What Is Bitcoin Halving?

Bitcoin halving is an event that reduces the BTC reward for miners by half every four years (210,000 blocks mined).

Originally, miners were rewarded with 50 BTC for each block they successfully mined. This reward was halved over time, decreasing to 25 BTC, then 12.5 BTC, and later 6.25 BTC. After the 2024 halving event, the mining reward has decreased to 3,125 BTC.

Bitcoin halving is a method created by Satoshi Nakamoto to slow down the creation of new Bitcoins. This keeps the supply of Bitcoins limited, preventing inflation.

Read more: How many Bitcoins are left to mine

Key Takeaways

|

History of Bitcoin Halving

Since its inception in 2009, Bitcoin has undergone four halving events.

| How many Bitcoin halvings are left?

There will be 29 Bitcoin halving events left. The final Bitcoin halving is expected to occur in the year 2140. This will be the last halving event, after which the number of Bitcoins issued per block will be so small that it will round down to zero. The total number of Bitcoins in circulation will reach the maximum supply limit of 21 million. |

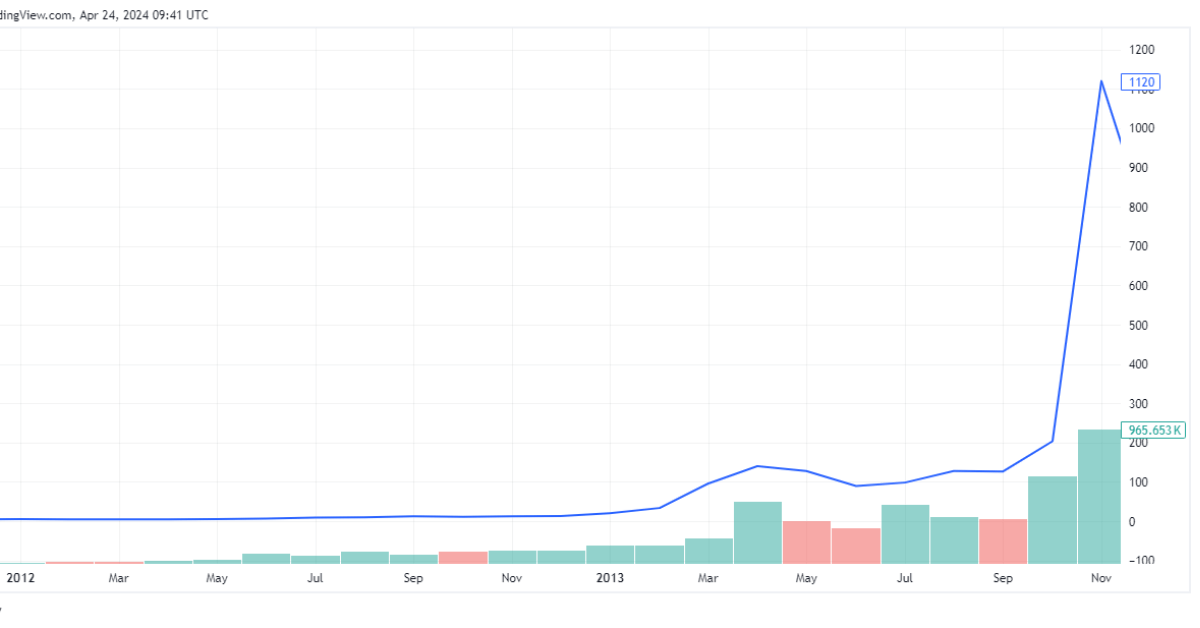

First Bitcoin Halving

The first Bitcoin halving event took place on November 28, 2012, at which point 10.5 million BTC had already been introduced into circulation.

Thanks to the first halving event along with other events, the price of Bitcoin increased from $12 to a peak of $1120 on November 28, 2013.

