Buying Bitcoin can be a valuable investment, but its current market value makes it challenging for investors to easily acquire. So, how can you buy this digital currency most cost-effectively? Join CoinMinutes to explore the cheapest ways to buy Bitcoin and optimize your investment in this cryptocurrency.

List of Cheapest Ways to Buy Bitcoin

|

Cheapest Way to Buy Bitcoin

Investors participating in Bitcoin investments often aim to buy BTC at the best and lowest price possible. You can buy Bitcoin in dozens, even hundreds of different places. So, where is the cheapest way to buy Bitcoin?

Using Exchange

Bitcoin exchanges are platforms for buying, selling, and trading cryptocurrencies, offering convenience, high liquidity, and a variety of digital currencies. However, using these exchanges comes with risks such as security, trading fees, price volatility, and legal concerns. Many investors need to carefully consider and choose reputable exchanges to minimize risks and maximize benefits from cryptocurrency trading.

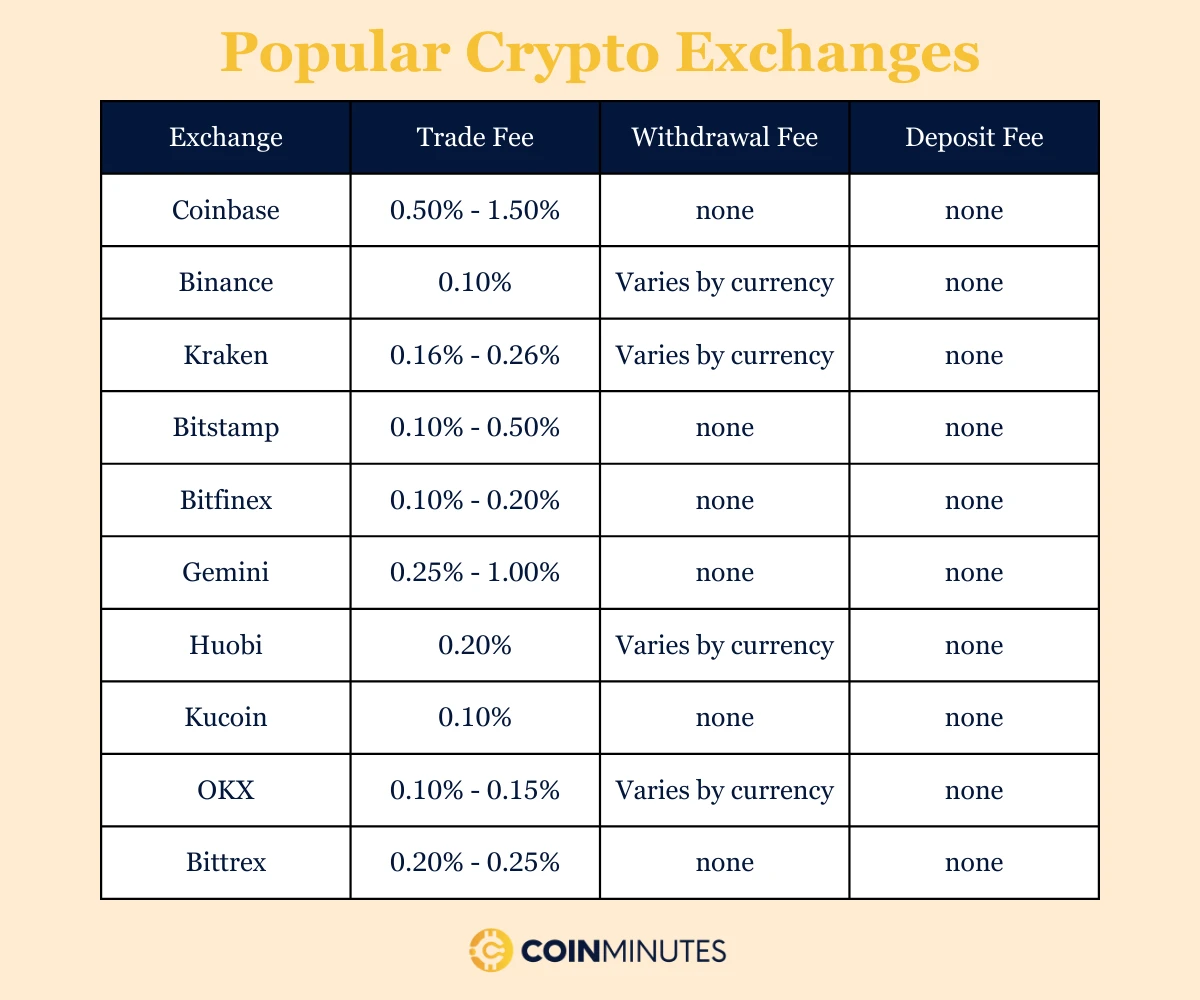

Below is a comparison table of basic trading fees for popular exchanges in the market that you can refer to:

Please note that these numbers are subject to change depending on the type of trade, trading volume, and policies of each exchange. For specific fees, users should refer directly to each exchange’s website for the most detailed and up-to-date information.

