On October 4, 2024, data analytics firm CCData released a report revealing a significant decrease in trading volume across cryptocurrency exchanges in September 2024. This marked the lowest level since June. The report indicated that both Spot and Futures trading volumes on centralized exchanges (CEX) experienced notable declines, with Spot trading down by 17.2% and Futures trading down by 17% compared to August.

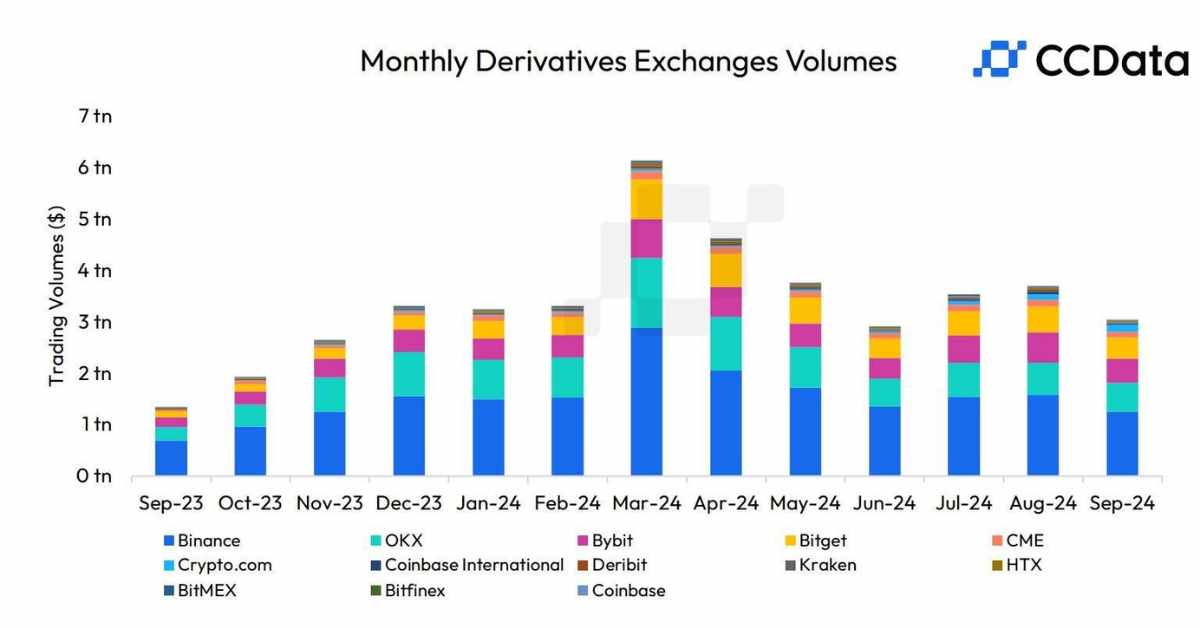

In total, the Spot trading volume on CEXs amounted to $1.27 trillion, while Futures trading volume stood at $3.07 trillion. The decline was attributed to investor caution ahead of the U.S. Federal Reserve’s decision to cut interest rates by 0.5% on September 19, which could potentially boost trading activity in October.

One of the most significant findings from the report was Binance’s continued drop in market share. The exchange processed 36.6% of the total Spot and Futures trading volume in September, marking its lowest market share since September 2020.

Although Binance remains the top player, its Spot and Futures volumes decreased by 21% and 23% respectively. By the end of September, Binance’s market share in the Futures market was 40.7%, and its Spot market share was 27%.

Conversely, Crypto.com defied the trend by recording significant gains in trading volume. The platform’s Spot and Futures volumes surged by 42.8% and 40.2% respectively in September. Crypto.com’s market share also increased by 10.5% compared to the same period last year.

Binance’s challenges occurred amid increased regulatory scrutiny. The U.S. Securities and Exchange Commission (SEC) filed a complaint against the exchange, seeking a closer review of its token listing practices. In late 2023, Binance settled legal charges with a $4.3 billion fine to U.S. regulators.

To counter these challenges, Binance has rolled out new initiatives, including listing TON-based and low-cap coins, in a bid to retain users and stabilize its position in the market.

Related news: Former Binance CEO Changpeng Zhao (CZ) Released: A New Chapter Begins