The Bitcoin mining network has undergone a huge advance, with a hash rate increase of up to 104% by 2023. This is a clear testament to the huge appeal and potential of cryptocurrency mining.

Therefore, to achieve success in this competitive market, the most important thing is to clearly understand the Bitcoin mining process safely, along with important notes before starting mining, and a variety of Bitcoin mining methods.

To address these questions, CoinMinutes will present an overview of how to mine Bitcoin in 2024.

Key takeaways

|

How to Mine Bitcoin?

Step 1: Preparing Hardware for Mining

To mine Bitcoin, you need to use special devices designed with high computing power. Here are some types of mining equipment: ASIC and GPU. These are indispensable tools for you to participate in the mining process most effectively.

- ASIC mining rigs are currently the most powerful Bitcoin mining hardware available in the market. These rigs are specifically designed and manufactured for the sole purpose of mining cryptocurrencies. As a result, they surpass other types of chips in terms of both performance and energy efficiency.

- A GPU mining rig represents an improvement over the traditional CPU rig. It can be a regular computer that is equipped with multiple GPU chips. While GPU rigs do enhance mining efficiency significantly compared to CPU rigs, they are not specifically designed for cryptocurrency mining purposes.

When selecting mining hardware, it’s crucial to consider below factors:

- Hash Rate: The hash rate measures how powerful your device is when it comes to mining Bitcoin. It directly determines how successful you’ll be in mining operations.

- Energy Consumption: It’s important to be efficient in terms of energy usage because the cost of electricity can have a significant impact on how profitable your mining operations are.

- Initial Investment: The initial cost of the hardware you need for mining can vary. It refers to the average cost of purchasing the physical equipment needed. It’s important to find a balance between your budget and the performance you require to ensure a good return on your investment.

- Cooling and Noise: When setting up a mining operation at home, you need to consider the heat and noise generated by high-performance mining rigs. It’s crucial to find ways to cool them down and minimize the noise.

- Size and Scalability: The available space and the potential for future expansions are important factors to consider when choosing mining hardware. You need to make sure you have enough room and flexibility for any future growth.

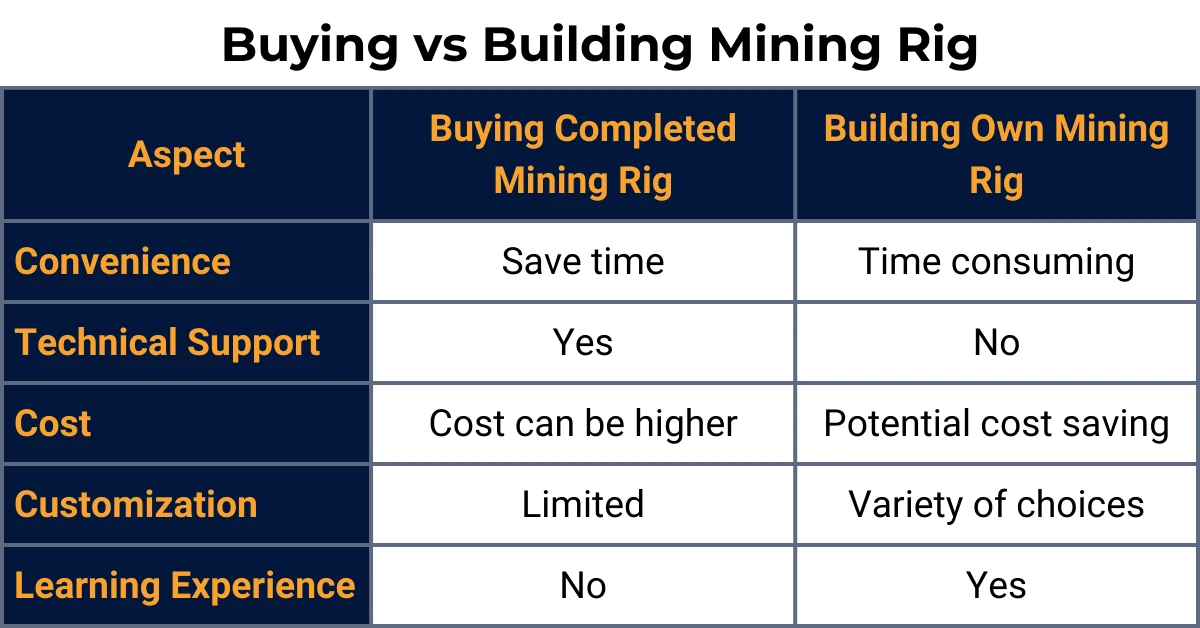

Besides considering factors in choosing mining hardware, it is important to weigh these factors against the options of purchasing a pre-assembled Bitcoin mining rig or building a mining rig.