Using P2P Platforms

The P2P (Peer-to-Peer) platform is a system that allows investors to directly exchange and trade with each other without the need for traditional intermediaries. P2P transactions often offer flexibility and high reliability, increasing privacy and reducing dependence on centralized exchanges.

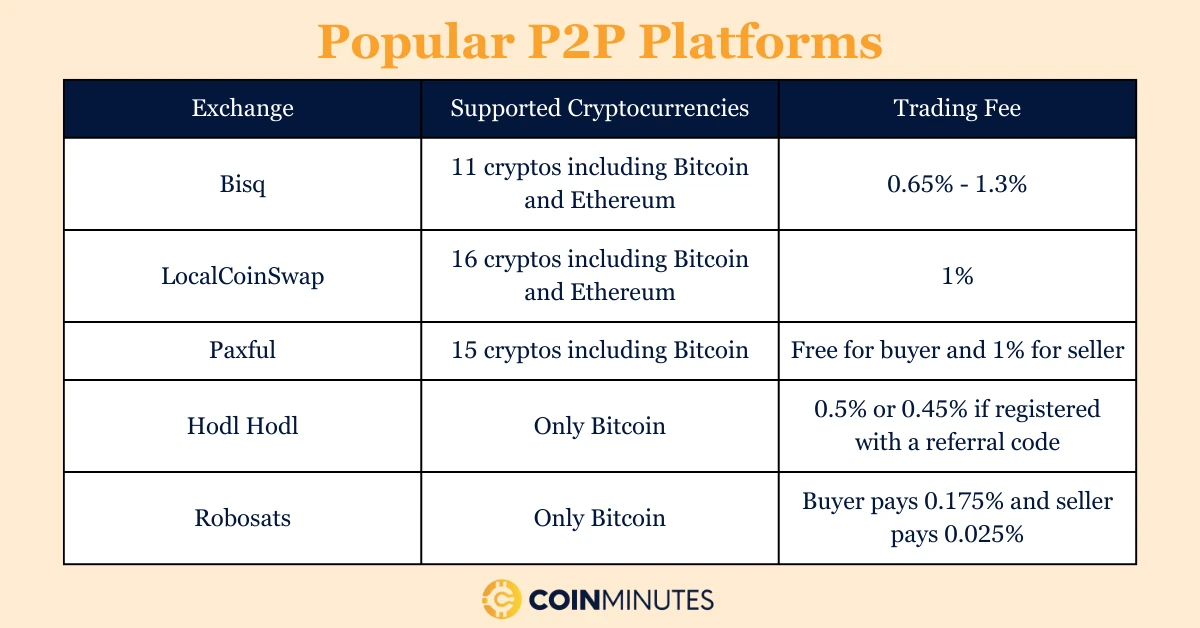

Below are some popular trading platforms that you may consider using:

These P2P exchanges allow users to directly exchange cryptocurrencies with each other without the need for an intermediary exchange, increasing flexibility and ensuring privacy in transactions.

Top 5 Cheapest Ways to Buy Bitcoin

After we’ve explored the exchanges and platforms where you can trade and exchange Bitcoin at a cheaper price, here CoinMinutes will suggest 5 cryptocurrency exchanges for you to buy Bitcoin at the lowest price:

Overview

Binance, founded in 2017 by Changpeng Zhao (CZ), quickly became one of the world’s largest cryptocurrency exchanges. Initially headquartered in China, the company moved its operations overseas due to the country’s regulations.

Binance offers a wide range of tradable cryptocurrencies, advanced market analysis tools, and a user-friendly interface. It also provides services such as staking, lending, and futures trading, with Binance Smart Chain (BSC) supporting decentralized applications (DApps) and smart contracts.

Trading fees on Binance are highly competitive, with a typical fee of 0.1% per transaction, reducible to 0.075% when using Binance Coin (BNB).

Pros

- Supports trading and storage of over 360 cryptocurrencies.

- Provides various trading pairs including BTC, ETH, BNB, and USDT.

- Offers a generous daily withdrawal limit (Binance’s limit for fully verified users is 400% higher than Bybit and Bitget’s maximum limits).

- Accessible globally.

- Competitive trading fees, especially when utilizing BNB (Binance Coin).

- Offers an outstanding mobile application.

Cons

- Customer support may experience occasional delays.

- Centralized, not decentralized.

- Binance US offers limited features.

- Crypto-fiat trading is not supported.

eToro

Overview

Founded in 2007 in Tel Aviv, Israel, eToro has become one of the world’s leading social trading platforms. With its social trading feature, eToro allows users to copy the trades of successful investors, providing support for both beginners and experienced investors.

It has a user-friendly interface, multilingual support, and a high-quality mobile app that enables users to manage and trade their accounts anytime, anywhere.

When purchasing Bitcoin on eToro, you’ll face fees including a spread fee of about 0.75%, a fixed withdrawal fee of $5 per transaction, and an inactivity fee of $10 per month after 12 months of inactivity.

Pros

- Access Bitcoin and various cryptocurrencies with just a 1% purchase fee.

- Start investing with a minimal deposit of just $10.

- Enjoy free deposits and withdrawals for amounts under $30.

- Trade without incurring any commission charges.

