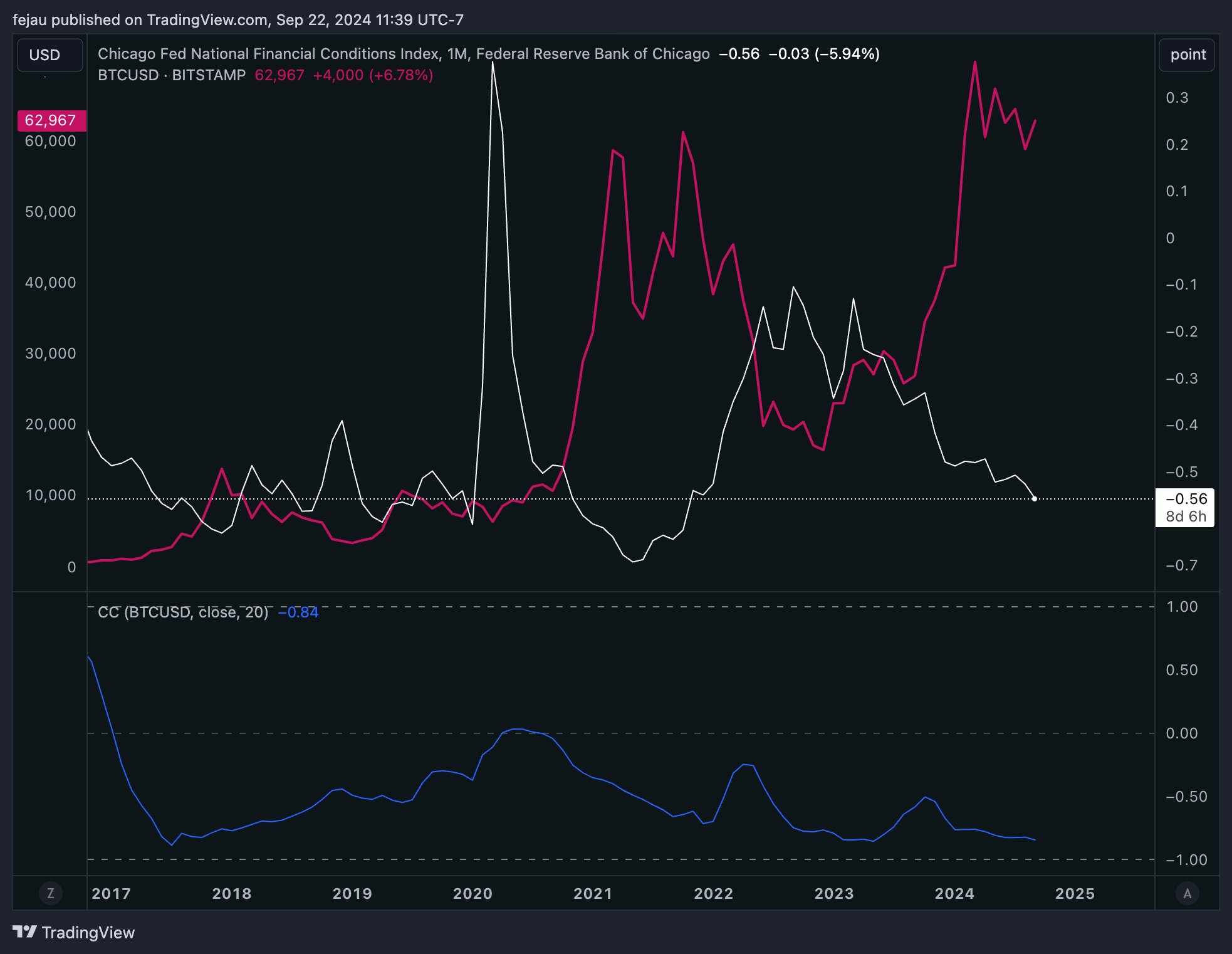

The latest report from the Chicago Federal Reserve analyzed U.S. financial conditions through its National Financial Conditions Index (NFCI), and it highlighted the loosest financial environment since November 2021. The NFCI provides weekly updates on liquidity, credit access, and market risk, and it currently stands at -0.56%, indicating easier access to capital and more available liquidity.

Historically, looser financial conditions have been associated with a surge in Bitcoin (BTC) prices. The report mentions an inverse relationship between the NFCI and Bitcoin’s performance. For example, BTC reached a peak of $69,000 in September 2021 during a period of low NFCI levels. Conversely, when the NFCI tightened in late 2021, Bitcoin prices plummeted to $16,000.

Since the NFCI sharply declined in late 2022, Bitcoin has experienced a 300% rally, rising from $16,000 to $63,000 at present. The correlation between BTC and NFCI has been evident since 2013, with loose financial conditions historically driving significant gains in the cryptocurrency market.

While the NFCI remains an important indicator for crypto investors, other metrics, such as the U.S. dollar strength index (DXY), also influence market dynamics. An increase in DXY often negatively impacts speculative assets like BTC, as a strong USD makes these assets less appealing.

As of the time of writing, Bitcoin is trading at $63,120, down 2% in the past 24 hours. Meanwhile, AI-trending cryptocurrencies like AR, ARKM, and NEAR have outperformed the market, driven by U.S. presidential candidate Kamala Harris’s tech-friendly stance, which promises support for cutting-edge technologies such as AI and digital assets.

Related news: Bitcoin Price Could Reach $200,000 by 2025, According to Standard Chartered Expert