As the world of decentralized finance (DeFi) evolves, Pendle stands out for its unique role in yield trading and liquidity provision. With recent price fluctuations and a complex market environment, investors are keen to understand what the future holds for Pendle. Below is an analysis of its current state and future price predictions based on market data, technical analysis, and broader industry trends.

Current Price Overview

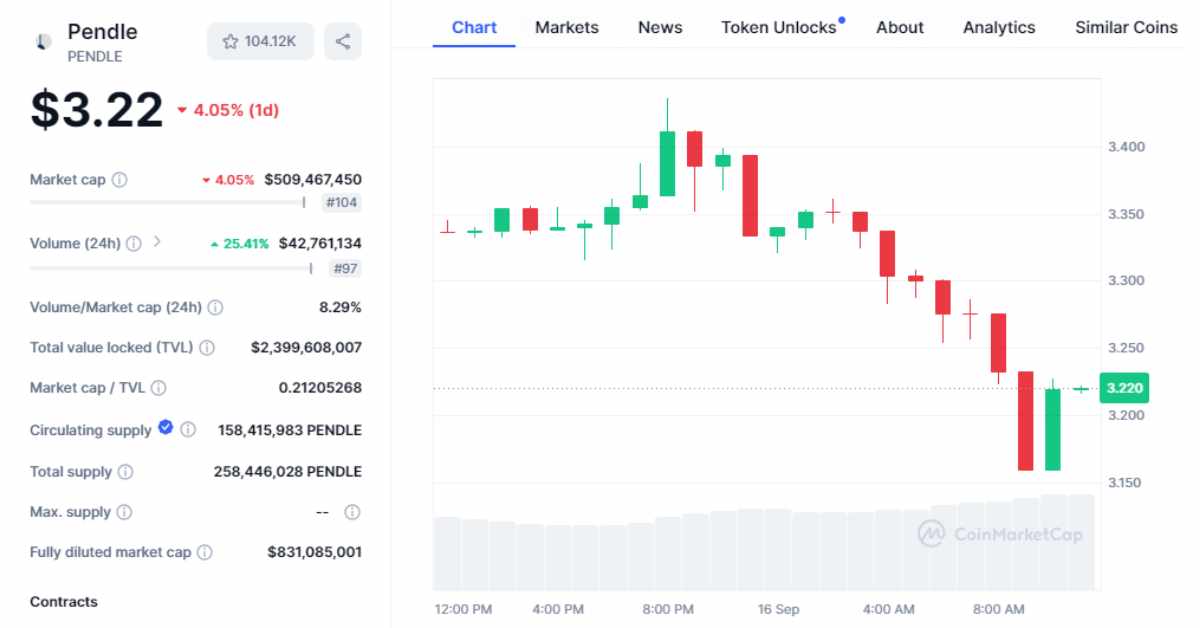

- Current Price: Pendle is currently trading between $2.6 and $3.42 per PENDLE, reflecting a relatively stable price range.

- Trading Volume: Over the past 24 hours, trading volume has fluctuated between $43.47 million and $87.71 million, signaling active market participation.

- Market Capitalization: Pendle’s market cap sits between $400 million and $575 million, which puts it in the mid-tier range of DeFi tokens.

