Spot Bitcoin ETFs in the U.S. have ended an eight-day streak of consecutive outflows, signaling a potential positive shift in investor sentiment. According to data from SoSoValue, on September 9, these funds attracted $28.6 million in net inflows, following a period during which their total assets under management had dropped by more than $1.18 billion.

This reversal may indicate a positive signal for the cryptocurrency market, which has faced significant challenges since late August. Specifically, Bitcoin ETFs saw a sharp decline in demand from professional investors throughout August and early September. However, the inflows on September 9 have altered this previously bleak outlook.

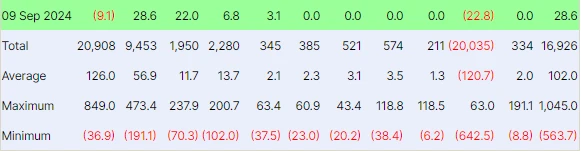

Leading this positive growth was Fidelity’s FBTC fund, which recorded inflows of up to $28.6 million. This increased the total cumulative inflows since the fund’s inception to $9.45 billion. Previously, the fund had endured seven consecutive trading days of outflows.

Other funds benefiting from this growth include Bitwise’s BITB and ARK 21Shares’ ARKB, which saw inflows of $22 million and $6.8 million, respectively.

However, not all ETFs recorded positive results. Grayscale’s GBTC fund reported outflows of $22.8 million, bringing its total outflows since launch to over $20 billion. Meanwhile, BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, also saw outflows of $9.1 million on the same day. Six other Bitcoin ETFs remained neutral, with no inflows or outflows.

The total trading volume of Bitcoin ETFs on September 9 reached $1.61 billion, a significant drop from the $2.39 billion recorded the previous day. Nonetheless, these ETFs have accumulated $16.92 billion in net inflows since their inception, demonstrating steady investor interest in the long term.

Although Bitcoin ETFs have shown positive signals, overall market sentiment remains relatively bearish, especially as outflows from Ethereum ETFs persist, with $5.2 million withdrawn on September 9.

The modest recovery of Bitcoin ETFs may suggest that investor sentiment is beginning to stabilize after a period of uncertainty. However, the market remains clouded by pessimism, with significant volatility and numerous economic factors likely to impact prices soon.

Related news: $287 Million Largest Outflow from Spot Bitcoin ETFs in 4 Months