Bitcoin and other major cryptocurrencies have shown significant price movements following the Federal Reserve’s December meeting minutes. The central bank’s cautious tone suggests inflation may persist above the 2% target, with interest rates likely to remain elevated throughout 2025.

Federal Reserve Governor Christopher Waller emphasized a measured approach, noting that while further rate cuts are possible, they will depend on continued progress in reducing inflation. This has tempered market expectations and introduced a sense of uncertainty for riskier assets like BTC.

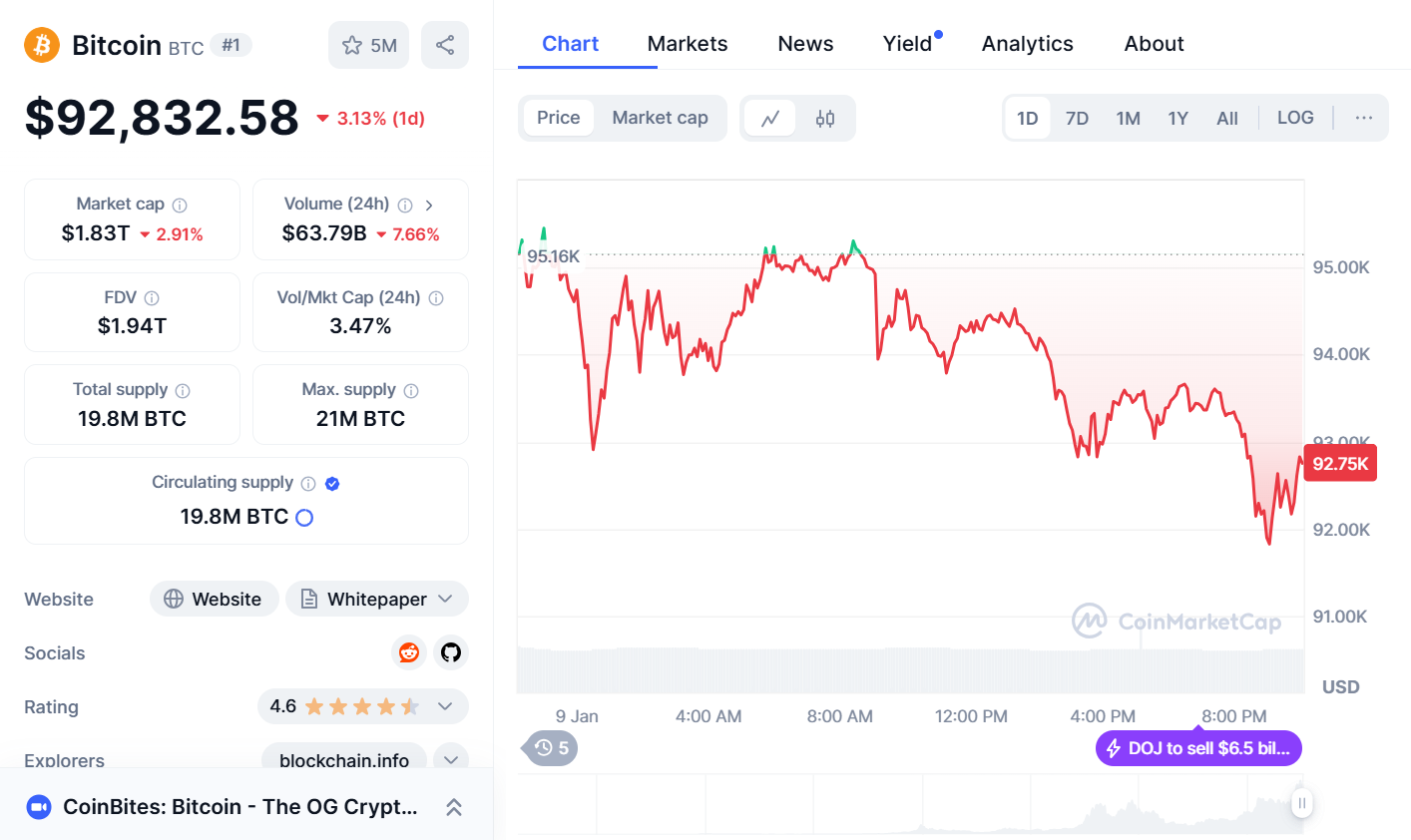

Bitcoin’s Recent Price Movements

Currently trading at approximately $92,044, BTC is down 3.4% over the past 24 hours. Much of this decline occurred before the release of the Fed minutes. Other major cryptocurrencies, including Ethereum (ETH), Solana (SOL), and Dogecoin (DOGE), have also seen notable declines.

Bitcoin, which reached a historic high of over $108,000 in December 2024, has been influenced by broader economic factors and shifting market sentiment. The cryptocurrency market has historically benefited from low interest rates, driving investors toward assets with higher potential returns.

Trump Administration’s Policies and Their Implications

The incoming administration of President-elect Donald Trump adds another layer of complexity to the market. Trump’s inclination toward trade tariffs has raised concerns about potential inflationary pressures. Although there have been reports of narrower tariffs under consideration, Trump has denied such claims, adding to the policy uncertainty.

Economists are closely watching how these policies might impact inflation and overall market conditions. The potential for inflation to remain above target levels could prompt the Federal Reserve to maintain a more cautious stance on interest rate reductions, directly affecting cryptocurrency investments.

🤓 #FameEX Insight: #Crypto prices tumbled with $BTC dropping to an intraday low of $96K.

The decline was largely driven by @realDonaldTrump‘s statement that US interest rates are too high, which further weighed on stock market sentiment. The Nasdaq fell over 1%.

Overall, the… pic.twitter.com/a4HMZGzS6x

— FameEX GLOBAL (@FameEXGlobal) January 8, 2025

The Role of Bitcoin ETFs and Institutional Sentiment

BTC exchange-traded funds (ETFs) have seen outflows totaling $582 million, reflecting bearish sentiment among investors. Analysts suggest that traders are targeting a potential price level of $90,000, contributing to the current volatility.

Despite these outflows, some experts remain optimistic about BTC’s long-term prospects. Projections indicate that the cryptocurrency’s price could rise to $225,000 by 2026, driven by factors such as broader adoption and potential regulatory support from the new administration.

MicroStrategy’s High-Stakes Bitcoin Strategy

MicroStrategy, a company heavily invested in BTC, has experienced significant stock movements over the past year. Its stock has soared by over 450%, outperforming BTC itself. However, this strategy comes with considerable risks, as the company’s valuation is closely tied to BTC’s performance. A sharp decline in BTC’s price could lead to a corresponding drop in MicroStrategy’s stock value.

The current landscape for Bitcoin and other cryptocurrencies is marked by uncertainty and volatility. Investors should carefully consider the impact of Federal Reserve policies, inflationary pressures, and shifting market sentiment when making investment decisions.

As the market continues to react to monetary policy and government actions, staying informed and adopting a strategic approach will be essential for navigating the cryptocurrency space.

Related news: Sonic SVM Unleashes Revolutionary SONIC Token to 2M TikTok Gamers with Exclusive Airdrop!