Filing Bitcoin taxes is the responsibility of every individual engaging in cryptocurrency investments. Additionally, tax regulations regarding Bitcoin vary across different countries. Let’s understand more about Bitcoin taxes in this article.

Key Takeaways

|

How Are Bitcoin Taxed?

Taxing Bitcoin is necessary because it is viewed as an asset similar to a property rather than a traditional currency as stated and classified by the IRS.[1] This approach ensures consistency in tax treatment across different asset classes and regulates transactions involving Bitcoin according to existing tax laws.

Taxpayers in the United States are required to report Bitcoin transactions for tax purposes. Retail transactions using Bitcoin, such as buying or selling goods, are also subject to capital gains tax.

The ways Bitcoin is taxed through the following:

Mining

Income and storage generated through cryptocurrency mining are taxed as regular income. However, if you purchase and hold cryptocurrency for more than a year before selling it, the tax shifts to capital gains (or losses).

For example, if you mine Bitcoin, you are responsible for paying income tax on that amount for that year. Subsequently, if you hold Bitcoin for over a year and exchange it for dollars with a profit compared to its market value at the time of mining, you will be subject to capital gains tax.

Selling

Selling Bitcoin may be subject to taxation depending on the tax regulations of your resident country. For instance, in countries like the United States, Canada, Australia, and the United Kingdom, individual income tax is applied to Bitcoin transactions, typically ranging from 0% to 45%, depending on income and holding period.

Some countries have specific regulations regarding reporting Bitcoin transactions and incurred taxes. Before selling Bitcoin, it’s advisable to seek advice from a tax expert or financial advisor better to understand the applicable tax implications in your specific case and to ensure compliance with relevant laws and regulations.

Buying

When purchasing Bitcoin, tax issues depend on subsequent activities. You may face taxes on purchases/sales and other transaction fees. Profits from trading may be subject to capital gains tax if you hold Bitcoin for over a year before selling.

Additionally, taxes may apply to income from lending Bitcoin or participating in DeFi. Inheritance tax regulations should also be considered when transferring Bitcoin to beneficiaries.

However, tax regulations vary by jurisdiction, so seeking advice from tax experts is necessary to understand and comply with rules accurately.

Trading

You’re liable for cryptocurrency taxes when you sell or utilize your crypto in a transaction, provided its value has increased since acquisition, thus incurring capital gains or losses reflecting market value changes.

Crypto received as payment for business purposes is subject to taxation as business income. Any cryptocurrency mined or earned for work completed on a blockchain is taxed as ordinary income.

How to Calculate Bitcoin Taxes?

With regulations on income tax for cryptocurrency transfers in the Budget 2022, all income from such transactions will be subject to a 30% tax rate.

Transactions across multiple exchanges and wallets create complexity in tax calculations. Therefore, using accounting software becomes necessary to handle these transactions. The software is designed to generate capital gains reports and holding reports, aiding in more comprehensive tax management.

The main steps in using the software include the following:

- Importing transactions such as deposits, withdrawals, and trades from various exchanges and wallets.

- Automated recognition of transaction types including deposits, withdrawals, staking income, and trades.

- Categorization of pending entries for organization and clarity.

- Verification of closing balances to align actual holdings with recorded data.

Additionally, calculating Bitcoin taxes can also be done manually by recording transactions, determining purchase prices, and calculating profits or losses from each transaction. Then, report the transactions on your tax return and pay the appropriate taxes.

