Built on the foundation of blockchain technology, Bitcoin and Ethereum have become the two most popular cryptocurrencies today.

While Bitcoin boasts a market capitalization significantly larger than Ethereum, the latter possesses the potential to compete with Bitcoin in terms of prospects. Let’s decode the difference between Bitcoin vs Ethereum.

Key Takeaways

|

Bitcoin vs Ethereum: Overview

Many experts believe that Ethereum is a Blockchain network that supports the growth of decentralized applications. While Bitcoin has always been built and oriented to function as a payment network. So, what is the essence of these two currencies?

What Is Bitcoin?

Bitcoin (BTC) is a type of cryptocurrency created in 2009 by an individual or a group of programmers under the pseudonym Satoshi Nakamoto. Bitcoin is designed as a payment method beyond the control of any individual, group, or organization, thereby eliminating the need for third-party involvement in financial transactions.

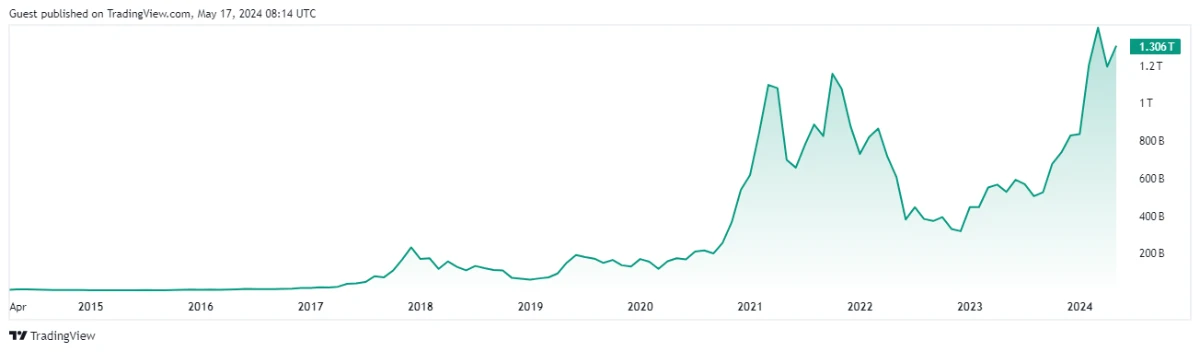

After 15 years, Bitcoin has become the largest cryptocurrency by market capitalization, reaching $1,322.98 billion. The current price of Bitcoin is $62,983.61 per BTC.[1] Following the Bitcoin halving event that took place in April, investors expect BTC to soon establish a new all-time high.

What Is Ethereum?

Ethereum is an open-source, public, and permissionless blockchain platform.[2] Ethereum’s blockchain network operates as a global, decentralized supercomputer with hundreds of thousands of devices connected worldwide to maintain its computational state.

To be more specific, instead of relying on a centralized server system like Google (a centralized system), Ethereum enables decentralized applications to run on a network of individual computers (a decentralized system). Thus, anyone can utilize this decentralized network to create and operate decentralized applications without the need for permission or registration with any third party, as there are no intermediaries involved.

This platform was created in 2013 by a Canadian-Russian programmer named Vitalik Buterin and several other cryptocurrency entrepreneurs, some of whom were previously involved in Bitcoin activities.

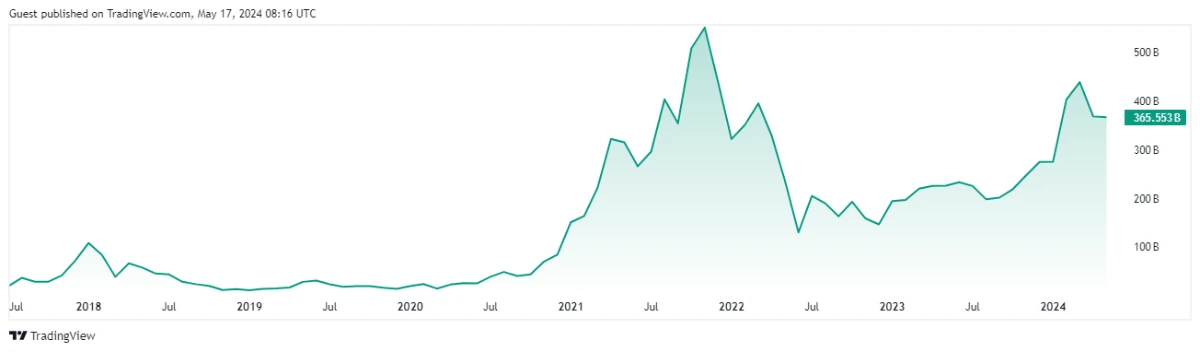

As of May 13, 2024, the current price of Ether (the native cryptocurrency associated with Ethereum) is $2,963.47 per ETH/USD, with a market capitalization of USD 355,870 billion.[3]

Bitcoin vs Ethereum: Differences

While both the Bitcoin and Ethereum networks are built on the principles of distributed ledgers and cryptography, they differ in several ways:

