In a strategic and headline-grabbing move, Bitcoin mining giant Riot Platforms has added 667 BTC to its growing cryptocurrency treasury, investing $69 million at an average purchase price of $101,135 per Bitcoin. This latest acquisition, filed with the U.S. Securities and Exchange Commission (SEC), has pushed Riot’s total Bitcoin holdings to an impressive 17,429 BTC. At Bitcoin’s current price, these holdings are valued at approximately $2 billion, underscoring Riot’s ambition to solidify its leadership in the cryptocurrency mining space.

Riot Platforms and the MicroStrategy Parallels: A Strategic Shift

Riot Platforms’ move to accumulate Bitcoin reflects an increasingly popular corporate strategy in the crypto world—one pioneered by MicroStrategy and its outspoken chairman, Michael Saylor. The parallels are clear: while MicroStrategy has positioned itself as a Bitcoin-accumulating enterprise, Riot is combining its Bitcoin mining operations with strategic BTC purchases to expand its holdings.

Since pivoting to Bitcoin mining in 2018, Riot has grown into one of the most prominent players in the mining industry. Operating primarily from its Oklahoma facility, the company has consistently optimized its operations to deliver increased BTC yields while strategically leveraging share buybacks to boost its crypto reserves. The firm’s blend of operational excellence and savvy capital management has allowed it to remain competitive in an industry facing significant macroeconomic pressures.

The results of Riot’s strategy are already evident. Following the announcement of the $69 million Bitcoin purchase, Riot’s stock price surged nearly 8%, demonstrating strong investor confidence in the company’s approach to building value through Bitcoin. Additionally, Riot reported a 36.7% Bitcoin yield for Q4 so far, alongside a year-to-date yield of 37.2%, solidifying its position as a growing force within the crypto ecosystem.

With the additional proceeds from Riot’s upsized $594 million, 0.75% coupon convertible bond issue, the Company has acquired 667 BTC at an average price of $101,135 per BTC. As a result, Riot has increased its holdings to 17,429 BTC, currently valued at $1.8 billion based on the… pic.twitter.com/t68Uy8nbHU

— Riot Platforms, Inc. (@RiotPlatforms) December 16, 2024

Industry-Wide Trend: Miners and Corporates Double Down on Bitcoin

Riot’s move mirrors a broader trend among Bitcoin miners and publicly traded companies. As Bitcoin’s price trajectory continues to climb, companies are doubling down on their BTC holdings. Competitor Marathon Digital Holdings (MARA) made waves last week with its own Bitcoin acquisition, purchasing 11,774 BTC for $1.1 billion. The funds for Marathon’s purchase came from a zero-coupon convertible note offering, showcasing a creative financing mechanism that echoes the strategies used by both Riot and MicroStrategy.

Meanwhile, MicroStrategy itself remains the undisputed leader in corporate Bitcoin accumulation. On the same day as Riot’s purchase announcement, MicroStrategy revealed that it had acquired 15,350 BTC for a staggering $1.5 billion, at an average price of $100,386 per BTC. With this addition, MicroStrategy’s total Bitcoin holdings have climbed to a remarkable $27.1 billion.

MicroStrategy’s performance has been extraordinary in 2024, with its stock (MSTR) surging nearly 500% year-to-date. This meteoric rise has placed the company among the top 100 publicly traded firms in the United States. MicroStrategy’s Bitcoin yield for Q4 has reached 46.4%, while its year-to-date yield stands at an eye-popping 72.4%. These figures illustrate the transformative impact of Bitcoin accumulation for companies willing to adopt an aggressive crypto strategy.

Michael Saylor’s Influence and the Institutional Bitcoin Debate

Michael Saylor, often regarded as Bitcoin’s most prominent advocate, continues to promote Bitcoin adoption among public companies. Recently, Saylor reaffirmed his stance on X (formerly Twitter), stating, “Everyone buys Bitcoin at the price they deserve. BTC doesn’t wait. It simply transfers wealth to those who see.”

Despite Saylor’s persuasive rhetoric, institutional adoption of Bitcoin remains a subject of debate. For instance, shareholders at Microsoft recently rejected a proposal to include Bitcoin in the tech giant’s treasury reserves. However, other corporate giants are showing a willingness to consider Bitcoin’s potential as a hedge against inflation. Notably, shareholders at Amazon have proposed allocating a portion of the company’s $88 billion cash reserves to Bitcoin, highlighting a potential shift in sentiment among major institutions.