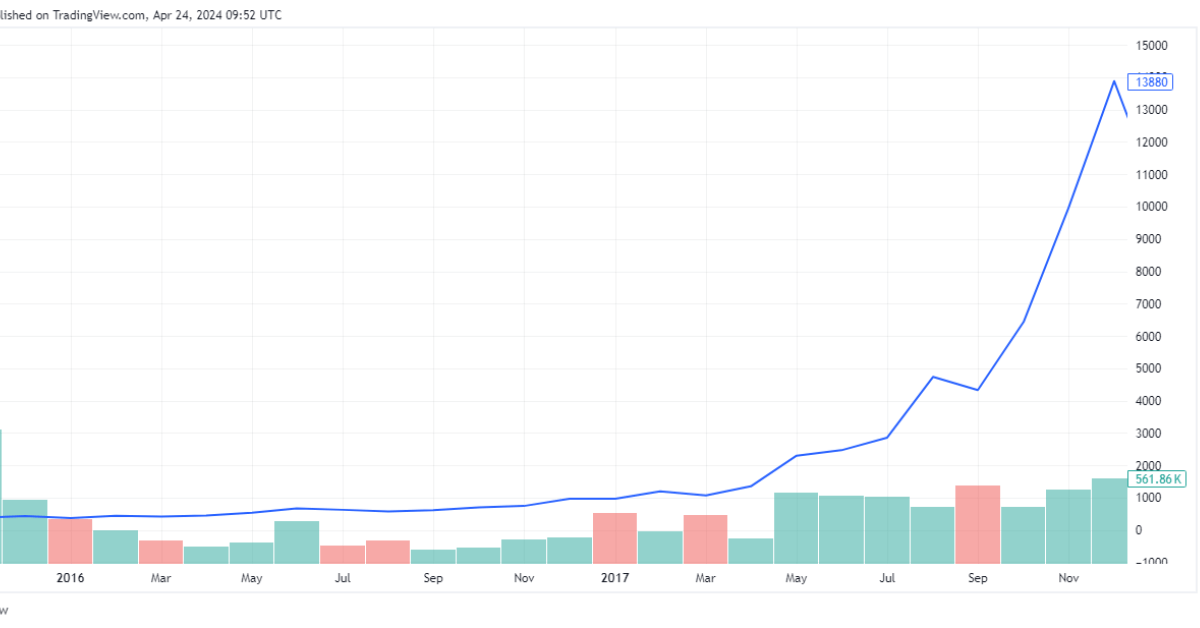

Second Halving Event

Bitcoin’s second halving took place on July 9, 2016, reducing the block reward from 25 BTC to 12.5 BTC.

After the second Bitcoin halving, Bitcoin entered a bull market phase, with its price rising from $643 to $13,884 on December 17, 2017.

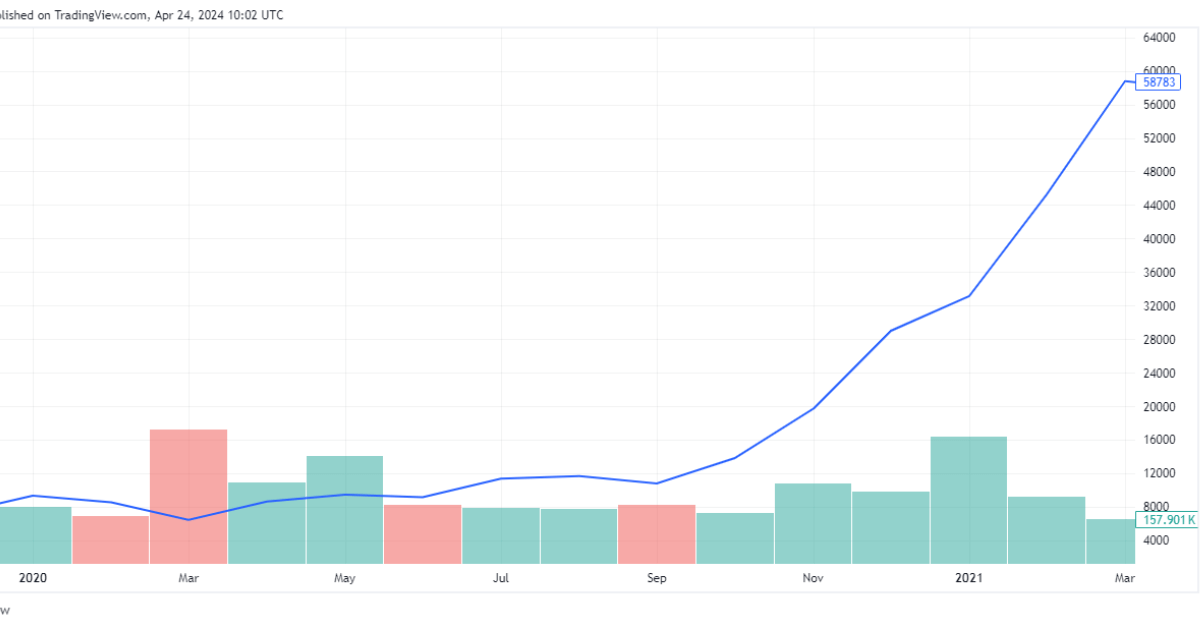

Third Halving Event

Bitcoin’s third halving occurred on May 11, 2020, with the block reward reduced to 6.125 BTC.

Similar to previous halvings, the price of BTC saw significant growth, reaching a peak of $58,783. During this period, Bitcoin’s market capitalization surpassed $1 trillion for the first time, a remarkable milestone after 12 years of development.

Read more: Bitcoin’s price history

Fourth Halving Event

Bitcoin’s fourth halving occurred on April 20, 2024, with the block reward reduced to 3.125 Bitcoin.

Contrary to many predictions, the price of Bitcoin remained relatively stable during the event, hovering around $63,700 per unit. BTC hasn’t experienced any significant price surges lately. On April 19th, the price dropped to a low of $59,685 before quickly rebounding back above $65,000.

Commonly, it takes a few months after the event for Bitcoin’s price to experience a significant jump because the reduced mining rewards take time to filter into the market. In the previous three halving events, it took an average of about five months for the cryptocurrency to increase in price and sustain that upward trend for around seven months.

| When is the next Bitcoin halving?