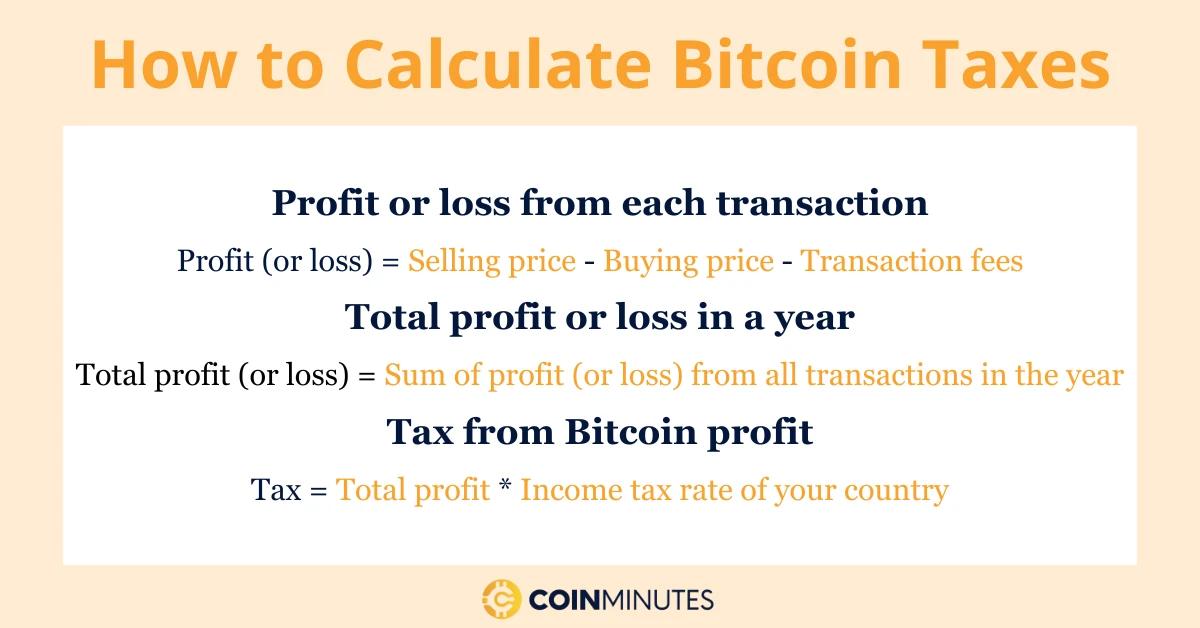

Some basic calculation formulas that can be mentioned include:

- Calculate profit or loss from each transaction: Profit (or loss) = Selling price – Buying price – Transaction fees

- Calculate total profit or loss in a year: Total profit (or loss) = Sum of profit (or loss) from all transactions in the year.

- Calculate tax from Bitcoin profit: Tax = Total profit * Income tax rate of your country.

Remember that the formulas and methods for calculating taxes may vary depending on the tax regulations of your country. So it’s always advisable to seek advice from a tax expert or accountant.

How to File Bitcoin Taxes?

Maintaining organized records throughout the year is vital to ensure accurate tax reporting, especially for cryptocurrency users. Each transaction requires meticulous logging of the expenditure amount and its corresponding market value at the time of utilization, facilitating seamless tax preparation. It’s noteworthy that cryptocurrency brokers and exchanges are mandated to issue 1099 forms to clients for the ongoing tax year.

When it comes to reporting cryptocurrency capital gains and losses, they’re treated akin to other capital assets and are disclosed on IRS Form 8949, Sales and Dispositions of Capital Assets. Manual record-keeping is an option, but leveraging blockchain solutions like CoinTracker can streamline data tracking and organization, offering comprehensive transaction and portfolio management alongside cryptocurrency tax information access.

For individuals unsure about navigating cryptocurrency tax implications, consulting with a certified accountant, especially for first-time filers is advisable.

Where Is Bitcoin Taxed?

Bitcoin taxation varies widely across different jurisdictions. Here are some examples of countries with differing policies:

United States

In the United States, regulations dictate that for Bitcoin held for one year or less, selling it incurs higher tax rates, ranging from 10% to 37%. Ownership exceeding one year qualifies for rates ranging from 0% to 20%.

Tax rates correlate with total annual income, with higher rates applicable to individuals with larger incomes.

United Kingdom

In the United Kingdom, income from cryptocurrency exceeding the £6,000 tax-free allowance is subject to tax rates of 10% or 20%.

Additionally, supplementary income from cryptocurrency beyond the personal allowance incurs tax rates ranging from 20% to 45%. The exact amount owed depends on the specific transaction, applicable tax, and the Income Tax band applicable to you.

Starting from the 2023-2024 financial year, the tax-free allowance for capital gains has been reduced from £12,300 to £6,000. This allowance halves once more in April 2024 to £3,000.

European Union

Calculating Bitcoin taxes in European countries typically involves a fixed tax rate of 0% for capital gains under €600 or gains made from holding cryptocurrency for over a year. This measure was introduced and implemented in May 2022.

As a result, individuals holding cryptocurrency, in general, and Bitcoin specifically, for more than six months, will be subject to a 25% tax on the capital gains derived from them.

Canada

In Canada, there are no separate short- or long-term capital gains tax rates for cryptocurrency. Instead, crypto capital gains are taxed at the same rate as Federal Income Tax and Provincial Income Tax. However, individuals are only taxed on 50% of their total capital gains, while professional (day) traders will be taxed on 100%.

Japan

Japan classifies crypto earnings exceeding 200,000 JPY as “miscellaneous income,” subjecting them to taxation at rates of up to 55%. This includes profits from cryptocurrency trading, Bitcoin mining, and DeFi lending for permanent residents. Comparatively, Japan taxes stock profits at a flat rate of 20%, making its crypto tax rates relatively high.

Additionally, Japanese taxpayers must pay a 10% inhabitant tax on profits, consisting of prefectural and municipal rates of 4% and 6%, respectively. Consequently, the effective crypto tax rate in Japan varies between 15% and 55%. Non-permanent residents in Japan face a flat 20% tax on all income earned in the country.

The Bottom Line

Navigating the complexities of Bitcoin taxes is essential for financial planning and compliance. Whether you’re a seasoned investor or new to the cryptocurrency space, understanding the significance of Bitcoin taxes can help you make informed decisions. Consulting with tax experts and staying updated on regulatory changes will ensure you’re prepared to fulfill your tax obligations while maximizing your financial strategies.