In the second week of July, the crypto market has shaken off the adverse effects of the Mt. Gox repayments and the German government selling coins.

Investor sentiment has strengthened, as evidenced by the inflows into Bitcoin spot ETFs in the US market.

Since getting the green light from the SEC, the flow of funds into and out of Bitcoin ETFs represents market sentiment. Positive net inflows into ETFs indicate more buying than selling, suggesting rising price expectations and vice versa.

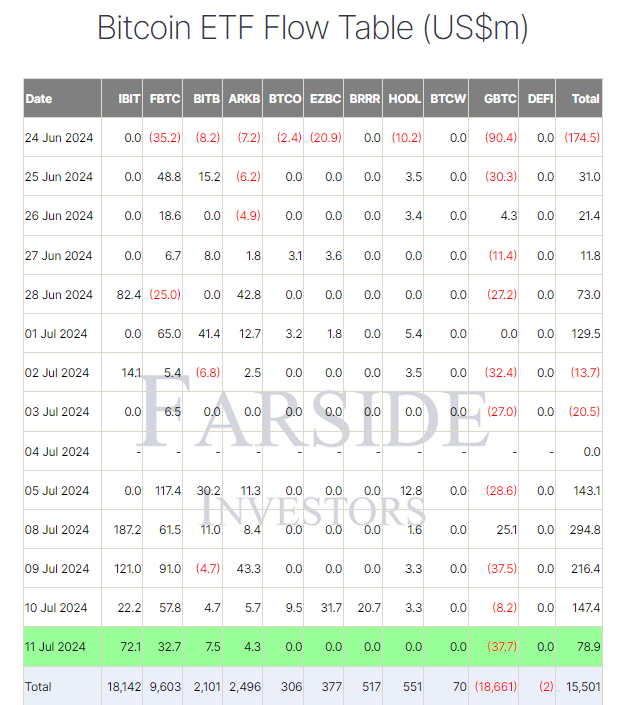

Over the past six months, 11 Bitcoin spot ETFs have recorded inflows totaling $15.5 billion. On July 8th alone, inflows reached nearly $300 million, the highest in a month. Consequently, Bitcoin’s price has rebounded from $54,260 on July 8th to around $57,000.

Bitcoin’s strong performance has also boosted Ethereum and other altcoins. ETH is now hovering around $3,110.

Related news: Bitcoin ETF Traders Pour $300M into Market Dip