There are a few different types of cooling systems out there: Air cooling uses fans to cool components, simple and cheap, but may not be enough for large setups. Liquid cooling absorbs heat with liquid, more efficient but pricier. Immersion cooling submerges components in cooling liquid, highly effective but costly and demanding maintenance.

Step 2: Setting Up a Bitcoin Wallet

This step will explore everything you need to know about creating a Bitcoin wallet, the kinds of wallets to suit your needs, and how to create them.

Software Wallet

A software wallet is a software program installed on a computer or mobile device to store private keys and make transactions with digital currency. The advantages of software wallets over other types of wallets are: easy installation and use on computers or mobile devices, and most mobile wallets are free.

Steps to Create a Software Wallet

- Step 1: Choose a trustworthy software wallet app.

- Step 2: Download the wallet app onto your phone or computer.

- Step 3: Create an account by providing basic information.

- Step 4: Transfer your assets.

Hardware Wallet

A hardware wallet, also known as a cold wallet, is an electronic device designed to securely store private keys for digital currency and other digital assets. Hardware wallets have the advantage of providing high security by keeping the private keys offline and requiring physical confirmation for transactions.

Steps to Create a Hardware Wallet

- Step 1: Choose a reputable and reliable hardware wallet that suits your needs.

- Step 2: Purchase the hardware and install the required software. Once the software is installed, you can connect your hardware wallet to your computer or mobile device using a USB cable or Bluetooth connection.

- Step 3: Transfer your cryptocurrency to the hardware wallet.

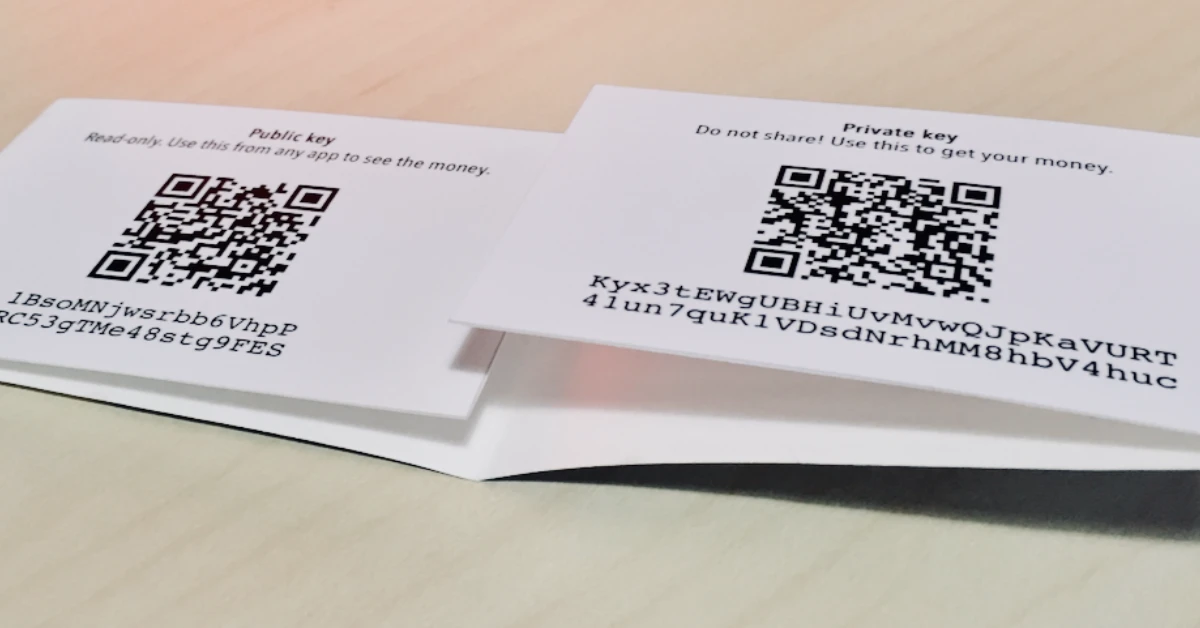

Paper Wallet

A paper wallet is an offline method of storing digital currency by printing your public and private keys on a piece of paper. It is considered a cold storage method, which helps protect your digital currency from network attacks and malicious software. Therefore, compared to other types of wallets, paper wallets are easy to use and can be accessed even when you are offline, providing greater security than software wallets.

Steps to Create a Paper Wallet

Step 1: Go to a wallet generator website and save it as a web archive on your computer.

Step 2: Disconnect from the internet when creating a paper wallet.

Step 3: Print the private key and store it in a safe and secure place.

Please back up your private key securely and confidentially. You can print out a QR code or write down the key information and store it on paper. In the unfortunate event of a loss of the private key, it can result in the loss of all your Bitcoin in the wallet.

