In a new report released on September 9, analysts from the brokerage firm Bernstein have outlined contrasting Bitcoin price scenarios based on the outcome of the upcoming U.S. presidential election. Their analysis suggests that the winner of the election will have a significant impact on the price of Bitcoin (BTC) over the next four years.

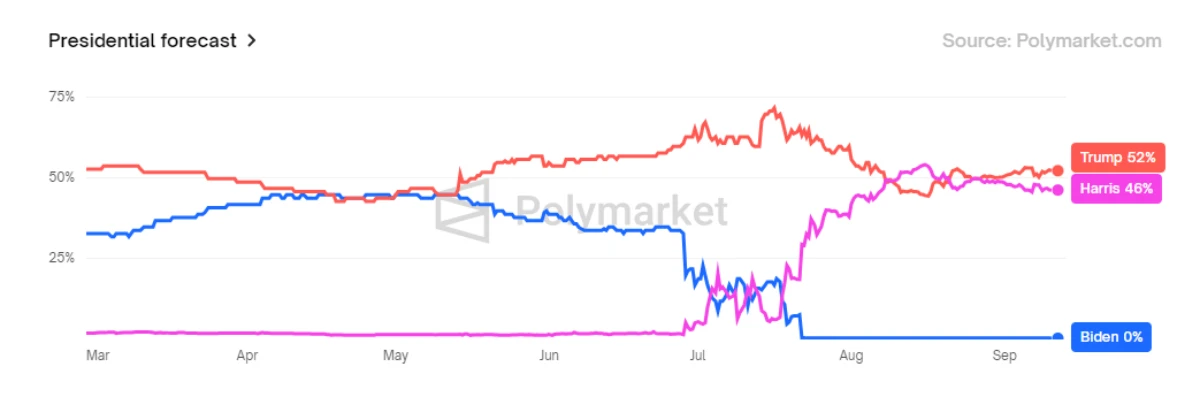

According to decentralized prediction platform Polymarket, Donald Trump currently leads Kamala Harris, with a 52% chance of winning compared to Harris’ 47%. In key swing states like Arizona, Georgia, Nevada, and Pennsylvania, Trump holds a lead, while Harris is ahead in Michigan and Wisconsin.

Bernstein’s analysts predict that if Donald Trump, the Republican candidate, secures the presidency, Bitcoin could experience a surge, potentially reaching $80,000 to $90,000 by the end of Q4 2024. This optimistic outlook is tied to Trump’s vocal support for cryptocurrency, including his promises to make the U.S. the “Bitcoin capital of the world” and to appoint a crypto-friendly chairman to the U.S. Securities and Exchange Commission (SEC). Trump has also floated the idea of establishing a Bitcoin reserve fund for the nation.

On the other hand, a victory for Kamala Harris, the current U.S. Vice President, could see Bitcoin fall below a critical support level of $50,000, with a potential retracement to the $30,000 – $40,000 range. Harris has not made any public statements on Bitcoin or cryptocurrency policy, leading to market uncertainty about her stance on regulation.

Bernstein analysts attribute these differing predictions to the candidates’ contrasting views on crypto regulation. Trump’s pro-Bitcoin stance, highlighted during the Bitcoin 2024 conference in July, is seen as a catalyst that could pave the way for institutional investments. In contrast, Harris’ silence on the matter has led to speculation that a more conservative regulatory approach could be in store under her leadership.

At the time of the report, Bitcoin was trading around $55,200, marking a 1% increase over the previous 24 hours. Analysts believe the $30,000 level will remain a solid support for BTC, especially given its recent surge following the approval of spot BTC exchange-traded funds (ETFs) in January 2024.

As the U.S. election approaches, the crypto market is closely watching how the outcome could shape the regulatory landscape—and, in turn, the future price of Bitcoin.

Related news: BTC Price Plummets as Capital Outflows Hit Spot BTC ETFs