What Is Crypto Winter?

Crypto winter refers to a period in which the crypto market experiences a prolonged price decline and investors have little interest in investing. The term is similar to a bear market in the traditional stock market but without a specific number such as a decline of 20% or more.

Many believe this term originated from a line in the TV series Game of Thrones. “The winter is coming” is the Stark family’s slogan in the film used to warn of a prolonged conflict that is about to take place on their land.

Similar to the warning of a prolonged conflict, crypto winter refers to a prolonged gloom in the crypto market and it will take a long time to recover.

Key Takeaways

|

History of Crypto Winter

In history, the crypto winter has recurred three times, with an average duration of about two years.

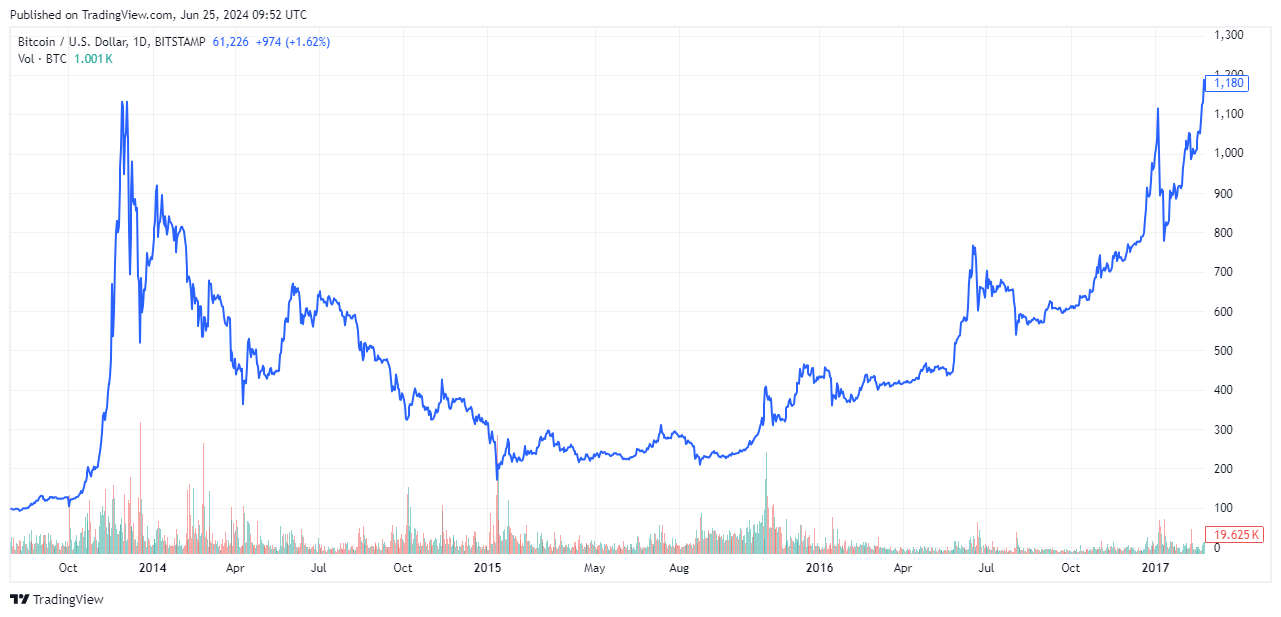

Crypto Winter 2014 – 2015

The first crypto winter began in early 2014 after Bitcoin peaked at around $1,200 in late 2013. At that time, the market was in a recession and the hack of the Bitcoin exchange Mt. Gox, which lost thousands of users’ Bitcoins, caused investors to lose confidence in the market.

The price of Bitcoin gradually fell from $900 in early 2014 to $200 in early 2015. After that, Bitcoin’s price remained in the $200 – $300 range throughout 2015. It only started to recover in mid-2016 when the price surpassed $500 and showed signs of increasing gradually.

Crypto Winter 2018 – 2020

The second cryptocurrency winter occurred after Bitcoin peaked at around $20,000 in 2017. In 2018, the market gradually entered a recession as many crypto ICOs (Initial Coin Offerings) failed and were considered scams. This was also the year that marked the first use of the term “crypto winter.”

