The world of cryptocurrency investment is no stranger to dramatic shifts, and BlackRock’s iShares ETH Trust has recently made waves by pulling in a staggering $1.5 billion in just 16 days. This influx marks a pivotal moment in the evolution of Ethereum ETFs and highlights shifting investor sentiment towards the second-largest cryptocurrency by market capitalization.

The Rise of Ethereum ETFs

Since the debut of ETH exchange-traded funds (ETFs) five months ago, investor interest has gained considerable momentum. BlackRock’s iShares Ethereum Trust (ETHA) has emerged as a leader, with total net inflows of $3.2 billion since its July launch. Remarkably, $1.5 billion of this amount was garnered between November 20 and December 7 alone, showcasing an accelerating trend.

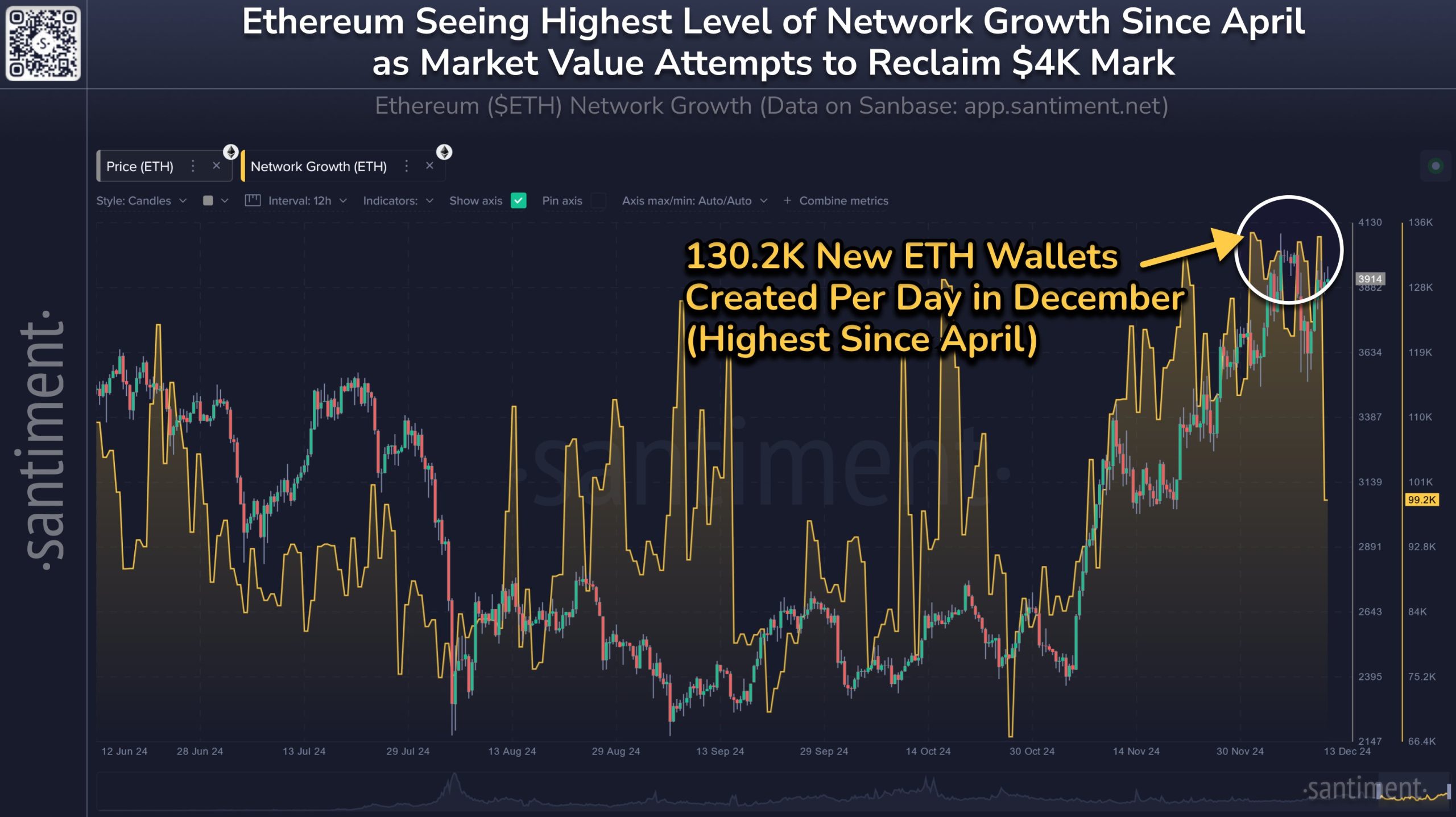

The ETF’s record-setting performance coincided with Ethereum’s price fluctuations. On December 5, Ethereum dipped to $3,800, prompting a $293 million influx into ETHA. A day later, the cryptocurrency rebounded, surpassing the $4,000 mark—a level it had not seen since March 2024. These price movements underscore the responsiveness of ETF inflows to market dynamics and investor sentiment.

A Turning Point for Ethereum

Despite Bitcoin ETFs’ unparalleled success in 2024, ETH has faced a more challenging journey. Bitcoin, often referred to as the “Wall Street darling” of cryptocurrencies, has dominated headlines and investor portfolios. However, recent trends suggest ETH is beginning to close the gap. As Jay Jacobs, BlackRock’s U.S. head of thematic and active ETFs, pointed out, the firm’s focus on Bitcoin and ETH products represents just the “tip of the iceberg.”

Globally, the narrative around ETH appears to be shifting. CoinShares Head of Research James Butterfill noted a “unanimous turnaround” in sentiment. From November 20 onward, ETH investment products worldwide attracted $3.5 billion. Butterfill’s observation underscores that this surge is not limited to BlackRock’s ETF but reflects a broader market interest.

🚨 BREAKING NEWS 🚨

BLACKROCK’S ETHEREUM ETF REACHES $3 BILLION IN INFLOWS!

EXPERTS PREDICT A $15,000 SURGE FOR $ETH

