As the digital economy continues to evolve, Bitcoin has emerged as a prominent asset class, capturing the attention of investors worldwide.

However, for many investors, direct participation in Bitcoin trading may seem daunting due to its inherent volatility and regulatory uncertainties.

Hence, Bitcoin Futures ETFs have been introduced to address this issue. So, what are Bitcoin Futures ETFs, how do they work, and what are their potential implications? Let’s join Coinminutes in exploring Bitcoin Futures ETFs.

Key Takeaways:

|

What Is Bitcoin Futures ETF?

A Bitcoin Futures ETF is an exchange-traded fund that enables investors to indirectly engage with the Bitcoin market. Instead of purchasing Bitcoin directly, this Bitcoin ETF invests in Bitcoin futures.

So what are Bitcoin futures? Bitcoin futures are agreements to buy or sell Bitcoin at a predetermined price at a specified future date, allowing investors to speculate on the future price movements of Bitcoin without directly owning the cryptocurrency.

An important point to note is the prices of these contracts can differ from the actual Bitcoin market price, depending on investors’ expectations. If many investors anticipate Bitcoin’s price to rise, the contract’s value may exceed Bitcoin’s real market price. Conversely, if more investors bet on Bitcoin’s price to fall, the futures contract’s value could be lower than the market price.

How Does Bitcoin Futures ETF Work?

When investors buy and sell Bitcoin futures contracts, they’re essentially making educated guesses about the future price movements of Bitcoin. It’s like placing bets on whether the price of Bitcoin will rise or fall over time. These contracts involve two parties: one party speculates that Bitcoin’s price will increase, while the other believes it will decrease. If the price moves in favor of one party, the other pays a cash settlement.

However, futures contracts have expiration dates. To maintain consistent exposure to Bitcoin’s price movements, the ETF periodically “rolls over” its futures contracts. This means selling contracts that are about to expire and purchasing new contracts with later expiration dates. The timing and strategy of these rollovers are crucial, especially during periods of contango (when future prices exceed spot prices) or backwardation (when future prices are below spot prices) in the futures market.

Like all ETFs, Bitcoin futures ETFs come with management fees. These fees cover the operational and administrative costs associated with running the fund. Investors should pay attention to the fee structure, as it can impact overall returns.

Additionally, Bitcoin futures ETFs are subject to regulatory oversight. Before these financial products can be offered to the public, regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States need to evaluate and approve them. This regulatory process ensures investor protection and market integrity.

As of now, there are several Bitcoin futures ETFs available in the US market, each subject to regulatory scrutiny and compliance.

History of Bitcoin Futures ETF

As Bitcoin gained popularity and its value soared, many investors wanted to get in on the action. However, they were worried about the wild swings in its price. That’s where Bitcoin futures came in handy. They were introduced to allow people to invest and trade Bitcoin more conveniently while offering a means to safeguard against extreme price fluctuations.

