UMA, standing for Universal Market Access, is a protocol for creating, maintaining, and settling synthetic assets on the Ethereum blockchain. It’s designed to empower users to build financial contracts and applications that can track any asset, leveraging an optimistic oracle system which allows for the flexible and secure verification of data.

As UMA continues to gain traction in the decentralized finance (DeFi) space, its recent price movements have caught the attention of traders and investors alike. In this article, we will explore UMA’s price prediction from 2024 to 2030, delving into technical analysis, community sentiment, and potential scenarios to help you navigate its market trajectory.

Please note that this is not investment advice. These are just our predictions, and we have no relation to the UMA development team.

Current Price Overview

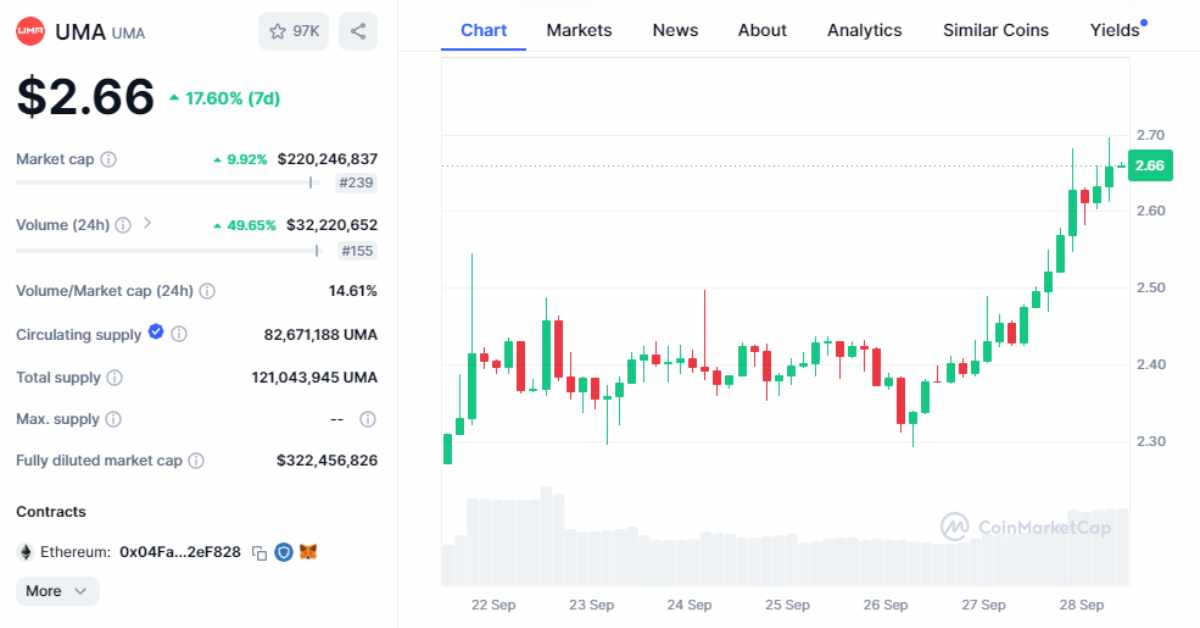

As of the latest data (September 28, 2024), UMA is trading between $2.45 and $2.66, marking a notable increase of 9.5% in the past 24 hours and a rise of 17.6% over the last seven days. With a market capitalization ranging from $185 million to $223 million, UMA is currently ranked 239th on CoinMarketCap, a position that reflects its growing prominence in the decentralized finance space.

Additionally, UMA’s 24-hour trading volume stands at approximately $32 million, signaling strong trading activity and considerable interest in the token.

Community Sentiment

Community discussions, especially on platforms like Binance, point to a bullish market sentiment surrounding UMA. The DeFi token has captured attention due to several factors, including its innovative position in DeFi, its unique product offerings (like synthetic assets), and potential technological upgrades.

