Since March 2024, the altcoin market has been in an odd uptrend, continuously testing its lower levels amidst overall market stagnation. Recent developments indicate a potential shift in momentum, hinting at positive prospects for altcoins.

The ETH/BTC chart has significantly impacted altcoins, as Ethereum has reached its lowest level against Bitcoin in over 1,000 days. This prolonged downtrend has influenced investor sentiment, despite important updates and events such as the ETH ETF.

Despite this bearish scenario, historical patterns show the altcoin market having seasonal declines followed by strong recoveries. For example, Chainlink (LINK) fell by up to 60% in the first half of both 2022 and 2023 but surged more than 120% in the second half.

China’s liquidity injection patterns are another overlooked factor influencing the altcoin market. Historically, China’s liquidity injections follow a six-month cycle, with a stronger inflow typically seen in the second half of the year. This injection of capital often correlates with rising altcoin prices.

For instance, the latest liquidity injection began in September 2023 and peaked in February 2024. Since then, global liquidity has weakened significantly, contributing to the sluggish performance of altcoins. However, the situation could change once both China and the U.S. Federal Reserve (FED) shift to more accommodative monetary policies.

The FED is expected to cut interest rates for the first time in September 2024, a move that could boost investor appetite for riskier assets like altcoins. Lower interest rates often spur liquidity, creating favorable conditions for speculative markets.

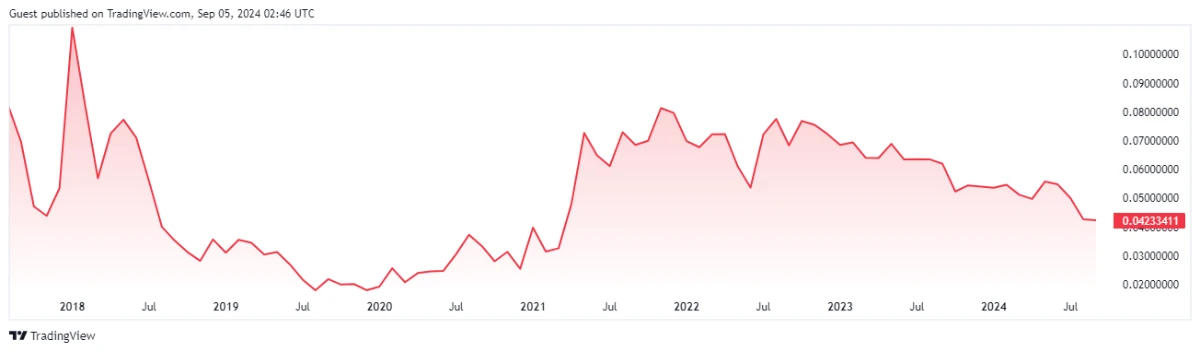

From a technical standpoint, the altcoin market is showing signs of stability. Current charts suggest that altcoins are undergoing a healthy retest of previous price ranges, without any alarming signals. Although total altcoin market capitalization remains 50% below its all-time high from 2021, this significant gap indicates that there is still ample room for growth.

In conclusion, while the altcoin market has faced challenges since early 2024, several factors point to a potential turnaround soon. A combination of seasonal altcoin cycles, China’s liquidity injections, and the FED’s expected rate cuts could play pivotal roles in rejuvenating the market. Despite the risks, the altcoin market still holds considerable growth potential, and investors should keep a close eye on these key drivers as they prepare for the next phase of the cycle.

Related news: 2 Key Reasons Why the Crypto Market Might Be Bottoming Out in Q3 2024