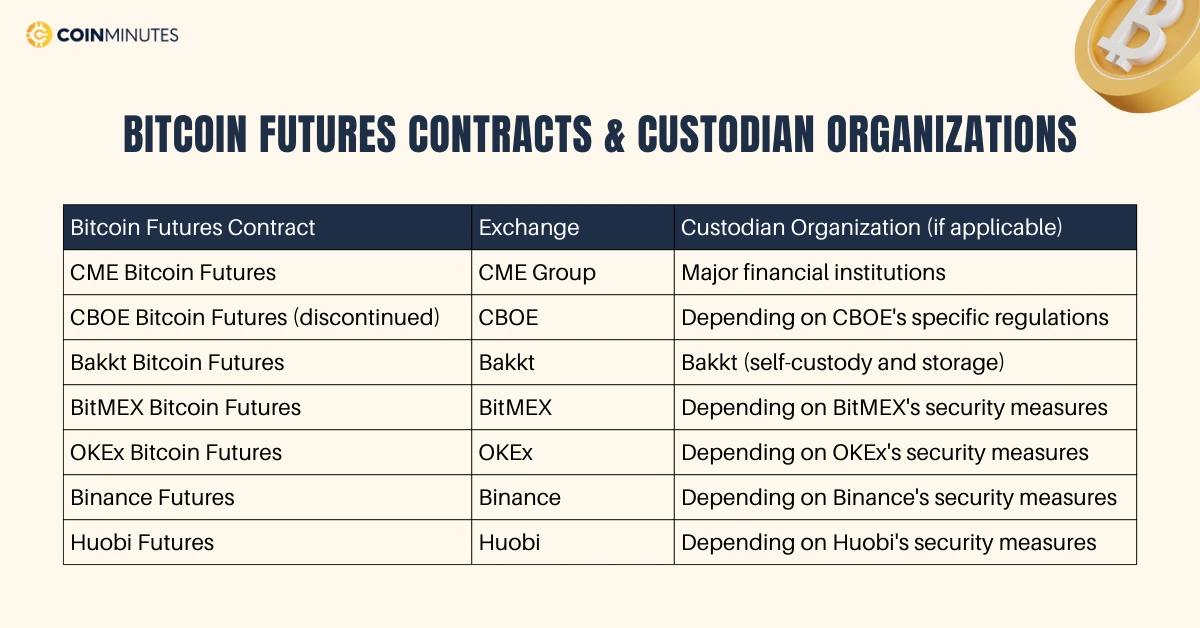

CME Group Inc., a major commodities and financial services exchange, was the first to apply for Bitcoin Futures licensing in December 2017.[1] They received approval from the Commodity Futures Trading Commission’s (CFTC) Division of Market Oversight that same month.[2] The first approved Bitcoin future was the Bitcoin futures listed on the CME (Chicago Mercantile Exchange), launched on December 17, 2017.

On the other hand, since 2017, the cryptocurrency market has witnessed significant development in Bitcoin futures contracts, created to meet the needs of investors looking to participate in this market without directly owning Bitcoin. Here are some notable Bitcoin futures:

Why You Should Invest in Bitcoin Futures ETF

Not only serving as a means to trade Bitcoin, Bitcoin Futures also offer a wide range of notable benefits for investors and businesses alike. Let’s delve deeper into the opportunities that Bitcoin Futures bring and the reasons why one should invest in a Bitcoin Futures ETF.

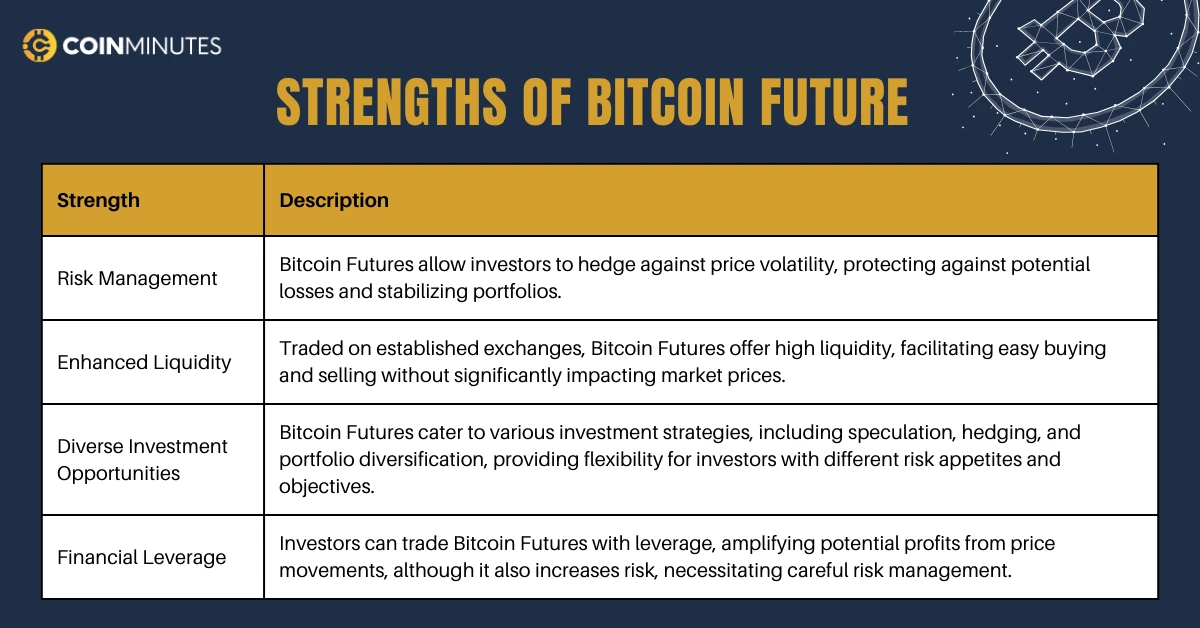

Bitcoin Futures serve as a valuable tool for risk management. Through futures contracts, investors can hedge against Bitcoin’s price volatility, shielding themselves from potential losses and promoting portfolio stability amid market fluctuations.

Additionally, these futures contracts benefit from high liquidity, as they are traded on established exchanges. This liquidity ensures seamless buying and selling without significantly impacting market prices, enhancing overall market efficiency.

