On September 4th, 2024, crypto investors are perplexed by the sudden drop in Bitcoin (BTC) and various altcoins. Despite the market’s downturn, there are emerging signs that the crypto market may be in the process of forming a bottom. This article delves into two compelling reasons why this bottom might solidify during Q3 2024.

Historical Trends: Q3 as the Crypto Market’s Lowest Point

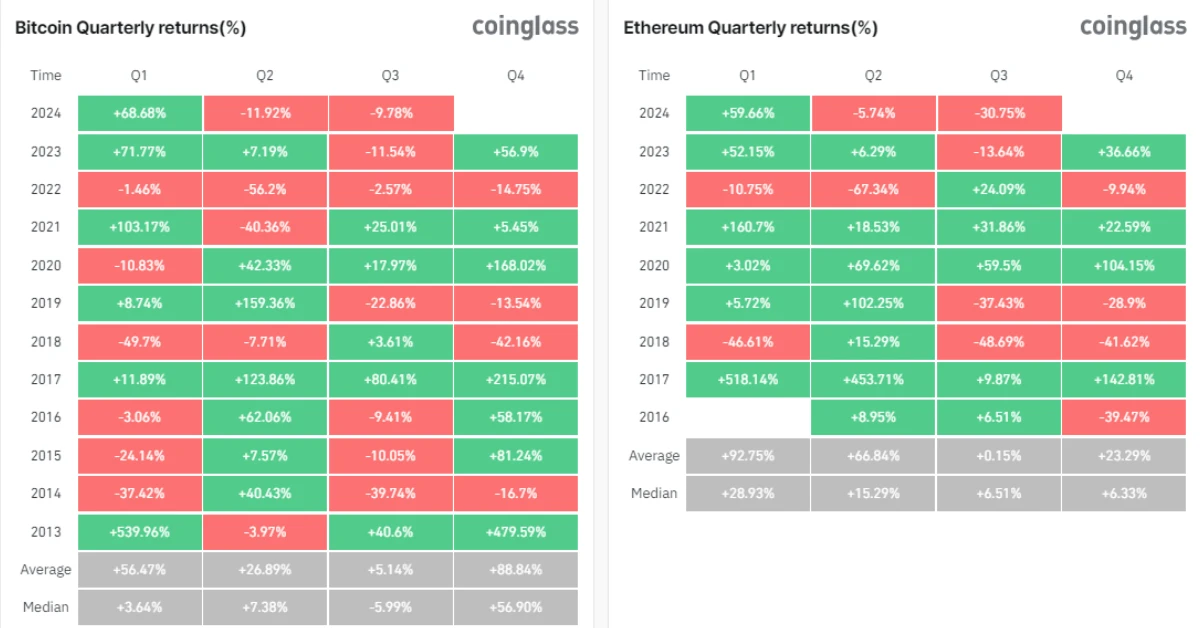

Data from Coinglass indicates that Q3 has historically been the weakest quarter for Bitcoin and Ethereum (ETH). The average performance of BTC in Q3 from 2013 to 2024 stands at a modest +5.14%, significantly lower than the performance in Q1 (56.47%), Q2 (26.89%), and especially Q4 (88.84%).

September has historically been the worst month for BTC, with an average performance of -4.72%. This seasonality pattern highlights the significant impact of the time of year on BTC prices.

Related news: Bitcoin Is Set for Its Worst Performing Month of the Year

ETH fares no better in Q3, with an average performance of -0.04%, trailing far behind its Q4 (23.29%), Q2 (66.84%), and Q1 (92.75%) averages.

Historically, BTC’s best performance has been observed in Q4, while ETH tends to follow suit with an explosive Q1. This trend can be attributed to the adage “Sell in May and go away,” a saying passed down through generations of investors. The reasoning behind this pattern is that consumer and investment activity typically surges towards the year’s end, driven by the Christmas and New Year holidays.

For those who can weather the difficult Q3 period, the rewards in Q4 are often substantial, as the market typically experiences significant growth.

Potential Monetary Stimulus by Major Economies

Famed analyst Michaël van de Poppe suggests that the crypto market could benefit from potential monetary stimulus by China, the world’s second-largest economy, later this year.

Van de Poppe, a respected technical analyst with over 700,000 followers on X (formerly Twitter), points out that China’s liquidity injections follow a cyclical pattern, typically accelerating towards the end of the year and around the Lunar New Year, while tapering off during the rest of the year.

He notes that China’s most recent significant liquidity injection began in September 2023 and peaked in February 2024, coinciding with explosive growth in many altcoins. During this period, BTC’s price surged by 134%, from $26,000 to $61,000. Several altcoins, such as FET, ORDI, SOL, and TIA, also experienced substantial gains, ranging from 100% to 400%.

Van de Poppe believes that global liquidity is currently low. Still, he anticipates an improvement as China potentially implements quantitative easing (QE) to stimulate its economy, which could have a ripple effect on the crypto market.

In addition to China’s potential actions, the US Federal Reserve (FED) is also expected to begin implementing QE to boost the US economy. The Fed is anticipated to start cutting interest rates in September, creating a more favorable environment for altcoins to thrive.

Van de Poppe further emphasizes that the crypto market has historically rebounded from significant crashes, such as those in March 2020 (Covid pandemic) and May 2021 (China’s crypto mining ban). After each of these events, the market gradually recovered and even reached new all-time highs in 2024, defying the expectations of many.

In conclusion, while the current market conditions may appear bleak, historical data and potential economic stimuli from major economies suggest that the crypto market could be on the brink of forming a bottom in Q3 2024. Investors who can endure the current downturn might be well-positioned to benefit from a potential market resurgence soon.

Related news: Ethereum’s $3,000 Target: Is 2024 the Year?