Grayscale, a leading asset management company, has finally released a much-anticipated list of 20 cryptocurrencies it believes hold high potential in the fourth quarter of 2024. This announcement comes after a relatively steady third quarter, which Grayscale described as “sideways,” using data from the FTSE/Grayscale Crypto Sectors index.

The report highlighted several emerging trends that could shape the market in the coming months. Among the key trends identified were Decentralized AI (Artificial Intelligence), Real World Asset (RWA) encryption, and the continued rise of Memecoins. Notable coins driving these trends include TAO (linked to the AI trend), ONDO, OM, and GFI (connected to RWA), and PEPE, WIF, FLOKI, and BONK (representing the Memecoin trend).

In terms of performance, Ethereum (ETH) has lagged behind Bitcoin (BTC) in 2024. While ETH has seen a 13% increase, BTC has surged by 50%. However, the report notes that Ethereum remains a leader in several key metrics, including the number of decentralized apps (dApps), developer activity, and total value locked (TVL).

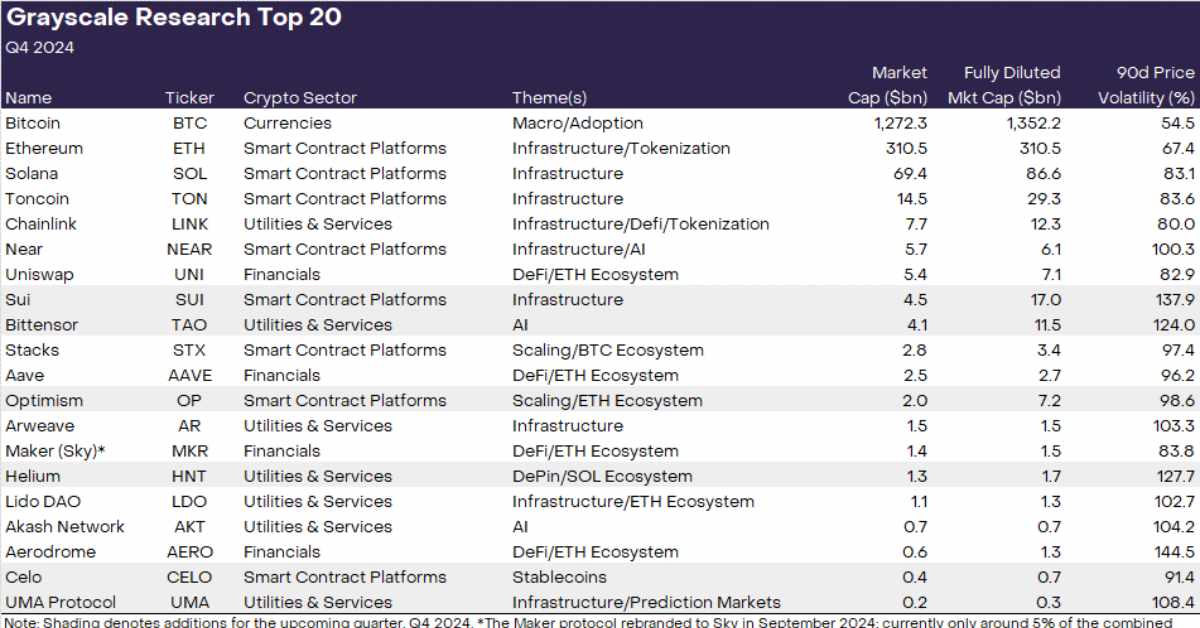

Grayscale’s list of the top 20 potential coins for Q4 2024 includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Toncoin (TON)

- Chainlink (LINK)

- Near Protocol (NEAR)

- Uniswap (UNI)

- Sui Network (SUI)

- Bittensor (TAO)

- Stacks (STX)

- Aave (AAVE)

- Optimism (OP)

- Arweave (AR)

- MakerDAO (MKR) (recently renamed Sky Protocol)

- Helium (HNT)

- Lido Finance (LDO)

- Akash Network (AKT)

- Aerodrome (AERO)

- Celo (CELO)

- Uma Protocol (UMA)

Notably, six new additions were made to the list in Q4, including Sui Network (SUI), Bittensor (TAO), Optimism (OP), Helium (HNT), Celo (CELO), and Uma Protocol (UMA). Grayscale highlighted several reasons for these choices:

- SUI: A high-performance Layer 1 blockchain that competes directly with Solana.

- TAO: A decentralized AI platform poised to benefit from the growing AI trend.

- OP: A Layer 2 platform set to thrive through the development of the Superchain network.

- HNT: A DePIN (Decentralized Physical Infrastructure Network) project with stable revenue potential from its IoT network.

- CELO: A Layer 2 project that could see growth in the Stablecoin and Payment sectors.

- UMA: An oracle platform expected to benefit from prediction market platforms like Polymarket.

Additionally, Grayscale cautioned that the upcoming U.S. presidential election could introduce significant volatility to the crypto market.

The report emphasized that the information is for illustrative and informational purposes only and does not constitute investment advice.

Related news: Grayscale Launches XRP Trust Fund, Signaling Potential for Future Spot XRP ETF Approval