Moreover, Bitcoin Futures offer diverse investment opportunities, catering to various strategies such as speculation, hedging, and portfolio diversification.

With these advantages, investing in Bitcoin futures contracts is not only a promising opportunity but also an essential component in building and safeguarding investment portfolios.

However, investors must approach trading with financial leverage cautiously. While leverage can amplify potential profits from price movements, it also escalates risks, necessitating careful risk management considerations.

Bitcoin Futures ETF Drawbacks

Bitcoin Futures ETFs have emerged as a popular avenue for investors seeking exposure to the crypto market without directly holding the underlying asset. However, there are several significant drawbacks that investors should consider before diving in.

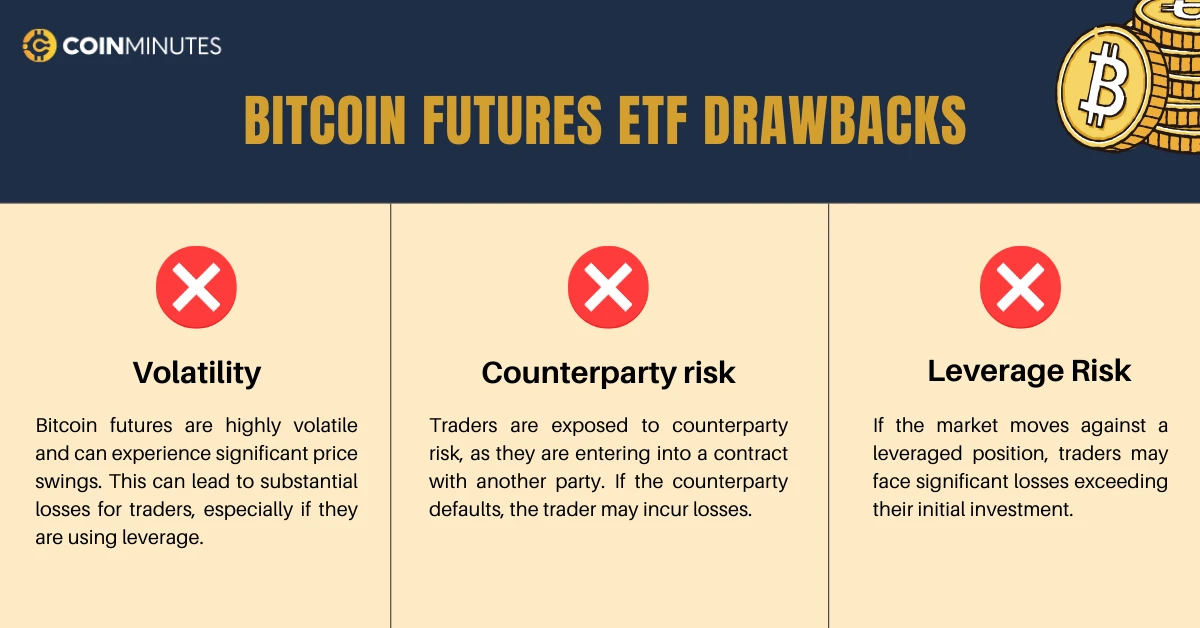

- Volatility: Bitcoin futures are highly volatile, meaning their prices can change rapidly and unpredictably. This volatility can result in significant gains but also substantial losses for traders, particularly if they’re using leverage to amplify their positions.

- Counterparty Risk: When trading Bitcoin futures, traders enter into contracts with other parties. If these counterparties fail to fulfill their obligations, such as delivering the agreed-upon Bitcoin at the contract’s expiration, traders may incur losses.

- Leverage Risk: Many traders use leverage when trading Bitcoin futures, meaning they borrow funds to amplify their trading positions. While leverage can magnify profits, it also increases the potential for losses. If the market moves against a leveraged position, traders may face significant losses exceeding their initial investment.

In addition to the aforementioned issues, there are other important factors to consider.

For example, liquidity risk may arise from low trading activity, resulting in wider bid-ask spreads and inherent difficulties in executing trades. Regulatory changes or uncertainty can also impact the market, affecting prices and trading conditions. Systemic risks, such as financial crises, may spill over into the Bitcoin futures market, while technological issues like platform outages or cyberattacks can disrupt trading activities.

Overall, traders should employ robust risk management strategies and stay updated on market developments to effectively address these challenges.

Popular Bitcoin Futures ETF

Are you seeking a Bitcoin Futures ETF? We’ve compiled the four most popular Bitcoin Futures ETFs available today, each offering unique opportunities for investors to participate in the cryptocurrency market. Let’s explore these leading ETFs and uncover the potential they hold for your investment portfolio.