ALL-TIME HIGH LOADING 🔥🚀 pic.twitter.com/q6TVOHGHy6

— Turbostrategy (@turbo_strategy) December 14, 2024

Competitors and Challenges

Other players in the ETF space are also experiencing heightened activity. Fidelity’s ETH Fund (FETH) recorded its highest daily inflow of $200 million on December 7. This diversification of investor interest among different ETH-focused funds highlights the growing recognition of ETH as a core investment asset.

However, ETH’s road to prominence has not been without obstacles. Layer-2 networks, designed to offer faster and cheaper transaction solutions, have sparked debates over their impact on ETH’s base layer value. Moreover, ETH’s inability to reclaim its all-time high of $4,800, set in 2021, has led some to question its competitive positioning. Meanwhile, rivals like Solana have captured attention with record-breaking price performances.

The Solana Factor

Interestingly, Solana’s recent success may be losing steam. According to Butterfill, Solana investment products experienced three consecutive weeks of outflows, signaling potential cooling enthusiasm. Despite this, firms like Bitwise and 21Shares have filed applications for spot Solana ETFs in the U.S., indicating that investor appetite for alternative cryptocurrencies remains strong.

In a notable twist, political developments also played a role in driving Ethereum ETF inflows. President-elect Donald Trump’s remarks during the New York Stock Exchange opening bell ceremony on December 7 sent ripples through the crypto market. Trump’s statement, “We’re gonna do something great with crypto,” was interpreted as a bullish signal, contributing to $273 million worth of inflows for spot Ethereum ETFs on the same day.

While the U.S. market remains a key driver, Ethereum ETFs are gaining traction on a global scale. International investors are showing renewed interest in Ethereum-focused products, driven by broader adoption trends and the growing perception of ETH as a “store of value” asset. This global perspective underscores ETH’s potential to rival Bitcoin as a leading digital investment vehicle.

Related news: Treasure scales with 15+ games on ZKsync, ushering in a new era for decentralized gaming