The exact timing of the next halving event depends on the speed of Bitcoin mining. However, we can be sure that it will take place in 2028. |

Will BTC Go Up after Halving?

Bitcoin has experienced three halvings before the one in 2024, and they all share a common pattern of driving up the price of Bitcoin.

This trend is easily explained by the principle of supply and demand, as demand for Bitcoin increases while the supply is reduced. As a result, the price of Bitcoin rises due to the scarcity of available coins.

While there is no guarantee of price appreciation following a halving, historical data indicates that Bitcoin prices tend to increase following certain events.

Note that price movements can be influenced by various factors, including market sentiment, investor behavior, regulatory developments, macroeconomic trends, and technological advancements.

Additionally, the impact of each halving event can differ, and it is common to observe short-term price fluctuations both before and after the event.

The narrative surrounding each halving event can also influence market sentiment and investor behavior. Media coverage, analyst reports, and public discourse often shape perceptions of Bitcoin’s prospects, impacting buying and selling decisions.

What Happens to the Crypto Market After Bitcoin Halving?

Bitcoin halving events primarily affect the cryptocurrency’s supply dynamics, but they also have significant implications for the performance of altcoins. Altcoins frequently display price movements that correlate with those of Bitcoin. Consequently, many traders and investors closely observe Bitcoin’s price behavior during halving events as an indicator of potential movements in altcoin markets.

How Will Bitcoin Halving Affect Miners?

Bitcoin halving reduces the reward for each block mined and increases the difficulty, forcing miners to upgrade their mining rigs if they want to have a chance to receive rewards.

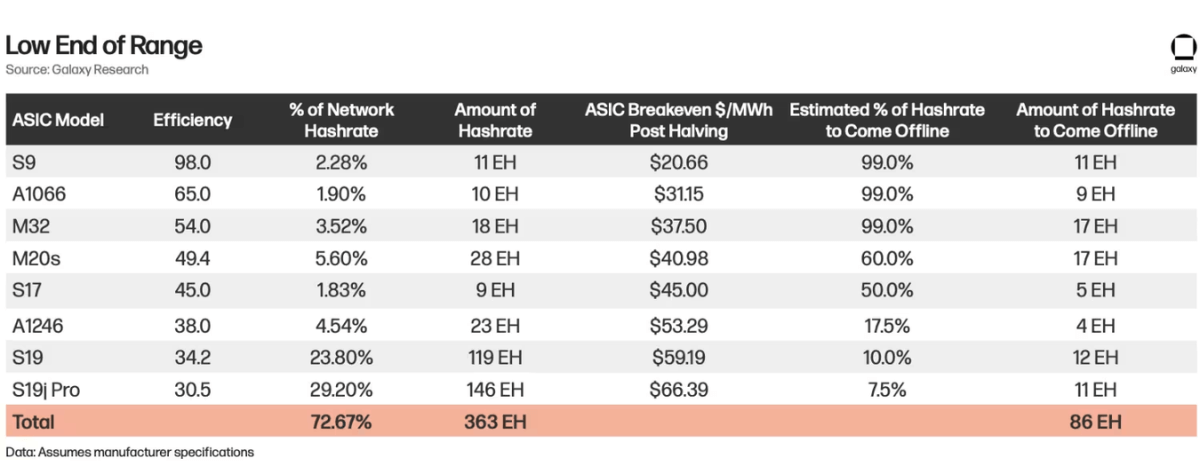

According to an analysis from Galaxy, older mining rigs like Bitmain’s S9, Canaan’s A1066, and MicroBT’s M32 might go offline, this transition paves the way for more efficient machines such as the S19j Pro to take their place, ensuring profitability and sustainability.

Moreover, addressing power consumption is crucial for miners. To maintain stable gross profit margins post-halving, miners need machines that consume electricity at $0.05/kWh. This challenge encourages innovation and the adoption of more energy-efficient solutions, driving the industry towards greater efficiency and resilience.

Should You Buy Bitcoin after the Halving Event in 2024?

The general trend of Bitcoin price is to increase after halving, this has been proven through the Bitcoin price after previous halving events mentioned above. Investors see halving events as milestones within a cycle. The price of BTC typically experiences significant fluctuations after halving. This is considered a good opportunity for investors to enter the Bitcoin market.

However, following the fourth halving event on April 20th, BTC has remained relatively stable, showing little reaction. Experts believe that investors remain in a wait-and-see mode, carefully evaluating market trends.

The Bottom Line

Bitcoin halving is an event that reduces mining rewards by 50%. It was added to the root of Bitcoin by Satoshi Nakamoto to ensure scarcity and avoid inflation.

Initially, the Bitcoin mining reward was 50 BTC per block. After four halvings, this reward has decreased to 3.125 BTC per block. The final halving event is anticipated to occur in 2140.

Bitcoin halving events present a noteworthy opportunity for investors, as they are often accompanied by significant changes in Bitcoin’s price, with a tendency for substantial increases. On the contrary, Bitcoin miners have to find ways to upgrade their mining rigs to make a profit.