In a bold move to expand their Bitcoin holdings, two of the world’s largest Bitcoin mining companies—Marathon Digital Holdings and Hut 8—have capitalized on a market dip to make substantial investments in the flagship cryptocurrency. The total value of their recent Bitcoin purchases exceeds a staggering $1.6 billion, marking one of the most significant market maneuvers in the crypto space this December. With these investments, both companies have increased their Bitcoin reserves, positioning themselves strategically for long-term growth as Bitcoin’s value remains volatile but promising.

Seizing the Moment: Marathon’s $1.53 Billion Investment

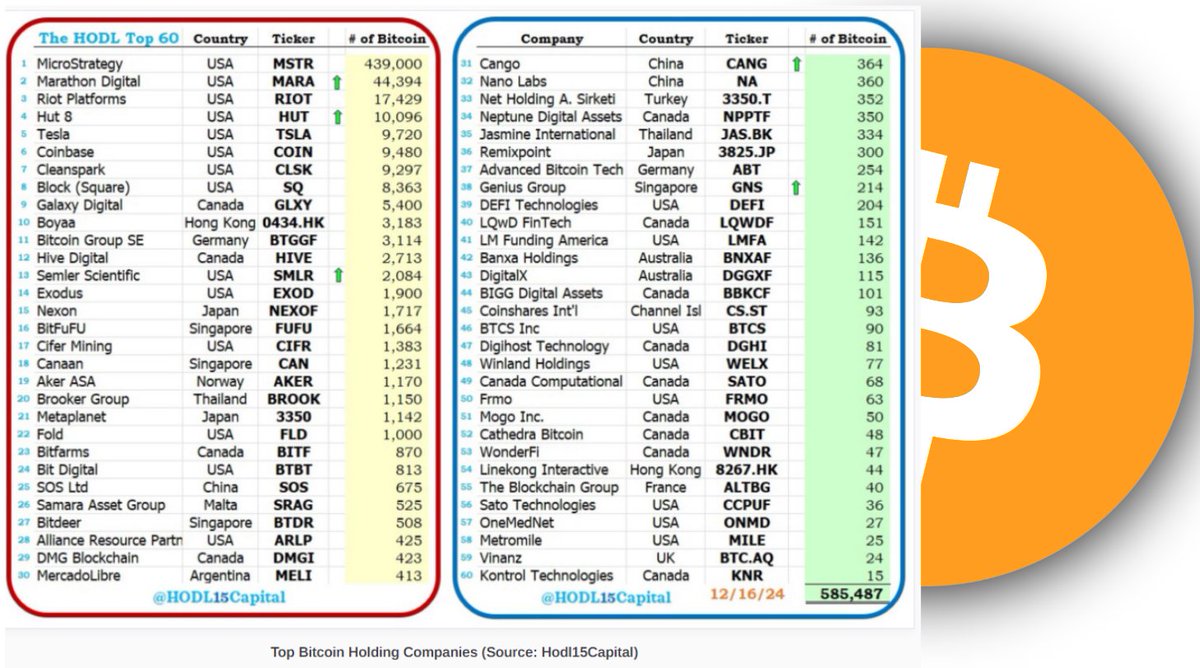

On December 19, 2024, Marathon Digital Holdings made a bold acquisition of 15,574 BTC for a total investment of $1.53 billion, at an average price of $98,529 per coin. This latest purchase brings Marathon’s total Bitcoin holdings to an impressive 44,394 BTC, which, based on the current market price of $100,151 per Bitcoin, now holds a value of $4.45 billion.

This acquisition not only strengthens Marathon’s position as a major player in the Bitcoin mining space but also reaffirms the company’s commitment to Bitcoin as a core asset. Marathon is now the second-largest publicly traded Bitcoin holder globally, just behind MicroStrategy, which has accumulated an enormous 439,000 BTC.

Marathon’s strategic move highlights the company’s belief in Bitcoin’s long-term potential, even as the cryptocurrency experiences cyclical volatility. By purchasing Bitcoin during a market dip, Marathon is betting on Bitcoin’s resilience and its ability to recover and continue appreciating in value. This is not the first time the company has made significant Bitcoin acquisitions, with Marathon having acquired over 11,000 BTC in previous months, which shows their unwavering confidence in the market’s future prospects.

Hut 8’s $100 Million Bet: An Unexpected Market Leader

In tandem with Marathon’s purchase, Hut 8 made its own bold move, acquiring 990 BTC for $100 million, or an average price of $101,710 per Bitcoin. This investment has boosted Hut 8’s total Bitcoin holdings to 10,096 BTC, putting the company among an exclusive group of public companies holding more than 10,000 Bitcoin on their balance sheets. Hut 8’s current Bitcoin stash is worth over $1 billion at current prices, making the company one of the most significant players in the crypto world.

Hut 8’s ability to acquire Bitcoin at a time when many other companies were hesitant due to the market’s downward correction shows that they are not just Bitcoin miners, but astute investors taking advantage of favorable market conditions. With this move, Hut 8 now holds more Bitcoin than Tesla, marking a key milestone for the company as it establishes itself as a leader in the crypto space.

Hut 8’s strategic decision to purchase Bitcoin during the market dip mirrors the approach taken by many large-scale institutional investors who see such corrections as opportunities to secure assets at lower prices, with an eye on long-term gains. As Bitcoin continues to evolve and gain institutional acceptance, Hut 8’s growing reserves could prove to be a lucrative asset for years to come.

JUST IN ⚠️ : 🇺🇸 Publicly traded Hut 8 buys 990 #Bitcoin for $100 MILLION 🚀

The company now holds $1 Billion worth of #BTC#Crypto #CryptoNews #altcoin #CryptoTwitter #CryptoInvestor #Altseason pic.twitter.com/jcyLpoXt9u— Global Rashid (@globalrashid007) December 20, 2024

Capitalizing on the Market Dip

The timing of these major Bitcoin purchases is not coincidental. Both Marathon and Hut 8 took advantage of a significant market decline spurred by recent changes in US Federal Reserve interest rates. On December 19, Bitcoin’s value dropped by over 5%, reaching a low of $96,781 before rebounding to $98,750. This volatility is a common characteristic of the cryptocurrency market, but it also presents opportunities for savvy investors who can capitalize on price dips.

The recent Fed rate hike caused tremors throughout financial markets, and cryptocurrencies like Bitcoin often experience sharp corrections in response to such shifts. Despite the temporary downturn, both Marathon and Hut 8 saw this as an opportunity to buy at discounted prices, with both companies making significant investments when Bitcoin’s price was lower than its average levels. These purchases may end up being incredibly profitable should Bitcoin’s value continue to appreciate over the coming months and years.

Related news: Meme Coin Mania: Trade Volumes Drop 50%, Is the Hype Fading?