Proshares Bitcoin Strategy ETF (BITO)

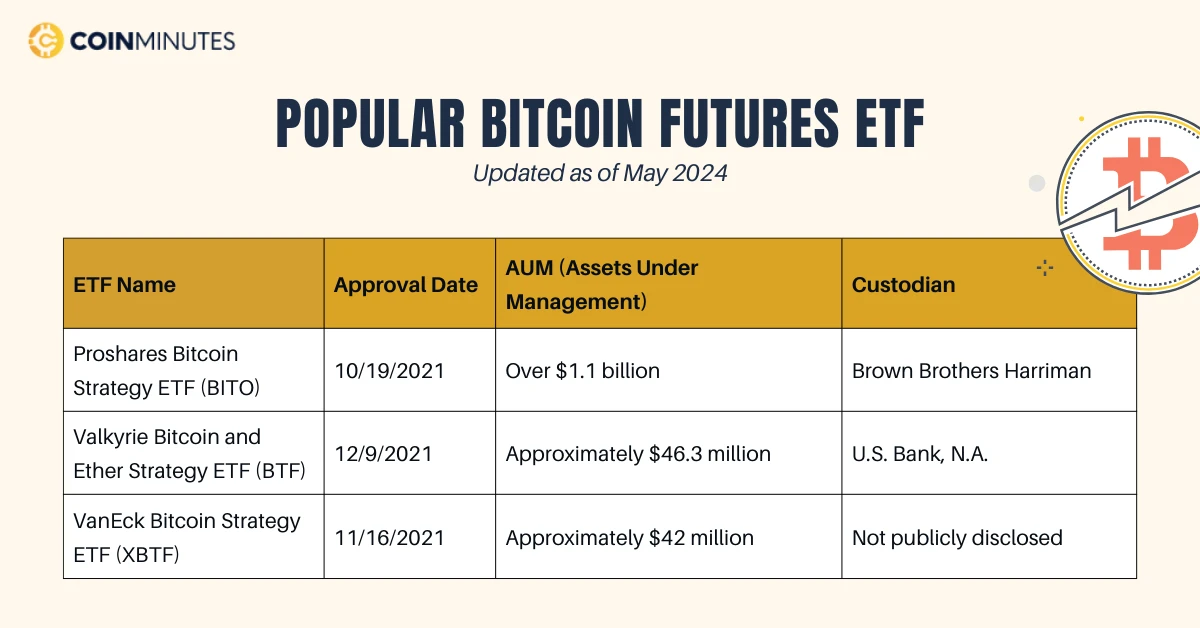

Proshares Bitcoin Strategy ETF (BITO) was approved on October 19, 2021. It has gained significant traction in the market with over $1.1 billion in assets under management (AUM). As of the latest available information, the custodian responsible for safeguarding the fund’s assets is Brown Brothers Harriman. This ETF aims to provide investors with exposure to Bitcoin’s price movements through various investment strategies, catering to both retail and institutional investors.

Valkyrie Bitcoin and Ether Strategy ETF (BTF)

Valkyrie Bitcoin and Ether Strategy ETF (BTF) received approval on December 9, 2021. With approximately $43.6 million in AUM, this ETF offers a unique investment approach by providing exposure to both Bitcoin and Ether, the two largest cryptocurrencies by market capitalization. U.S. Bank, N.A. serves as the custodian for this ETF, ensuring the safekeeping of its assets.

VanEck Bitcoin Strategy ETF (XBTF)

VanEck Bitcoin Strategy ETF (XBTF) was approved on November 16, 2021. With approximately $42 million in AUM, this ETF offers investors exposure to Bitcoin’s price movements. While the specific custodian for XBTF is not publicly disclosed, it adheres to regulatory requirements and industry standards to ensure the security and integrity of its assets.

These Bitcoin Futures ETFs provide investors with diverse options for gaining exposure to the cryptocurrency market while mitigating some of the risks associated with directly holding digital assets. Each ETF has its own unique features and investment strategies, catering to different investor preferences and risk appetites.

The Bottom Line

In summary, Bitcoin Futures ETFs serve as a regulated pathway for investors to engage indirectly with the dynamic cryptocurrency market. These financial instruments provide various advantages such as risk management tools, portfolio diversification, and potential returns linked to Bitcoin’s price fluctuations.

Nevertheless, investors must recognize the inherent risks inherent in Bitcoin futures trading. The market’s volatility, counterparty risk, and the allure of leverage emphasize the need for prudent decision-making and effective risk management strategies.