Riot Platforms’ $69 million Bitcoin purchase and MicroStrategy’s parallel acquisition reflect a broader narrative in today’s financial landscape: Bitcoin is becoming an increasingly valuable asset class for institutions, miners, and publicly traded companies. With rising inflation concerns and global economic uncertainty, Bitcoin is emerging as a preferred store of value and a hedge against fiat currency devaluation.

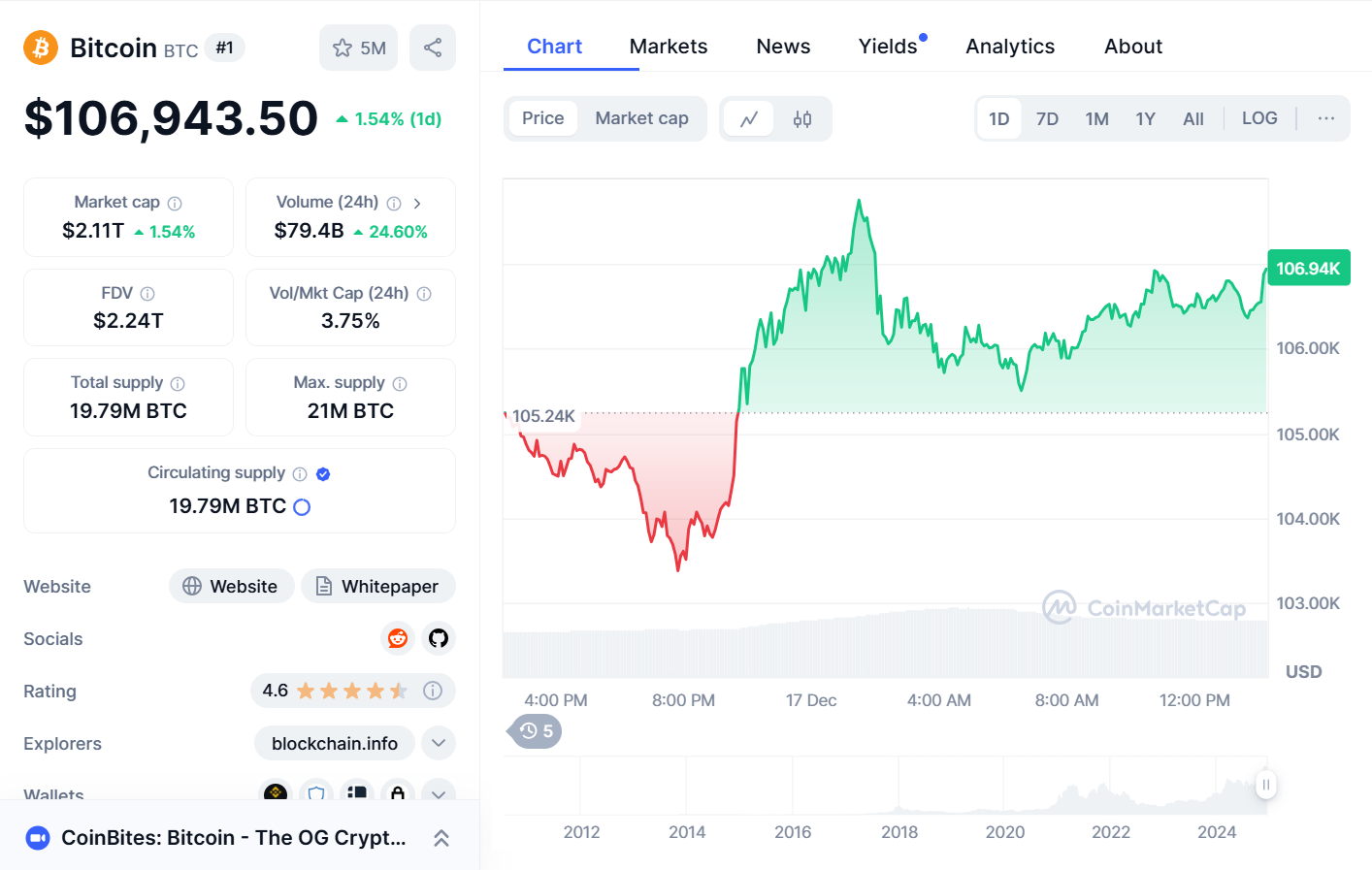

Related news: Bitcoin Soars to $106K Amid Trump’s Bold U.S. Bitcoin Reserve Plans