Technology

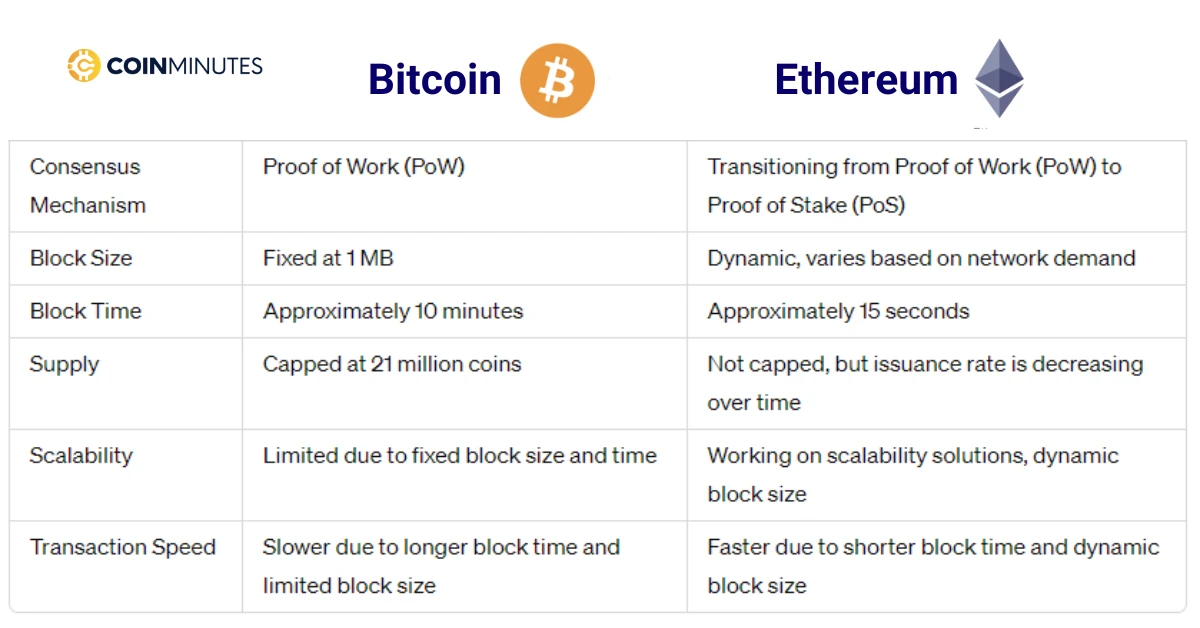

Consensus Mechanism

- Bitcoin relies on Proof of Work (PoW), where miners compete with complex math problems to validate transactions and add them to the blockchain.

- Ethereum is in the process of transitioning from Proof of Work to Proof of Stake (PoS). Proof of Stake doesn’t require miners; instead, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

Block size and time

- Bitcoin has a fixed block time of 10 minutes and a block size of 1 MB, which limits the number of transactions that can be processed per block.

- Ethereum’s block size varies dynamically based on network demand. It’s around 15-20 KB, allowing for more transactions per block. Moreover, Ethereum’s block time is approximately 15 seconds. This means Ethereum can process transactions much faster than Bitcoin.

Supply

- Bitcoin has a capped supply of 21 million coins. This scarcity is built into its protocol as a mechanism to maintain its value.

- Ethereum’s supply is limitless, but the rate of new issuance is decreasing over time.

Scalability and Transaction Speeds

Scalability

- Bitcoin faces scalability challenges due to its limited block size (1 MB) and fixed block time (approximately 10 minutes). This limits the number of transactions the network can process per second.

- Ethereum has been working on solutions to improve scalability. Its block size is dynamic, and its block time is much shorter (around 15 seconds), allowing for more transactions to be processed per second compared to Bitcoin.

Transaction Speed

- Bitcoin’s transaction speed is slower due to its longer block time and limited block size. Transactions can take several hours to be confirmed, especially during periods of high network activity.

- Ethereum’s shorter block time and more flexible block size contribute to faster transaction speeds. Transactions on the Ethereum network typically confirm within seconds, making it more suitable for applications requiring faster transaction times, such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

Use Cases

Bitcoin primarily serves as a payment network, enabling the transfer of value between each individual anywhere in the world. Additionally, Bitcoin is increasingly recognized as one of the most valuable investment assets today.

On the other hand, Ethereum aims to establish infrastructure for a decentralized internet network that isn’t controlled by any single authority. Ethereum’s major focus currently lies in decentralized finance (DeFi) – a term encompassing traditional financial products like loans or mortgages, but built on blockchain technology. In this scenario, the blockchain replaces intermediaries – from banks to governments – and oversees all aspects of transactions.

In essence, while Bitcoin facilitates peer-to-peer transactions and serves as a store of value, Ethereum is carving out a niche in decentralized finance, revolutionizing traditional financial services through blockchain technology.

Investment Potential

As the top two cryptocurrencies in the market, Bitcoin and Ethereum continue to stand out as highly promising investments for the future.

- For those with a risk appetite, Bitcoin is undoubtedly the go-to choice. Its growth potential stems from its utility in non-cash payments, limited supply, and benefits from geopolitical and economic instability. Despite the emergence of alternative cryptocurrencies, Bitcoin remains the most widely accepted and used digital currency, making its growth prospects promising. This is evidenced by major companies like Tesla, Grayscale Investments, and MicroStrategy choosing to invest in Bitcoin.

However, Bitcoin’s value is subject to unlimited price volatility, which means asset values can fluctuate significantly in the short term, making profit realization challenging.

- Ethereum, on the other hand, is not an investment asset with high volatility as sudden as Bitcoin’s. Unlike Bitcoin, which has many fixed attributes (such as its supply) established from inception, the Ethereum platform is still evolving with promising updates expected to enhance its system. Moreover, regulatory changes could potentially decrease the supply of Ethereum, leading to an increase in its price.

Therefore, this investment avenue is more suitable for investors with a preference for a safer approach.

In summary, while Bitcoin offers potentially high returns with heightened risk, Ethereum provides a more stable investment option with promising long-term growth prospects. Investors should consider their risk tolerance and investment goals carefully when choosing between the two.

The Bottom Line

In short, Bitcoin is like digital gold, prized for its reliability and used for transactions worldwide. Ethereum, on the other hand, is more like a digital infrastructure, powering decentralized finance and innovative applications. Knowing the difference between Bitcoin and Ethereum helps investors navigate the ever-changing world of cryptocurrencies wisely.