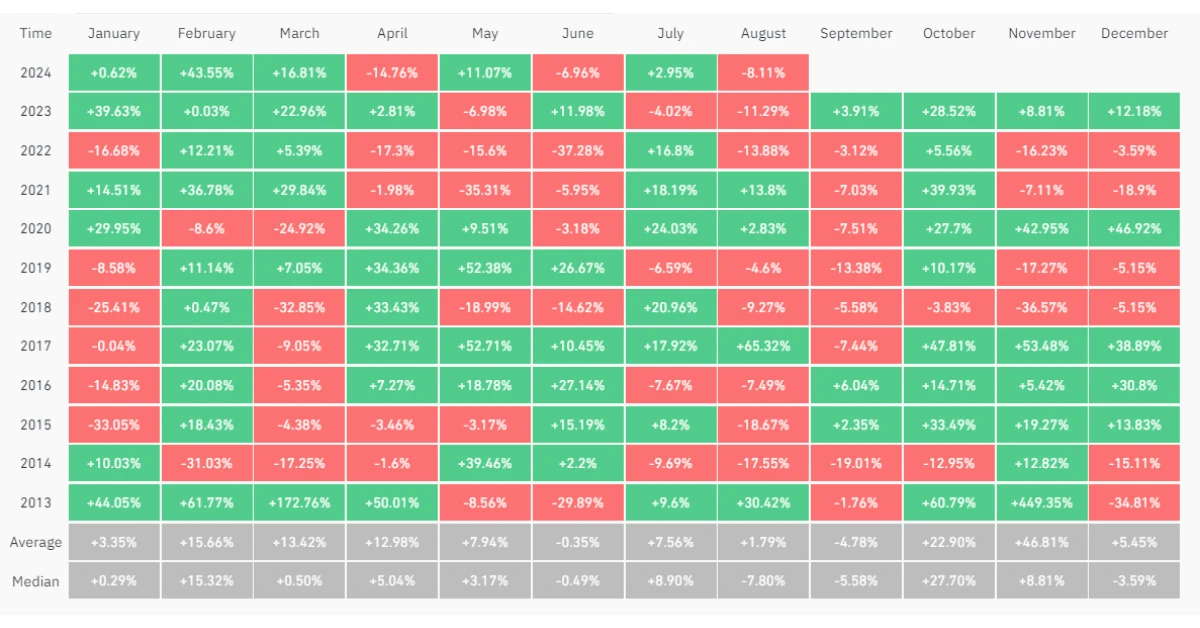

The cryptocurrency community is currently speculating about Bitcoin’s performance in September. Historically, September has been the worst month for Bitcoin’s price performance, with an average drop of 4.78%.

However, in September 2023, Bitcoin’s price rose by 3.91%, leading to a significant surge in its value. As of now, Bitcoin is trading at approximately $59,500, with a slight dip of 1.5% over the past 24 hours and an 8% decrease since the beginning of August.

Bitcoin has been in a downtrend since March 2024, with a pattern of “lower highs, lower lows.” This trend reflects cautious sentiment in the market due to various macroeconomic factors.

Recent inflation data in the US and Eurozone suggests a possible interest rate cut by the Federal Reserve and early interest rate reduction in the Eurozone.

There are potential risks on the horizon, including possible selling pressure from the Mt. Gox exchange and the US government in September. The combined value of BTC held by these two entities is estimated at nearly $15 billion; however, the likelihood of them selling their Bitcoin holdings is considered low at this point.

Analysts have also highlighted concerns about liquidity shortages and lingering effects of the summer slump, which may persist through September. These factors could make it challenging for Bitcoin to break through the significant resistance level of $63,900.

In conclusion, as we head into September, the outlook for Bitcoin remains uncertain. Historical trends and potential market disruptions could keep prices volatile, requiring investors to monitor market data and macroeconomic indicators closely.

Related news: Babylon’s Staking Platform Launch Causes Bitcoin Transaction Fees to Surge