The price of Bitcoin dropped to a low of $3,000 in mid-2018. After that, it fluctuated between $3,000 and $11,000 but didn’t reach the peak price seen at the end of 2017. It was not until the last quarter of 2020 that Bitcoin regained its growth momentum and skyrocketed to surpass the old record high.

In addition, the total market capitalization of all cryptocurrencies plummeted from $800 billion at the beginning of 2018 to $100 billion by the end of 2018, and then stabilized at around $200 billion until the end of 2020.

Crypto Winter 2022 – 2023

This is the most recent time that crypto winter occurred. The signs began when Bitcoin peaked at approximately $68,000 at the end of 2021 and began to cool down gradually in 2022.

The reason for this is due to the tightening of crypto regulations from countries as well as the unstable economic situation of countries. In addition, the collapse of one of the largest exchanges FTX along with the collapse of Luna/Terra has caused investors to lose confidence in the market.

Bitcoin has lost nearly 80% of its value since its peak in November 2021. It was not until the end of 2023 that Bitcoin showed signs of positive recovery.

The total market capitalization of crypto has fallen from a peak of $3,057,639,148,576 to below $1 trillion and has remained there for a long time.

Signs of Crypto Winter Coming

From previous crypto winters, we can see that the first and most obvious sign is the decline in the prices of major crypto, specifically Bitcoin and Ethereum. These are the pillars of the crypto market, if they are peaking and showing signs of continuous decline, investors are likely to lose interest.

The second sign is red everywhere and the total market capitalization is decreasing. Because crypto is very volatile, this needs to be observed over a long period, from 3 months or more. If the red color remains continuous for such a long period, the market will fall into a crypto winter.

The third sign is that people will no longer trade crypto actively but will only be waiting and the price of crypto will remain at a certain low level.

In addition, when crypto winter occurs, new crypto projects will become less because investors are no longer interested.

Causes of Crypto Winter

There are several reasons for the crypto winter. Below are some of the reasons that we believe are the main causes.

Security incidents and scams: This is the direct cause that impacts the psychology of investors when exchanges are hacked, go bankrupt, or when crypto projects turn out to be scams, or when there are sudden changes in prices. For example, Mt. Gox in 2014 and FTX in 2022 were hacked, leading to bankruptcy and eroding investor confidence.

Speculative bubble: Because crypto is very volatile, especially Bitcoin, many investors participate to make a profit in a short time, pushing the value of crypto up and then dumping, causing the price to suddenly drop. This occurred between 2018 and 2020 when the cryptocurrency market garnered significant attention from investors. This led to a substantial speculative bubble, causing crypto prices to surge temporarily before dropping to lower levels.

Legal regulations for crypto: Although crypto is not controlled by the government, the authorities can completely issue regulations that are beneficial or unfavorable for it. It was China’s tightening of regulations on crypto that caused a part of investors to leave the market, contributing to the decline of crypto in 2018.

Market psychology and rumors: The crypto community is built on trust, so just a move or rumor from an influencer can cause controversy. This can create panic and mass sell-offs, leading to a rapid decline in the value of cryptocurrencies.

Comparison with Traditional Bear Markets

Similarities:

- Price Decline: Both crypto winters and traditional bear markets involve a sustained decrease in asset prices. In both cases, the market sentiment turns negative, leading to a downward trend in prices.

- Sentiment: Investor sentiment in both scenarios tends to be pessimistic and irrational. Fear and uncertainty dominate the market, causing further price drops as investors rush to sell their assets.

- Duration: Both crypto winters and traditional bear markets can last for a long time.

Differences:

- Volatility: Cryptocurrency markets tend to have higher volatility compared to traditional financial markets. This results in more abrupt and extreme price movements during crypto winters.

- Market Structure: Traditional financial markets have more established institutions and mechanisms for trading and regulation compared to cryptocurrency markets. This can lead to differences in the speed and efficiency of market responses during bearish conditions.

Duration of Crypto Winter

From the past crypto winters, we can conclude that the average duration is 2 years. However, this duration will also be affected by factors such as technology, law, or the world economy.

The Bottom Line

Crypto winter refers to a prolonged period of price decline and low investor interest in the cryptocurrency market, similar to a bear market in traditional finance but without a specific percentage drop.

These periods were driven by various factors such as security incidents, speculative bubbles, regulatory changes, and market psychology.