Market Sentiment

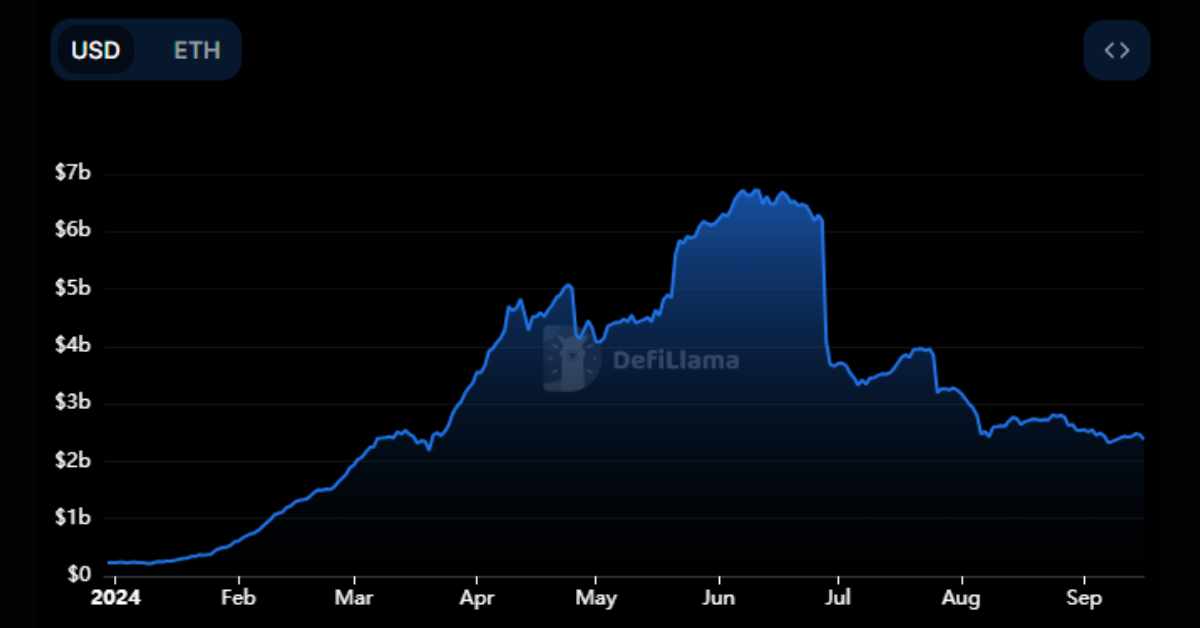

Sentiment around Pendle remains mixed. While some traders remain optimistic about its potential in DeFi, especially in yield trading, others express caution due to a noticeable drop in its Total Value Locked (TVL). Market discussions on platforms like X (formerly Twitter) reflect this dichotomy—investors are torn between Pendle’s innovative offerings and concerns about its short-term volatility.

The cautious optimism can be linked to Pendle’s unique product positioning, allowing users to trade future yields, which has set it apart from other DeFi protocols. However, the decline in TVL is raising questions about the platform’s ability to maintain its current pace of innovation and adoption.

Technical Analysis

From a technical standpoint, Pendle presents a complex picture:

- Moving Averages: The 50-day moving average signals a bearish short-term trend, suggesting potential resistance ahead. However, the longer-term weekly chart remains bullish, indicating that investors with a longer horizon might still see value in holding Pendle.

- Relative Strength Index (RSI): Currently, Pendle’s RSI is in the neutral zone, neither overbought nor oversold. This suggests a possible consolidation phase, with the potential for a price breakout or breakdown depending on broader market conditions.

- Support and Resistance Levels: Key support for Pendle sits around $2.40, while resistance is noted at $4. A successful break above $4 could signal a bullish trend, while a dip below $2.40 might indicate further price declines.

Short and Long-Term Price Predictions

Short-Term Prediction (Q4 2024)

Given current trends and technical indicators, analysts predict that Pendle could rise to around $3.82 in the short term. This prediction is based on market momentum and a gradual recovery in DeFi interest.

Long-Term Prediction (2025–2027)

Looking further ahead, predictions for 2025 suggest a wide price range between $3.40 and $15.84. This range reflects both conservative estimates based on current market trends and more optimistic scenarios assuming Pendle successfully capitalizes on its DeFi niche. By 2027, Pendle could potentially reach $14.40, highlighting its growth potential if it continues to innovate and expand its market share.

Market Dynamics and Risks

Pendle’s price trajectory will be heavily influenced by broader market dynamics, including its integration into emerging DeFi narratives like Liquid Restaking Tokens (LRT). This development could drive increased utility and demand for Pendle, propelling its value upward. However, recent declines in TVL suggest that external factors, such as the maturation of liquidity pools and shifts in investor sentiment, could introduce volatility. Investors should also be mindful of market maturity dates for pools, which could impact short-term price stability.

Conclusion

Pendle’s price prediction is a balancing act between innovation and market forces. While technical analysis offers valuable insights into potential price movements, the real test for Pendle will be its ability to adapt within the DeFi space. Its unique focus on yield trading and liquidity provision could provide a significant competitive edge, especially as the market for decentralized financial products continues to grow.

For investors, Pendle represents an intriguing opportunity with both potential for significant returns and inherent risks associated with the volatile crypto market. Keeping an eye on broader DeFi trends and Pendle’s ability to innovate will be crucial for predicting its future price movements. As of mid-September 2024, Pendle remains a compelling case study in DeFi’s evolving landscape, offering both short-term opportunities and long-term growth potential for investors who can navigate its complexities.

Related: Space ID Price Prediction. Will ID Break Above $1 Again?