On September 4, Bitcoin (BTC) experienced a significant price decline due to widespread selling pressure in global financial markets. This unexpected decrease has had an impact on the cryptocurrency world, leading to concerns and speculation among investors.

The drop in BTC price is consistent with a larger downtrend in financial markets, where major U.S. stock indexes also saw substantial declines. This negative sentiment has affected the capital flowing into Spot BTC Exchange-Traded Funds (ETFs), marking one of the most negative days since May of this year.

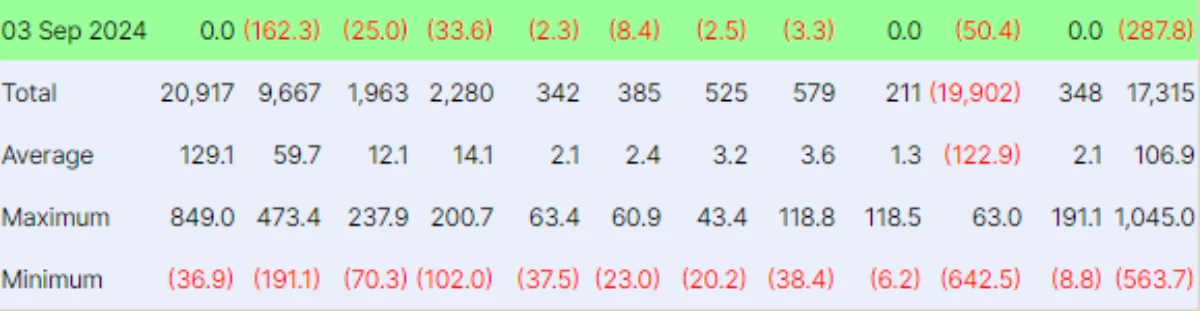

According to data from Farside Investor, Spot BTC ETFs in the United States experienced a net outflow of $287.8 million during the trading session on September 4. This represents the largest capital outflow since May 1 and is part of a five-session streak of consecutive net outflows. This trend sharply contrasts the positive capital inflows recorded in the seven sessions from August 18 to August 26.

Selling pressure affected most BTC ETF funds, with no fund experiencing any capital inflows. The hardest hit was Fidelity’s FBTC fund, which saw an outflow of $162.3 million. Grayscale’s GBTC fund followed, with a $50.4 million outflow. Other funds, including BITB (Bitwise) and ARKB (21Shares), also experienced negative flows of $25 million and $33.6 million, respectively. Even smaller funds by VanEck, Valkyrie, Invesco, and Franklin Templeton were not spared, each seeing outflows of less than $10 million.

Despite these outflows, BlackRock’s IBIT fund continues to lead in terms of assets under management (AUM), with over $20 billion, positioning it well ahead of its closest competitors, GBTC (Grayscale) and FBTC (Fidelity).

The total trading volume of Spot BTC ETFs on September 3 reached $1.56 billion, a slight increase from $1.56 billion the previous Friday. U.S. markets were closed on Monday, September 2, due to a holiday, which may have contributed to the low trading volumes.

U.S. stocks experienced their most significant drop since August 5, driven by recession fears following weaker-than-expected ISM data. The U.S. ISM manufacturing index for August came in at 47.2%, a slight increase from July but still indicative of economic contraction.

In the Ethereum (ETH) market, Spot ETH ETFs also reported negative inflows, with $47.4 million flowing out on September 3. Grayscale’s ETHE fund was hit particularly hard, recording a net outflow of $52.3 million. Fidelity’s FETH fund was the only one to buck the trend, reporting a modest inflow of $4.9 million. The trading volume of ETH ETFs was just $163.5 million on September 3, significantly lower than the over $1 billion traded on their launch day, highlighting the current lack of investor interest.

While the negative capital flows for BTC ETFs may be concerning, some analysts view this as a potential “bottoming” signal for BTC prices. Historically, strong capital flows often indicate a peak in BTC prices driven by investor FOMO (Fear of Missing Out). In contrast, negative capital flows can indicate that the market is approaching a bottom, potentially setting the stage for a rebound.

As of now, BTC is trading at around $56,400, a 4% decrease in the past 24 hours. ETH has also seen a decline, dropping over 5% to trade at $2,385.

However, there is some optimism in the market, with several top altcoins showing signs of recovery. For instance, Solana (SOL) has rebounded nearly 6% from $122 to $130 since September.

In conclusion, while the current market environment is challenging, the observed patterns in ETF capital flows and price movements could suggest that a market bottom is near. Investors will be closely watching to see if this signals a broader recovery in the cryptocurrency space.

Related news: Morgan Stanley Revealed Holding Nearly $200 Million in BlackRock Bitcoin ETFs