Step 3: Setting Up Mining Software

To start mining the cryptocurrency of your choice and join a mining pool, you need to install mining software. There are several popular options available, such as CGMiner, EasyMiner, and BFGMiner. It’s important to choose the software that is compatible with the specific cryptocurrency you want to mine.

- CGMiner, an open-source Bitcoin mining software, is designed to be compatible with various hardware types including FPGA, GPU, and ASIC devices.

- EasyMiner is designed to optimize mining performance by dividing miners into separate groups, thereby increasing mining efficiency.

- BFGMiner possesses the capability to engage in mining various and employs a diverse set of mining algorithms, enabling compatibility with a multitude of hardware setups.

Once you have the mining software installed, you’ll need to configure it. This involves entering the address of the mining pool, along with your username and password. You also need to specify the cryptocurrency you are mining and indicate the number of GPUs (graphics processing units) you are using for mining.

Read more about the best mining software: coinminutes.com/reviews/bitcoin-mining-software

Step 4: Starting the Mining Process

After you have completed the setup process for the mining software, you can initiate the mining of your chosen cryptocurrency by simply clicking the “Start Mining” button.

What You Need to Know Before Mining Bitcoin?

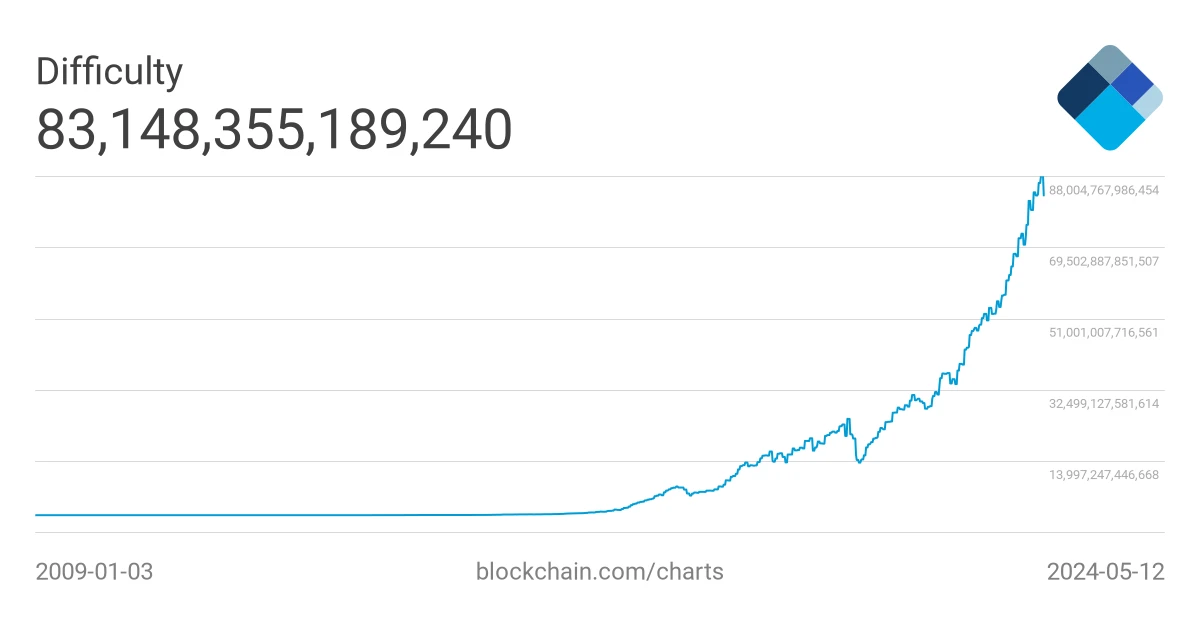

Mining Difficulty

After 2,016 blocks of Bitcoin are mined on the network, the mining difficulty will be automatically adjusted. This adjustment depends on the number of participants in the mining activity and their collective computational power (hash rate). Depending on this situation, the mining difficulty can either increase or decrease.

Hash rate

The hash rate is a measure of the computational power that Bitcoin miners use to process transactions. When the hash rate is high, the Bitcoin blockchain (public ledger) becomes more secure.

Currently, the hash rate fluctuates between 500-600 EH/s. Specifically, on May 10, the hash rate was about 620.2626 EH/s.

To ensure that Bitcoin mining occurs stably, a new block is created approximately every 10 minutes. The difficulty of mining Bitcoin on the blockchain is adjusted periodically, usually every two weeks. A higher hash rate means that it is more difficult to mine Bitcoin.

Halving

The halving is a significant occurrence in the world of Bitcoin. During this event, the Bitcoin reward for each mined block is reduced by half. This has a notable impact on the profitability of miners. The purpose of this reduction is to control the pace of new Bitcoin production while ensuring scarcity and limiting inflation. Halving takes place once every four years, with the next event expected to occur in 2028.