Additionally, strategic partnerships and market expansions have added to the positive outlook. These elements have played a pivotal role in boosting investor confidence and driving the price momentum upward.

Technical Analysis

Moving Averages: Most short-term and long-term moving averages (SMA and EMA) suggest a ‘Strong Buy’ signal, indicating that UMA is currently in an uptrend. Historical data indicates that UMA’s price might continue to climb, supported by a strong market momentum.

Oscillators and Indicators: While moving averages paint a bullish picture, other indicators like the Relative Strength Index (RSI) and Commodity Channel Index (CCI) reflect neutral signals. This suggests that UMA could be entering an overbought phase or experiencing some indecision. Traders should be cautious, as these mixed signals could indicate potential volatility ahead.

Support and Resistance Levels:

- Support Levels: Key support is seen around $1.32, $2.00, and $2.53 (as a stop-loss point), which could act as safety nets in case of market pullbacks.

- Resistance Levels: UMA faces resistance at $1.65, $2.60, $2.63, and $2.67. These levels could be key points where the price might consolidate before making any further moves upward.

UMA Price Prediction: 2024-2030

| Year | Bearish | Bullish | Average |

| 2024 | $2.00 – $2.50 | $5 – $7 | $3.50 – $4.50 |

| 2025 | $2.50 – $3.00 | $8 – $10 | $4 – $6 |

| 2026 – 2028 | $2 – $4 | $12 – $15 | $5 – $9 |

| 2029 – 2030 | $3 – $5 | $20 | $7 – $12 |

2024 Price Prediction

- Bearish: If market sentiment turns negative, possibly due to regulatory hurdles or broader market corrections, UMA’s price could dip to around $2.00 to $2.50. This scenario might arise if project deliverables are delayed or if the broader crypto market faces significant headwinds.

- Bullish: On the upside, if UMA continues to innovate and make strategic partnerships, the price could rise to $5 – $7. The DeFi market’s growth and UMA’s unique value proposition might attract more users and investors, pushing the token higher.

- Average: In a balanced market scenario, UMA could stabilize between $3.50 and $4.50, reflecting both the token’s utility and market volatility.

2025 Price Prediction

- Bearish: If UMA faces challenges such as slow adoption or market downturns, the price might hover around $2.50 – $3.00.

- Bullish: With successful platform upgrades and broader DeFi adoption, UMA could soar to $8 – $10, especially if its synthetic assets gain traction.

- Average: The token may settle around $4 to $6, considering the overall market’s progression and steady demand for DeFi services.

2026 – 2028 Price Prediction

- Bearish: If innovation slows down or regulatory issues hinder DeFi’s growth, UMA could drop to $2 – $4 during these years.

- Bullish: Conversely, if UMA integrates emerging technologies such as cross-chain capabilities or artificial intelligence, it could reach $12 to $15 by 2028.

- Average: A moderate growth trajectory may see UMA trading between $5 and $9, assuming stable market conditions and gradual platform improvements.

2029 – 2030 Price Prediction

- Bearish: A prolonged bear market or competition from alternative projects could see UMA’s price decline to around $3 to $5.

- Bullish: Should UMA cement its position as a leading DeFi project and expand into new financial products, it could hit highs of $20 or more, driven by utility and speculative market activity.

- Average: A balanced prediction for this period suggests UMA trading in the range of $7 to $12, factoring in innovation, adoption, and the cyclical nature of crypto markets.

Conclusion

UMA’s future appears promising, but like most cryptocurrencies, it is subject to both market and project-specific risks. The short-term outlook is bullish, with many indicators suggesting further price appreciation.

However, long-term predictions hinge on several factors, including UMA’s ability to innovate, regulatory developments, and the overall growth of the DeFi space. Investors should watch for key support and resistance levels and stay updated on market sentiment and technical trends.

Related: JasmyCoin Price Prediction 2024 – 2030. Can JASMY Reach Bitcoin Price?