- Benefit from social investing tools enabling seamless trade replication from others.

- Rely on a highly regulated and trusted platform for your investments.

- Has a mobile app

Cons

- Not accessible in remote areas.

- While robust, its cryptocurrency selection may lag behind some competitors.

Coinbase

Coinbase was founded in 2012 in San Francisco, California, quickly becoming one of the world’s leading cryptocurrency exchanges.

Providing a range of cryptocurrency products and services from exchanges to wallets and professional trading platforms, it’s a popular choice for both beginners and experienced investors thanks to its user-friendly interface. Alongside this is its high security and wide-ranging regulatory approval, creating a safe and trustworthy trading environment.

The fee for buying Bitcoin on Coinbase ranges from 1.49% to 3.99%, depending on your payment method and country.

Pros

- The widest selection of cryptocurrencies in the United States with over 170 options available.

- An easy-to-use interface for newcomers to engage in cryptocurrency trading.

- Start with small trade sizes to test before committing larger capital amounts.

- Enjoy low transaction fees for your trades.

- Has a mobile app

Pros

- While fees are competitive, they may not be as low as some competitors in the US.

- Unfortunately, it’s not suitable for users in remote regions without access to popular payment methods.

Bitstamp

Overview

Bitstamp, established in 2011, is one of the pioneering cryptocurrency exchanges, renowned for its longevity in the market.

Some standout features of the Bitstamp platform include providing a user-friendly trading experience, with a particular emphasis on using stringent protocols to protect user data and accounts. Furthermore, Bitstamp sets itself apart with its 24/7 customer support service, ensuring that users receive timely and effective assistance whenever needed.

You won’t incur any trading fees if your trading volume is below $1,000 within a rolling 30-day period. Beyond that threshold, fees begin at 0.4% and decrease as your trading volume increases. Staking carries a 15% charge, while withdrawals are subject to a flat $3 fee.

Pros

- Enjoy low trading fees with no spreads.

- Support various types of fiat currencies from USD, EUR, GBP, CHF,… and some other currencies.

- Platform regulated by CSSF.

Cons

- Limited coin selection.

- Significant fees are applied to deposits and withdrawals.

- Liquidity has been impacted by the restricted coin options, with the majority of liquidity focused on top cryptocurrencies such as Bitcoin and Ethereum.

KuCoin

KuCoin was established in 2017 in Seychelles. It’s one of the rapidly growing cryptocurrency exchanges, aiming to provide a comprehensive and convenient trading platform for users worldwide.

It offers over 200 cryptocurrencies for trading, catering to both popular tokens and emerging projects. The platform features a user-friendly interface, suitable for both beginners and experienced traders. Additionally, KuCoin prioritizes security and safety, implementing advanced measures to protect user data and accounts, including two-factor authentication.

Trading fees on KuCoin follow a sliding scale. For trading volumes below 50 BTC in 30 days, fees are 0.1%. Discounts are offered if fees are paid in KCS or if you store over 1000 KCS in your account.

Pros

- Anonymous trading allows for withdrawals of up to 2 BTC every 24 hours.

- A diverse selection of cryptocurrencies is available.

- Deposit transactions are fee-free.

Cons

- Low trading volumes may not be conducive for large-scale traders.

- Not available to US customers.

- Delays and lags may occur during peak traffic periods.

How to Buy Bitcoin Cheaply?

In addition to buying Bitcoin at lower prices on the exchanges listed by CoinMinutes, traders can also buy Bitcoin at lower prices through the following methods:

- Peer-to-Peer (P2P) Brokerage Services: Platforms like LocalBitcoins, Paxful, or Bisq enable direct Bitcoin purchases from sellers, bypassing intermediary exchanges, helping to reduce fees and offer more flexibility for you.

- Join local communities: Participating in local Bitcoin and cryptocurrency communities can help you find sellers offering Bitcoin at better prices.

- Use cryptocurrency swap services: Cryptocurrency swap services like Changelly or ShapeShift allow you to exchange one type of cryptocurrency (such as Ethereum or Litecoin) for Bitcoin.

- Buy Bitcoin in Bulk: If you intend to purchase a large quantity of Bitcoin, consider negotiating with exchanges or direct sellers to discuss pricing and transaction fees. Typically, buying in bulk can result in favorable pricing and better trading terms.

Why Is the Price of Bitcoin Different on Different Platforms?

The price of Bitcoin varies across exchanges due to several factors including liquidity, market demand, regulations, exchange fees, and market size. Each exchange operates under different conditions leading to price discrepancies. Geographic location, trading costs, and associated fees also play a role in these differences.

Additionally, market sentiment and news can affect Bitcoin prices differently across regions and platforms. Traders often take advantage of these price fluctuations through arbitrage, buying Bitcoin on exchanges with lower prices and selling it on those with higher prices, helping to balance prices across exchanges but not significantly.

The Bottom Line

To uncover the cheapest ways to buy Bitcoin, investors need to explore both traditional exchanges and peer-to-peer platforms. By comparing fees, liquidity, security, and user experience, investors can make informed decisions to optimize their purchases while ensuring cost-effectiveness and security.