Bitcoin Mining Cost

The expenses associated with high hash rate mining equipment are substantial. Advanced mining rigs like the Antminer S19 XP Hyd (255 TH/s) and MicroBT WhatsMiner M56S (212 TH/s) come with price tags ranging from $4,000 to $6,000 per device.

Besides, to mine Bitcoin, you need to purchase expensive equipment that costs hundreds or thousands of dollars. Additionally, if you don’t monitor your energy usage and the electricity cost exceeds $0.05/kWh, mining operations today will become unprofitable.

Ways to Mine Bitcoin

Solo Mining

Solo mining refers to the practice of an individual miner independently carrying out the mining process without relying on any external party. These solo miners connect their mining computers directly to native cryptocurrency wallet clients and are responsible for discovering blocks on their own.

Pros:

- Solo mining provides the opportunity for the sole miner to receive the full reward if the new block is successfully verified into the blockchain.

- There is a lower risk of interruptions due to outages, resulting in improved uptime.

- Solo mining eliminates the need to worry about pool timeouts and allows for the configuration of backup pools.

Cons:

- Solo mining requires a significant amount of capital to start and sustain the mining process independently.

- There is a risk of losing out on rewards if other miners with better computational power join the network.

- It may be challenging to match the computational power of a group of miners, limiting potential earnings.

- Investing in popular cryptocurrencies like Bitcoin carries a high risk of capital loss.

Pool Mining

Pool mining refers to a collective of cryptocurrency miners who join forces and combine their computational resources to increase the likelihood of discovering blocks and completing the mining process more efficiently. In a mining pool, members work together, pooling their processing power to find blocks at a faster rate.

Pros:

- Sharing equipment costs, electricity costs, and time to recover costs make it cheaper for all stakeholders.

- Members have the flexibility to adjust their pool mining configurations.

- Regardless of your hashing power, there’s still a chance to mine Bitcoin because profits are distributed according to your contribution ratio.

Cons:

- Pool mining can be challenging due to hash rate variability, network difficulty, and competition from large pools. Additionally, pool providers may present security risks and inequality within the group.

- Participation in mining pools necessitates paying substantial fees as a requirement for joining each pool.

- Currency pools storing ample funds are prone to attracting potential attackers, leading to increased vulnerability to distributed denial-of-service (DDOS) attacks and other security threats.

- The rewards for mining Bitcoin must be shared with many other participants.

Cloud Mining

Cloud mining is a method of mining Bitcoin where individuals can rent cloud computing power instead of having to buy and operate their hardware and software. Companies offering cloud mining services allow people to create an account and participate in Bitcoin mining remotely for a fee. This makes mining more accessible to a wider range of individuals since it eliminates the need to purchase and maintain equipment or pay for direct energy costs.

Pros:

- Cloud mining allows you to avoid the financial responsibility of purchasing expensive equipment and taking care of its maintenance, as those costs are transferred to the owner.

- By leasing equipment or hash rate, cloud mining providers can generate multiple streams of income.

- Cloud mining providers have the potential to reach the break-even point and start making profits much faster compared to mining independently.

- Renting hash power from a mining farm enables you to receive a portion of the farm’s total profits without incurring the associated costs.

Cons

- Numerous cloud mining services are fraudulent schemes that exploit investors, offering high returns but ultimately causing significant financial losses.

- The increasing mining difficulty and the growing number of miners entering the networks to compete for earnings pose a risk of diminishing profits.

- The dominance of certain entities can lead to the centralization of cryptocurrencies.

Is Bitcoin Mining Profitable?

Following the 2024 Bitcoin halving, the mining reward has decreased to 3.125 BTC while the algorithmic difficulty has risen, resulting in a significantly more challenging Bitcoin mining process. This has led miners to upgrade their mining equipment to have a chance at earning Bitcoin.

The profitability of Bitcoin mining is determined by several factors, such as electricity costs, Bitcoin price, mining hardware efficiency, and operational expenses. Given the substantial costs involved, small-scale Bitcoin mining is no longer a profitable venture. Instead, it has become dominated by large mining companies with substantial financial resources.

Furthermore, as more individuals, especially prominent companies and organizations, enter the cryptocurrency mining industry, intense competition arises for the limited supply of Bitcoin. This increased competition, coupled with the potential for the Bitcoin price to remain stagnant or even decline during the predicted cryptocurrency winter, can further diminish the profitability of Bitcoin mining.

Learn more about Bitcoin mining profit: coinminutes.com/learn/is-bitcoin-mining-profitable

The Bottom Line

With the technological advancements in mining rigs and the growing popularity of cryptocurrencies, it has become easier to mine Bitcoin even at home. CoinMinutes has provided detailed steps on how to mine Bitcoin, showing that it was possible to do so in the early days using just a laptop.